History Tells Us A Lot About The Future

When you look at information from the past you can see how major issues of the time were dealt with. You can easily identify trends, responses and mistakes. When you look at the issues of today, you can identify the same trends, see the same responses and identify the same mistakes. It’s not rocket science to know if you keep doing the same things there will be the same outcomes. Lessons can be learnt from the past but very few countries look at the past or even learn from them. It means the future is easy to see and the same mistakes are repeated over and over.

Table of Contents

- Are You Ready for a Financial Crash?

- Forgotten Recession

- The Great Depression

- History Repeats

- Inflation on the Rise

- History Can Tell Us a Lot About the Future

Are You Ready for a Financial Crash?

This week, I did a presentation entitled “Are You Ready for A Financial Crash”.

It was about the likelihood of a recession or even a probable depression occurring in a very near future. The time frame for future events can be established simply by looking at similar events from the past. Identifying the trends, watching the responses and seeing the same mistakes being made. The 20th Century pandemic led to the Great Depression of 1929-1946. There is no doubt, that they reactions of countries to the 21st century pandemic menas the world is being led towards the Great Depression version 2.

Forgotten Recession

In 1918, a virus triggered one of the worst pandemics in history. With less knowledge around medicines and viruses than we have today the population was doomed. It is estimated around 50 million people died.

The virus was spread worldwide due to travel when soldiers were returning home after years at war in other countries. It spread very quickly. The pandemic ran from 1918 – 1921.

To try and limit the pandemic, countries were placed in lockdown. This prevented many businesses from trading and triggered a recession which history refers to as the forgotten recession.

Governments quickly responded by pumping lots of money into faltering economies. Today it would be called Quatitative Easing. They encouraged a feel-good factor and encouraged people to spend. Businesses recovered quickly and an economic boomed ensued. This era became known as the roaring 20’s.

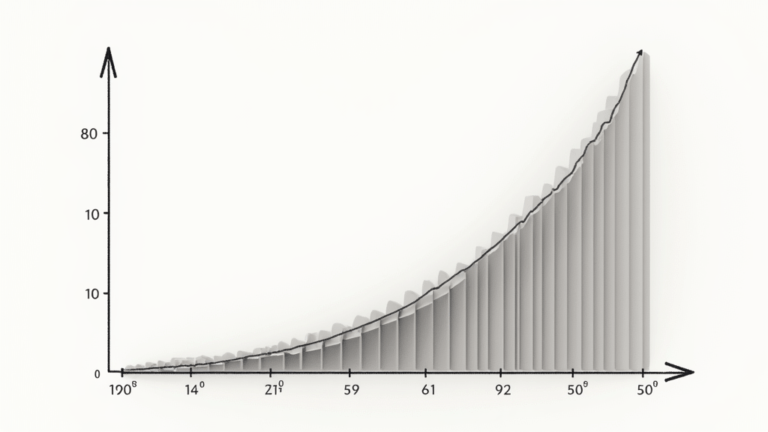

The amount of money in circulation, in the US alone, went up 61.8%. A property bubble was created due to demand for housing from cash rich buyers. A share market bubble was created. Everyone believed everything would continue to go up and up. They were wrong.

The Great Depression

Come 1929, the US Federal Reserve realised inflation was getting out of control. They decided the best way to control spending was to cut the amount of money in circulation. And cut they did, taking one third of the money supply out of circulation. This had a devastating effect. People did not have money to pay for their mortgages, loans and overdrafts. The shortage of funds meant consumers couldn’t spend. The property bubble burst and many associated businesses such a timber merchants, plumbers, electricians, carpenters etc. closed.

The share market bubble also burst with many fortunes lost in the blink of an eye.

Businesses closed.

The Great Depression had started.

History Repeats

Fast forward to 2020. A travel hungry population quickly spread a coronavirus leading to the current pandemic. The pandemic has caused severe lockdowns affecting many businesses. The self-employed became one of the hardest hit industries with many having to close their businesses permanently. Another industry hit particularly hard was the travel industry as many countries closed borders to prevent travel. Still millions of people around the world have lost their lives as a world struggled to come to terms with lack of medical treatments.

Most people forget the mini recession of 2020. They were, rightly so, more concerned with doing what was necessary to avoid the virus. But a recession did happen. The reaction of most governments was to start printing more money and putting it into circulation via furlough schemes, grants for businesses and other initiatives.

As governments try to encourage spending there has been a lot of Quantitative Easing. Governments have come up with an incredible number of initiatives to put money into workers hands. They want workers to spend. In the UK vouchers were given to consumers encouraging them to eat at restaurants. Governments are encouraging the feel-good factor.

Inflation on the Rise

The suspension of stamp duty on house purchases has seen a property bubble with house prices rising 13% in UK for the month of June and 15% in Ireland for the same month. Support businesses have also boomed to the extent that homeowners wanting smaller jobs done around their homes are being quoted astronomical prices. Conveyancing Solicitors in Wales, UK, were turning prospective clients away because they did have the resources to cope with the property buying surge.

Despite businesses being closed and profits being hit hard, the share market has boomed. Mobile phone apps for the share market, and social media sites have encouraged to general public to buy into shares. This has also triggered a share market bubble.

In August 2021, US Congress supported the printing of $1.2 trillion. As soon as it was passed a request went in from the president for a further $3.5 trillion.

Inflation is rampant. Food inflation is up 20%. Fuel is up 26% and power particularly in Spain went up 36%. The US announced it would allow inflation to continue for the foreseeable future. The UK Central Bank has suggested interest rates are likely to go up shortly.

While consumers are still being encouraged to spend there is no doubt that now is the time to be reigning in the spending and planning for a recession.

History Can Tell Us a Lot About the Future

History can tell us a lot about the future. The pandemic from 1918 – 1921 should be a lesson to global economies about what can happen when there is no money printing management or sensible fiscal plan. Just as the world went into the worst depression in history in 1929 it again stands on the brink of another major depression.

As the window of opportunity is closing, now is the time to start planning for your future.

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.