The Power Of Compound Interest In Wealth Accumulation

Key Takeaways

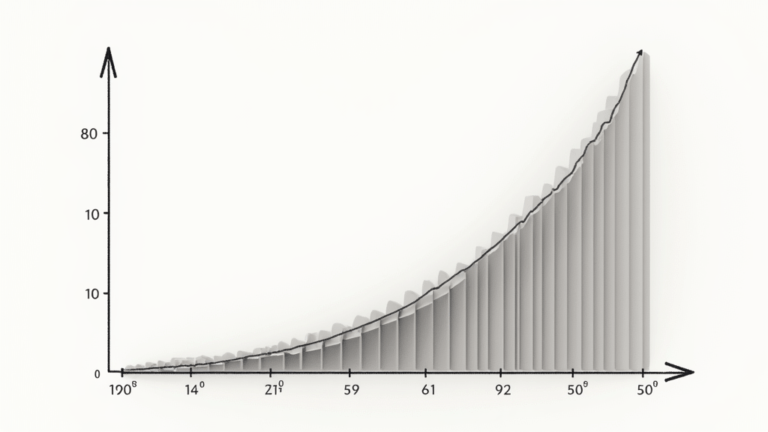

- Exponential Growth using the compounding effect

- Time is Key – the longer the time the better the return

- Frequency Matters – short intervals better returns

- Longterm Strategy – 80% growth in last period

Einstein described it as the 8th wonder of the world so why do so few people understand the concept or even apply it to grow their wealth.

In this blog, we take a look at The Power of Compound Interest in Wealth Accumulation.

Table of Contents

- What is Compound Interest?

- How Time Influences Compound Interest

- Frequency Matters – Shorter Periods Provide a Better Compound Interest Return

- Using Compounding Interest as a Long-Term Strategy

- Frequently Asked Questions

- The Power of Compound Interest in Wealth Accumulation

Compound interest is often misunderstood and not appreciated. Yet, when used as part of an investment strategy it is a power tool that can be utilized to build wealth quicker.

What is Compound Interest?

Imagine saving $1000 per year, into an investment earning 14% per annum return.

At the end of the first year, $140 interest is received.

In year 2, another $1000 is invested so the total invested is $2000. The assumption is that the interest earned is $280 (2 x 140) however, if year one interest had been deposited into the investment the pot would be worth $2140 and the interest earned is $300.

The compounding effect is earning interest on interest.

If the above scenario of reinvesting interest, continued annually, by year 6, the interest earned would be higher than the amount invested yearly.

So, what exactly is compound interest?

It is reinvesting interest so more interest can be earned.

How Time Influences Compound Interest

Time is one of the most important elements to making compounding interest work.

This is why most people fail to make the most out of the compounding effect, as they want results instantly.

For example – invest $1000 annually, at 14% return for 5 years. The amount invested is $5,000 but with compounding interest, the value is $7,537 The compounding interest earned is $2,537

Invest $1000 annually, at a 14% return for 10 years and the results are incredibly different. Invested $10,000 but with the compounding effect the value is $22,045. The interest earned is $12,045

The time element has increased the compounding effect.

So, the longer you can invest your money and allow the compounding effect to work the better the benefit.

If we continue to use this scenario of $1000 per year at 14% by year 37 the investment has been $37,000, however, the value of the pot is over $1 million.

Time influences compounding interest. The longer the time the better the return.

Frequency Matters – Shorter Periods Provide a Better Compound Interest Return

When I worked in banking we did an exercise in calculating the return on 30 days and 12 months investments.

Although the interest paid was higher on the 12-month investment term, it was the 30 days investment that provided the better return if the interest was reinvested every 30 days.

In another exercise, we compared share investing with dividends paid monthly and dividends paid twice yearly.

Again, the monthly dividend-paying shares outperformed other shares over time.

The frequency of reinvesting over shorter periods has an impact on providing a better compound interest return.

Using Compounding Interest as a Long-Term Strategy

When it comes to building wealth, short-term activity over a longer period is the most beneficial way of achieving success.

It is also the reason very few people achieve wealth. They want instant results.

When I work with clients, they start by investing in monthly dividend income shares. Most are extremely disappointed when they get their first dividend which is a few pence.

With perseverance, by the end of the year, the pennies become pounds and they now start to see how reinvesting each month has grown their overall pot.

After a couple of years, they are receiving hundreds of pounds a month. The realization starts to sink in – short-term activity over a longer period is the most beneficial way of achieving success.

Frequently Asked Questions

What is the Difference Between Simple Interest and Compounding Interest?

Simple interest is calculated on the principle. Compounding interest is calculated on principle and accumulated interest from previous periods.

What is the Main Disadvantage of Compounding Interest?

Compounding interest has no disadvantage for investors. However, as a borrower with compound interest, it has a detrimental effect on payments if the consumer is only making the minimum monthly payments.

What is the Formula for Calculating Compound Interest?

The formula for calculating compound interest is A = P(1 + r/n)^(nt), where A is the future value of the investment, P is the principal amount, r is the annual interest rate (in decimal), n is the number of times interest is compounded per year, and t is the time the money is invested for in years.

Can I Make a Million Using Compound Interest?

Yes, you can.

It will depend on how much is being invested, at what rate and over what time.

The formula above can be used to calculate how long it will take.

In the scenario in this blog of investing $1000 per year at a 14% annual return, it will take 37 years to become a millionaire.

Learn more with the Zero to Millionaire Membership.

The Power of Compound Interest in Wealth Accumulation

Compound interest offers exponential growth potential by accruing interest not just on the principal but also on previously earned interest.

Over time, this compounding effect magnifies wealth accumulation, making it a powerful tool for long-term financial growth.

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.