4 Simple Steps For Building Wealth

It’s a fallacy that you need money to make money. When I first meet my clients, many believe they need $10,000 or $20,000 to start investing. Nothing could be further from the truth. There are 4 simple steps for building wealth which anyone can follow.

It the same formula, the richest people in the world used to build their wealth and start living their dream lifestyle.

Table of Contents

Build the Foundation

Have you ever potted a new plant?

For the first few days you look it every day thinking nothing is happening. You water it daily but is still doesn’t appear to be growing. Frustrated, you forget about the plant for a few weeks and when you next check it you are surprised at how much it has grown. It is taller and spread wider.

Investing is exactly the same. When you put in place a system for Building a Foundation, which you can add money to on a regular basis then leave it alone and give it time to work its magic, you will be surprised by how quickly your investments grow.

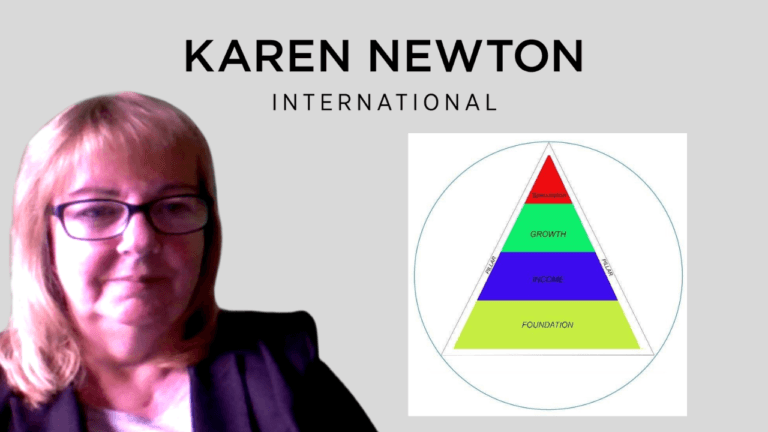

There are 4 key areas in which to invest your time and effort to get the best results possible.

Side Hustle

Many people forget business is an investment. It is one of the biggest investments you will ever make. It is the investment that generates profit and money for you to reinvest into other projects.

But who wants to go through the process of finding premises and employing staff?

Today, we live in an online world. It’s where the majority of customers are to be found. So, building an online business, not just any business, but a cash rich online business makes sense. They are called Side Hustles.

Side Hustles are businesses such a eCommerce, Affiliate Marketing, Drop Shipping etc. They allow you to start small with little or no overheads and start earning cash almost immediately.

In my Zero to Millionaire, Building the Foundation course, the first thing clients are taught is about starting an online business. Most are surprised yet when they do the exercise and report back the following month they have generated between £211 – £1000.

That income allows them to start the next investment.

Property

Property is one of the biggest investments that can be made. It is the realm of the wealthiest people in the world. Yet, for many, saving a deposit and obtaining a mortgage is nigh on impossible. Poor credit ratings affect many people.

But, there are many ways to invest in property regardless of how much money you have or how poor your credit rating is.

Property Options have been around for hundreds of years and are used on a daily basis by big businesses. For the individual investor with little funds using Lease Options, Rent to Buy Options, Rent to Rent Options and endless types of other options, opens the door for the ordinary investor to get started.

A few of my clients, have used Rent2Rent strategies to control property and earn from it. Usually, the upfront fee is paying the owner of the property and the person who put the deal together a few thousand. (Money earned from the Side Hustle).

Other clients have used Rent2Buy options and purchased properties outright over a period of time again just by paying the person who put the deal together a small finders fee.

Options are flexible and can suit almost any budget. They provide a simple way to get into property and start earning from it.

But if owning property is not something which appeals then there is Peer2Peer Lending with property as security.

Different platforms offer different types of investment opportunities from fractional ownership to just being a lender and earning interest.

Digital Investments

One of my favourite types of investment categories. Digital Investments include, shares, bonds, cryptocurrency etc.

These type of investment can be started with very little cash. Over the past month, I bought cryptocurrency which had a limitation on it. The maximum I could buy each day was $5 worth.

Again, the fallacy that you need money to make money.

Digital investments are very flexible, have a low entry cost and provide good returns over the long term. Add in the compounding effect of reinvesting the profits and the investment will grow very quickly.

I use the analogy of a hockey stick to show the compounding effect. The foot of the stick represents the first few years of investing. Its fairly flat and doesn’t appear to be doing very much. Soon, the interest being earned on the investment becomes more and more with exponential growth appearing to represent the handle of the hockey stick.

Give any investment time and the growth chart will look like a hockey stick.

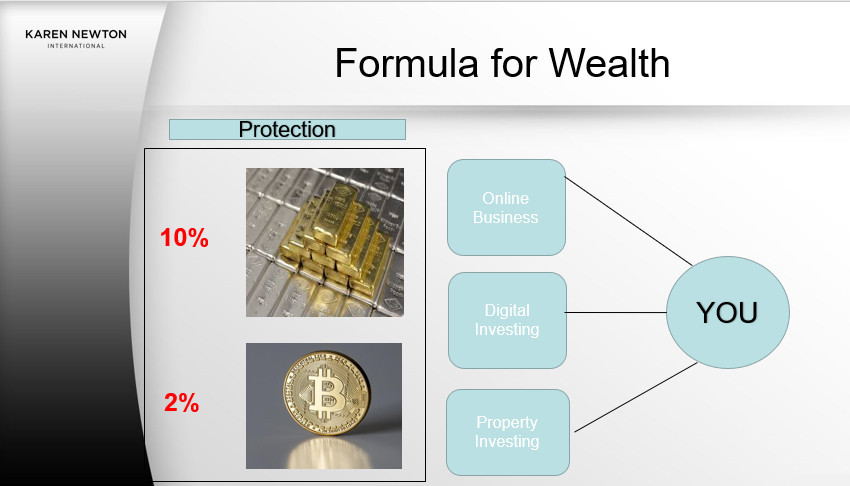

Protection

When you have your investment strategy in place, you need protection because investments do go up and down. They fluctuate at different times.

Precious metals such as Gold, Silver and Platinum provide a protection hedge. They are a safe have so when other investments go down they tend to go up.

In recent years Bitcoin has also been seen as a protection hedge, despite its volatility.

And finally, there are some currencies such as the Swiss Franc and the Japanese Yen which are considered safe havens due to their countries low inflation records not eroding the value of the currency as much as other countries.

Add some of these to your portfolio and you have a portfolio built for growth, income and sustainability.

The Formula for Wealth

Now you have a formula for wealth. A pathway to build a foundation of investments which will over time grow.

It is a starting point to becoming wealthy and living the type of lifestyle you want.

When you look at the wealthiest people in the world the started with a business – Jeff Bezos built Amazon, Richard Branson created Virgin and Elon Musk has Tesla. Businesses which then allowed them to invest in other assets and just keep adding and adding to the investments.

Each was then able to build the lifestyle they desired be it living on an island or travelling to space.

What can you achieve now you know how to build a foundation of wealth?