Understand Investment Cycles, Understand How To Make Money

How many times have you been to a wealth training course, learned a strategy for making money and found it didn’t work?

You are left feeling disappointed and let down and feel you wasted your money on the training course.

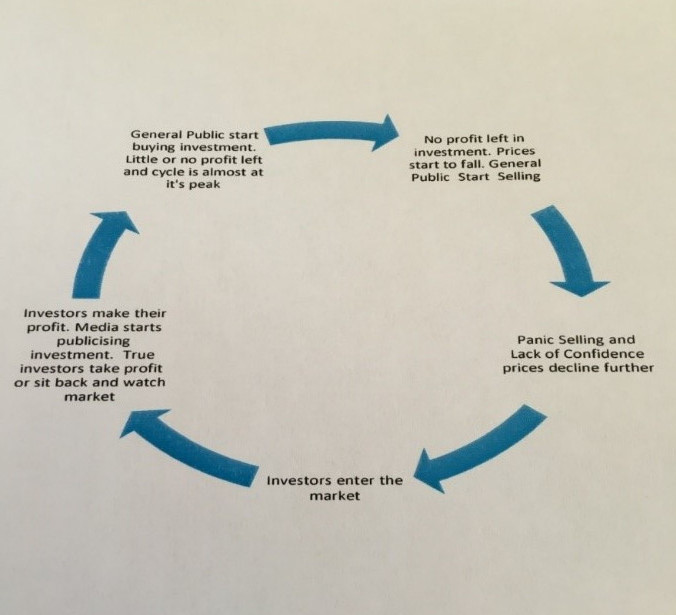

In most cases the system works it is just the timing was wrong as all investments rely on entering the investment cycle and exiting at the right time.

Table of Contents

- Investment Cycles

- How I Went From Borrowing £300 to £10 Million in 4 Years

- Use Cycles to Your Advantage

- Build Your Own Data Don’t Rely on Others

- History Teaches Us A Lot About the Markets

- Understand Investment Cycles and Understand How to Make Money

- Strategic Investing Membership

In this post, you’ll learn the benefits of understanding investment cycles and how they can help you buy in to and exist from an investment so you always make money.

Investment Cycles

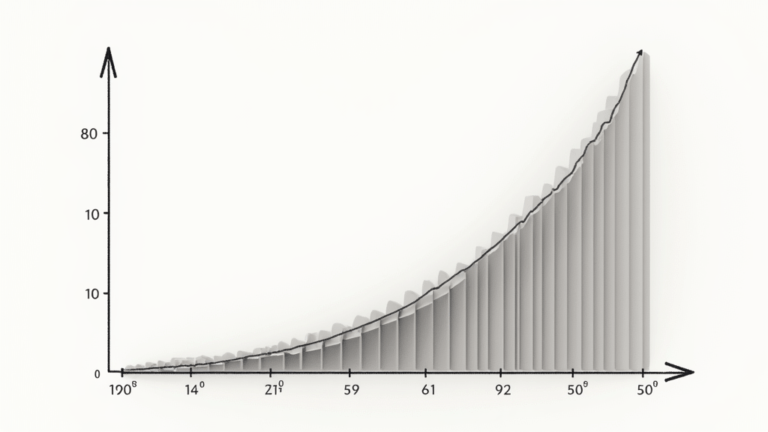

In today’s economy, everything works in a cycle.

The UK has, on average, a ten-year cycle for the economy going up and down. It is essential to understand where the cycle is and what is the best strategy to use to make money at that time.

Money can be made in both an upward and downward market if you use the right strategy.

For example, if the property market is going down, then buying property using a buy-to-let mortgage is asking for trouble unless you have some big cash reserves.

This is because, of a Loan To Value clause, where if the value of the property goes down then payments must be made off the mortgage to keep the Loan to Value between the property and mortgage.

In the 2008 credit crunch and subsequent recession, many people found themselves with properties worth less than their mortgages.

Lenders were quickly repossessing properties to get the liabilities off their books.

Many property investors were burnt and lost their portfolios because they had the wrong strategy for the times.

However, in an upward market, mortgages offer the best way to buy a property.

Using the right strategy at the right time and money will be made very quickly which is how I went from borrowing £300 on a credit card and turning it into £10 million in 4 years.

How I Went From Borrowing £300 to £10 Million in 4 Years

When I arrived in the UK in 2000 the country was coming out of recession.

Green shoots (signs the economy is growing again) were being seen in the business sector. However, the share market and the property market were still at record lows.

The first thing I did was start a business. It became a distributor for Kleeneze and Avon. Every little bit of money made was invested into shares that I identified were below value. Shares such as Corus trading at 2p later sold for £4.52 and Rolls Royce was bought for 9p and sold for 1.56

Next, my husband negotiated zero-deposit property deals. We bought 2 properties within 3 months using this.

The properties were renovated, revalued and remortgaged. The funds generated were reinvested into more properties. This allowed us to buy 60 properties within 4 years.

Finally, gold was at a low and we started buying around $400 a troy ounce before selling at just under $1900 a troy ounce.

We identified the lows in the markets and bought. We then sold as they reached highs investing in the next undervalued asset.

Use Cycles to Your Advantage

Within every market, there is a sub-market that has a different cycle.

For instance, within the property market, there are residential properties, HMO properties, holiday lets, commercial, garages and storage units to name just a few.

They don’t all go up and down at the same time. The key to using investment cycles is to identify where each market is. Then buy into the markets that are low ready for them to go up again.

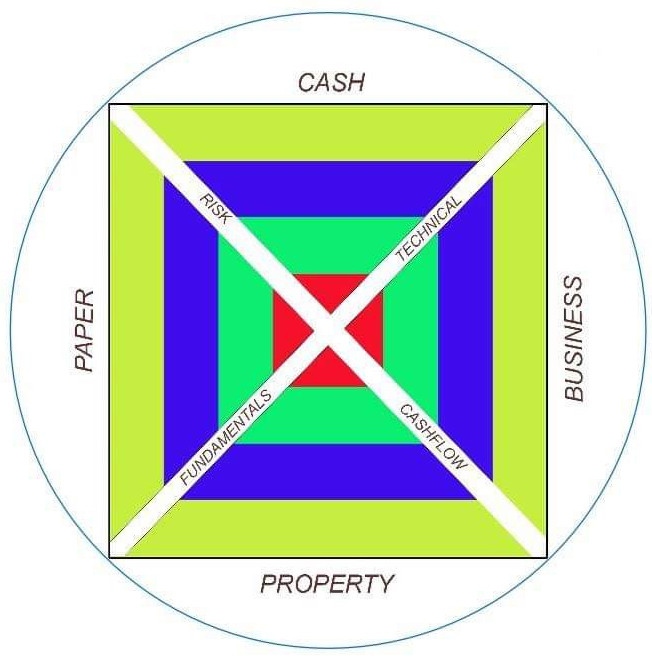

When you look at the key investment markets, business, property, shares and commodities there are multiple markets going up and down.

Identify which market is at a low and buy into it. Sell when the market is moving up and you’ve made a profit.

Just repeat this process until rich.

Build Your Own Data Don’t Rely on Others

Research becomes your best friend. The more research the more you can identify markets that are out of favour.

Don’t listen to the experts for advice. Take their information along with everything else you’ve accumulated and make your own decisions.

Nobody times the market perfectly. Be willing to take a small dip before the market recovers and start making more money.

Be confident in your research. Many people will tell you you’re wrong. I had bank managers telling me not to buy yet as the market wasn’t strong enough. I made money they didn’t.

A friend of mine says he hates to hear me telling the story about Corus and Rolls Royce shares as he was also looking at them at the same time.

However, he listened to the “experts” who said don’t invest. He missed the opportunity to make money while I was already building my wealth.

You have to be your own counsel and have faith that your research is good.

Ignore the noise.

History Teaches Us A Lot About the Markets

Everything that has happened so far in the 21st century also happened in the 20th century.

Nothing is new.

If you study the markets, what happened, how people reacted then you are one step closer to judging your entry into or exit out of the market.

Studying history and watching what is happening today makes it appear that you have a crystal ball and can see the future. In reality, you just understand how the market is likely to react and can make decisions based on your research.

Understand Investment Cycles and Understand How to Make Money

When you understand how the investment cycles work and where to find your data you will understand exactly how and where to make money.

The key is to be patient.

You have no control over the markets. All you can do is be patient and wait for the markets to come to you.

Be observant and keep your own information. Then you too will know the best time to invest in the markets and the best time to sell and move on to the next.

Strategic Investing Membership

Karen Newton International offers strategic investing training and joint venture opportunities to help you understand the market, and know when to enter and exit the market.

The joint venture opportunities provide access to business, property and share joint ventures for as little as £100 per month.

Join the Strategic Investing Membership today and be one step closer to achieving wealth, income and lifestyle.

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.