Don’t Fear Recession, Be Fearless – 4 Financial Education Tips

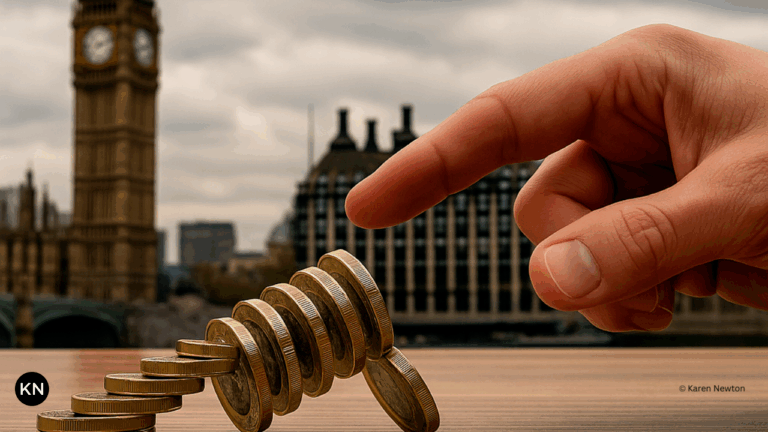

As more countries tumble into recession, fear takes hold—and panic often follows.

“What happens if I lose my job?”

“Will I still be able to pay my mortgage or rent?”

“How will I cover the bills and support my family?”

These are real, valid concerns. But in times like this, the biggest threat isn’t the recession itself—it’s a lack of financial education. Without the knowledge to respond strategically, fear takes over and opportunities are lost.

When you have knowledge, fear is no longer an option as you identify opportunities for surviving and thriving during a recession.

Key Takeaways

- Recessions can be an opportunity, not just a threat — if you’re financially prepared.

- Financial education helps you respond strategically instead of reacting with fear.

- Investors who understand economic cycles can build wealth while others panic.

- Safe-haven assets like gold and silver, and cash-flowing side businesses, offer protection and potential gains.

- The real winners in any recession are those who prepare early and position for the transfer of wealth.

Table of Contents

Why Financial Education Matters Most

When the economy contracts, many people freeze. But those with strong financial knowledge don’t just survive—they find ways to thrive. Recessions present unique wealth-building opportunities that aren’t visible to the untrained eye.

A recession wealth strategy begins with knowing how to respond, not react.

Understanding how different asset classes behave in a downturn, when to hold cash, and how to position yourself for the recovery is what sets successful investors apart from everyone else.

The Zero to Millionaire Membership covers a mixture of investment opportunities and strategies for thriving during difficult times.

Opportunities For Investors in Difficult Times

One of the key distinctions I teach is the difference between investors and traders. While traders look for quick wins, investors play the long game. And patience is one of their most valuable assets.

For example, as a bullion investor, I’ve been waiting over 20 years for the right conditions to maximise my gold and silver investments. And I expect to wait several more. But I’m prepared—because I’ve taken the time to build my Bullion Financial Education.

Another strategy is using a PCA Strategy with Monthly Income Dividend Shares. This strategy is perfect not just for beginners but for navigating investment cycles.

Economic cycles are predictable. The ups and downs may vary in timing, but they always come around. Downturn periods create some of the best opportunities across all four investment categories I teach:

- Business

- Property

- Digital Assets

- Cash and Commodities

While some businesses and assets fall in value during a downturn, others rise. The key is knowing where to look, and how to position yourself in advance.

Which Businesses Perform Best?

It’s true—some traditional businesses suffer in a downturn. But others absolutely thrive.

Franchise models and network marketing businesses, for example, often do well during recessions. Why? Because people who have lost jobs and are motivated. They bring urgency, dedication, and hunger to create an income. And that drive often leads to success.

These don’t need to be full-scale operations. A well-structured side hustle can bring in steady cash flow with as little as one focused hour per day. During uncertain times, that kind of stability becomes a lifeline—and for some, a launchpad to long-term freedom.

Income Building Strategy

While some people panic, others prepared for success. They spend time learning about economic cycles and the best time to in. That’s what separates survivors from wealth-builders.

Those who understand economic indicators often shift to cash in advance of a downturn. And as the saying goes: cash is king—because it gives you buying power when asset prices fall.

Bullion as a Safe Haven

Gold and silver aren’t just stores of value—they’re strategic safe haven tools.

For example, when the Gold:Silver ratio is high, investors buy silver. As the ratio drops, they convert that silver into gold—often gaining more ounces than they could have purchased outright.

But here’s the real power:

During prosperous times, it might take 100 gold coins to buy a house. But in a deep recession, you might only need 50, or even 10—depending on how far the market drops.

If you’d acquired those coins when gold was lower—and property was higher—your buying power in a downward turn could multiply dramatically.

Understanding the Transfer of Wealth

You’ll often hear that “wealth changes hands during a recession.” But what does that really mean?

It means those who are prepared—with cash flow, diversified assets, and a plan—can take advantage of lower prices to acquire more income-producing assets.

By investing when others are selling, they position themselves for massive gains when the economy recovers.

This shift—the increase in wealth during recovery—is what’s known as the transfer of wealth. And those with a strong financial education are the ones best positioned to benefit from it.

Recession Wealth Strategy: Build, Protect, Position

To build lasting wealth during a recession, smart investors focus on three things:

- Build assets in diverse categories (business, property, digital, cash).

- Protect income through hedging and smart asset allocation.

- Position for opportunity by staying liquid and informed.

Most importantly, they focus on creating multiple streams of income—ideally across all 8 income sources—so cash flow continues, regardless of what the economy is doing.

Final Thoughts: Education Over Fear

As we enter another global recession cycle, ask yourself:

- Are you reacting to fear—or responding with a plan?

- Do you have the financial education to protect yourself, your family, and your future?

Recession doesn’t have to be a time of loss.

It can be a time of learning, of building, and of positioning for wealth.

But only if you choose knowledge over fear.

Ready to Build Real Wealth – Even During A Recession

The Zero to Millionaire Membership gives you the strategies, support, and systems to grow your wealth through smart investing and income-building — even when the economy is uncertain.

- Learn how to invest in shares, crypto, property, gold & silver

- Build multiple income streams with step-by-step guidance

- Get access to weekly updates, tools, and proven frameworks

👉 Click here to join Zero to Millionaire now

Take control of your financial future — one smart move at a time.

Further Reading

Frequently Asked Questions

What is a recession wealth strategy?

A recession wealth strategy is a plan that focuses on building, protecting, and positioning wealth during economic downturns. It includes learning how different asset classes behave, holding cash when necessary, and using strategies like PCA or bullion investments to gain long-term advantage.

Why is financial education more important than ever during a recession?

Financial education helps you respond strategically instead of reacting emotionally. Understanding cycles, asset behavior, and wealth-building tactics allows you to see opportunities while others panic.

What types of investments perform well in a downturn?

While some investments drop in value, others—like gold, silver, income-producing property, and recession-resilient businesses—can thrive. Knowing when and where to invest makes the difference.

What is the Gold-to-Silver ratio, and why does it matter?

The Gold-to-Silver ratio measures how many ounces of silver it takes to buy one ounce of gold. Investors use it to identify when silver is undervalued and when to convert holdings between metals for maximum gain.

Can I really build wealth during a recession?

Yes. Recessions often trigger a transfer of wealth—those who are prepared with cash flow and financial knowledge can buy assets at lower prices and benefit during recovery.

What is PCA and how can it help me invest smarter?

PCA stands for Price Cost Averaging. It’s a strategy that involves investing the same amount regularly over time, helping smooth out price volatility—ideal for dividend stocks or crypto during uncertain markets.

How can I start building multiple income streams?

Begin with a simple, cash-generating business or side hustle. From there, reinvest profits into property, digital assets, or dividend shares to build long-term cash flow across multiple sources.

Explore More From Karen Newton International

Glossary

A full glossary of term and phrases is available here

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.