From Zero To Millionaire – My Journey

Is it even possible to go from zero to multimillionaire in just 4 years?

The answer is – Yes!

This is my story about how I started with absolute zero money and built my wealth up to £10 million and income to £360k a year in just 4 years.

Table of Contents

- The Lightbulb Moment

- The Plan

- Step 1 – Business

- Step 2 – Digital Investing, Monthly Dividend Income Shares

- Step 3 – Build a Property Portfolio

- Step 4 – Hedge with Commodities

- Step 5 – Write Books About Experiences, Skills and Knowledge

- Full Circle

- Zero to Millionaire Membership

The Lightbulb Moment

For as long as I can remember, studying the wealthy and how they made money was my hobby.

As a kid, my mother had asked me what type of lifestyle I wanted in the future. Describing my future dreams her reaction was “You better marry a millionaire” My response was, “Why can’t I be one?”

That was the catalyst to becoming a millionaire.

However, it didn’t matter how much I studied the wealthy, things just never worked for me until one day I had a lightbulb moment.

There was one thing I had not done – create a plan.

The Plan

As a business owner, planning was part of my business culture. Plans were created and regularly reviewed. I knew all about planning.

But I had never thought about a personal plan for wealth. That was a challenge and took time to reflect on.

Eventually, the plan was created.

Step 1 – Create businesses to generate cash for investing

Step 2 – Invest into Monthly Dividend Income Shares for income and growth

Step 3 – Build a property portfolio

Step 4 – Hedge investments by investing in commodities

Step 5 – write books about experience, skills and knowledge for each part of the journey.

The result was going from Zero to Multi-Millionaire within 4 years.

Step 1 – Business

Businesses are easy to start and create a cashflow that can be used for investing.

When working with clients, I challenge them on the 1st month to take a look around their homes at something they haven’t used for 6 months and think unlikely they will use again in the coming 6 months. Then sell it. Use platforms such as eBay, Etsy, Shopify etc.

The results have been quite amazing. Earnings range from £211 – £5500 in one month.

Clients now have a business opportunity / side hustle they can continue growing.

One client now earns circa £40,000 a year from eBay. Found a niche they liked and developed it into a business model that generates an income that allowed them to give up their full-time job.

As for me, I had just arrived in the UK and didn’t have any unused item to sell. I joined Kleeneze and Avon.

Every night I would walk down one street delivering catalogues and walk back on the street I had delivered to the previous night.

Profit from the catalogue business went into share investing.

Later this developed into online businesses – affiliate marketing; information products, books and courses.

Step 2 – Digital Investing, Monthly Dividend Income Shares

The first target for the catalogue business was to generate a monthly profit in excess of £100 to invest into shares.

I opened an online brokerage account and started investing in Monthly Dividend Income Shares. Reinvesting the dividends each month back into the shares.

This compounding effect provided a higher return than traditional investing with income growing every month.

As the dividends grew, I expanded into penny share investing for growth income.

As the country was coming out of recession, many shares were undervalued. Identifying penny shares, I started accumulating as many as possible.

As the shares went up in value and doubled in price, half the shares were sold with the income going into monthly income dividend shares.

The remaining shares were left to again double in price, when another 50% of holdings were sold.

This process was continued until all the penny shares were sold.

I still use this strategy today only now cryptocurrency is also included.

Cryptocurrency has monthly earnings and low value tokens equivalent to the monthly dividend shares and penny shares.

Step 3 – Build a Property Portfolio

I returned to the UK when my mum died. I lost 6 members of my family over the next 8 months. During this time my husband and I were living with my step-father.

He was in his 70s and didn’t want to be on his own. So, we looked at a property opposite his providing him with the companionship he still needed.

The property was on the market for £54,999. We had a mortgage approved for 95% as a first-time buyer in UK. We made an offer on the property for the asking price but asked for a gifted deposit. The offer was declined.

A month later the price was dropped to £49,999 and again we made an offer with a gifted deposit it was declined.

Two months later, the price dropped again to £44,999 and again our offer was declined.

After several months the price dropped to £39,999 with a gifted deposit and we bought the property.

Refurbished the property, got it revalued to £65,000 and applied for an 85% mortgage.

With the surplus cash in hand after the old mortgage had been repaid, we headed to Auction. Bought a property for £7200. Refurbished it. It was revalued at £35,000. Applied for an 85% mortgage using the cash from the mortgage to buy more properties.

This process was continued until we owned 60 properties in under 4 years.

With property prices rising and each property worth well over £100,000 we had £6 million in property assets.

Step 4 – Hedge with Commodities

Gold and Silver were the commodities we chose to buy. Coins and Bars could easily be purchased online.

We set a rule, that 10% of mortgage cash we were generating would be used to buy Gold and Silver bars and coins.

Some were placed in vault storage, while some coins were kept in a home safe for easy access and liquidity.

Gold has been on a long bull run since President Nixon took the dollar off the gold standard. In the 1970s gold was $32 a troy ounce. When we started buying it was $400 and today it is $2696.

While not an exciting investment, it has been a long and steady growth for many years.

Step 5 – Write Books About Experiences, Skills and Knowledge

The decision to write about my journey to building wealth has resulted today in 30 books. Three number 1 international best-selling books.

Once the books drop off their peak sales, I create information products and courses.

There is demand for “how to” books, courses and videos (YouTube & TikTok). This has created another business generating income.

The books are self-published through Amazon and the courses and information products are available through Karen Newton International. Videos are available on YouTube Channels and TikTok.

Full Circle

The plan I created, helped to build my wealth, and is a continuous cycle of business creation; income generation and investing.

I went from Zero to £10 million in under 4 years. Today, this simple plan has helped me to increase wealth even more with the aim to become a billionaire by 2030.

The plan was the missing step in building wealth. It helped me to focus on my plan, not go astray trying this that or the other. It is a plan that still works for me today. I keep building businesses; adding property to my portfolio; buying shares and cryptocurrency; hedging with gold and silver and writing about my experiences, skills and knowledge.

Zero to Millionaire Membership

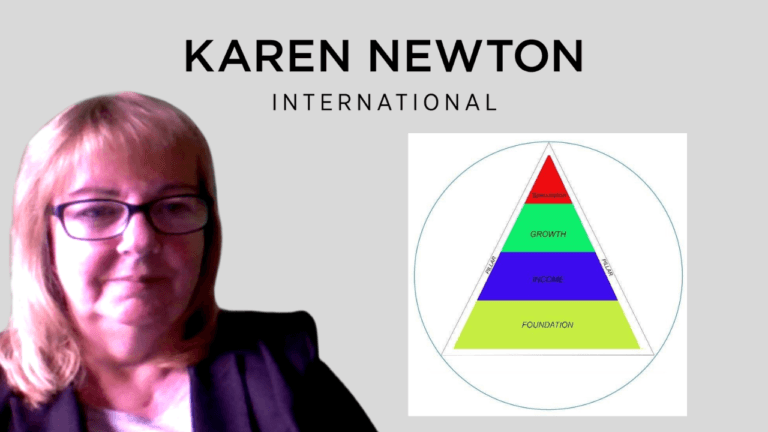

The Zero to Millionaire Membership is a step-by-step process for how to build wealth using my wealth plan.

It provides instruction to put into place a foundation on which to build wealth, income and lifestyle.

Join us live on the 1st Monday monthly and start your journey from Zero to Millionaire.

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.