Stagflation 2025: 5 Warning Signals And Strategic Benefits

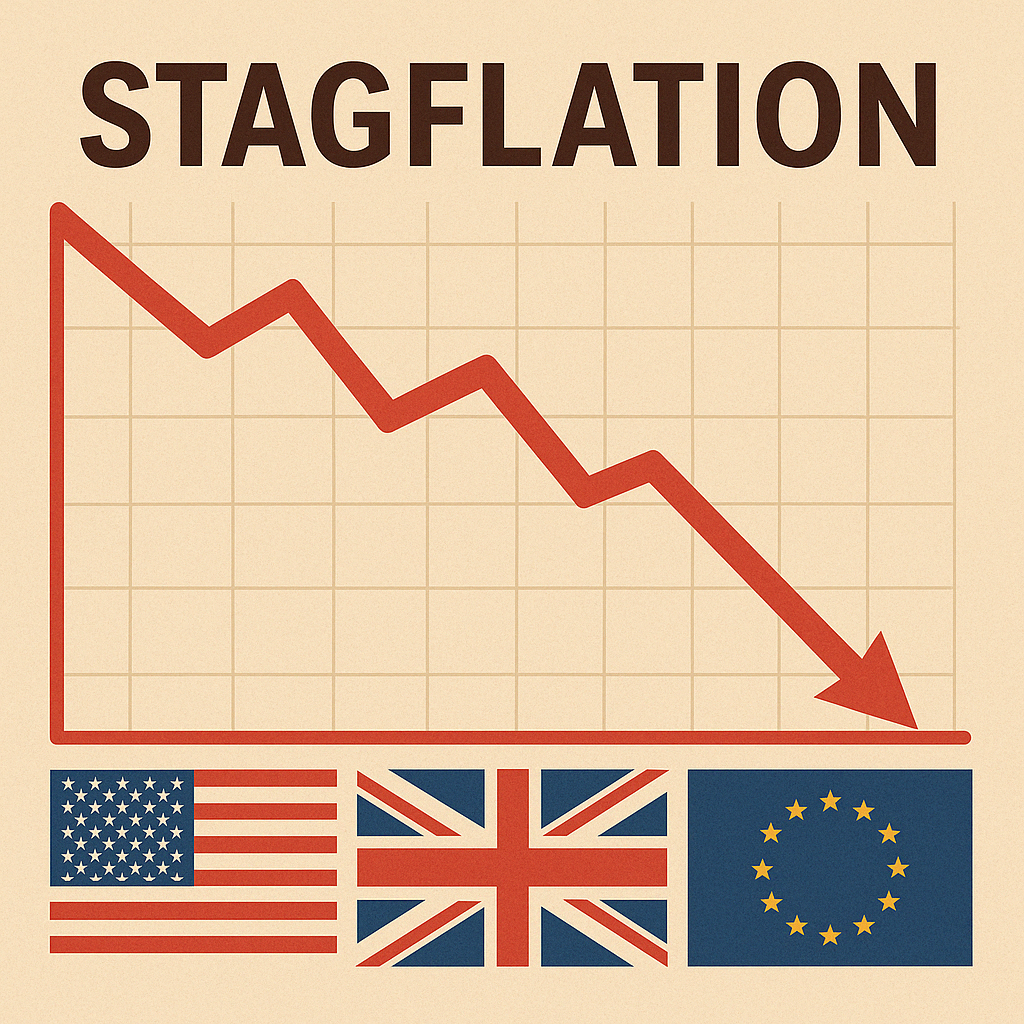

As we move deeper into Stagflation 2025, the global economy is flashing warning signs that seasoned investors haven’t seen since the 1970s. Inflation is rising. Growth is stalling. Confidence is collapsing. And the term that’s quickly gaining traction across boardrooms and newsrooms alike is stagflation. This rare and dangerous economic condition—where high inflation meets stagnant growth—is no longer just a theoretical risk. It’s becoming a very real threat to businesses, households, and financial markets around the world.

In this week’s roundup, we break down what’s happening in the U.S., U.K., and EU, and what stagflation 2025 could mean for your wealth strategy moving forward.

Key Takeaways

- Investor confidence in the U.S. is at a 30-year low, driven by fears of stagflation 2025.

- Inflation and interest rate uncertainty are reshaping monetary policy in the U.S., U.K., and EU.

- Central banks are cutting rates, but growth remains sluggish.

- Rising consumer costs, weak growth, and supply chain issues point to deeper systemic risks.

- Understanding Stagflation 2025 is essential for preparing a smart financial strategy in 2025.

Table of Contents

- Key Takeaways

- What Is Stagflation 2025 and Why Is It Dangerous?

- The U.S. Economy: Inflation, Investor Fear & Trade Tensions

- The U.K. Economy: Slower Growth, Rising Costs

- The EU Outlook: Rate Cuts, Sluggish Growth, and Diplomatic Tension

- What This Means for Entrepreneurs & Investors

- Stagflation Warning Signs

- Stagflation 2025 Updates

- FAQ: Understanding Stagflation 2025

- Related Reading

What Is Stagflation 2025 and Why Is It Dangerous?

Stagflation is a rare but economically painful situation where high inflation exists alongside slow economic growth and rising unemployment. The term gained prominence in the 1970s when oil shocks and policy missteps led to a prolonged economic slump in the West.

Unlike typical inflationary periods—where economic growth offsets rising prices—stagflation creates a double-edged problem. Central banks can’t fight inflation with interest rate hikes without worsening unemployment. Nor can they stimulate growth without risking higher inflation.

In short, stagflation traps policymakers. For individuals and businesses, it results in:

- Declining purchasing power

- Sluggish income growth

- Rising costs without increased consumer demand

- Greater risk for long-term investments

Stagflation 2025 is the term used to define the current economic situation.

The U.S. Economy: Inflation, Investor Fear & Trade Tensions

This week’s big headlines came from the U.S., where signs of stagflation are flashing red:

Inflation Expectations Climb

Following new tariffs on EU and Chinese imports, economists now expect inflation to remain above the Fed’s 2% target until at least 2027. The tariffs are increasing input costs across industries, pushing consumer prices higher.

Federal Reserve on the Defensive

Fed Chair Jerome Powell expressed concern that these trade policies are moving both inflation and unemployment further away from their targets. While earlier forecasts suggested multiple rate cuts in 2025, that number has been revised down to just two—if conditions allow.

Investor Confidence Crashes

A Bank of America survey reported that 80% of fund managers now see the trade war as the top market risk. Investor sentiment is at its lowest in three decades, with 90% expecting stagflation.

Stock Market Reaction

The S&P 500 has dropped 12% since February. Investors are shifting from growth stocks to safer assets—like bonds and dividend-paying shares—as uncertainty grows.

Consumer Impact

Retailers like Walmart and Target have announced upcoming price hikes due to import costs. This puts further pressure on household budgets, especially for low and middle-income families.

The U.K. Economy: Slower Growth, Rising Costs

The U.K. isn’t immune from these global shocks.

Inflation Set to Rise

After a slight reprieve, inflation is now expected to approach 4% by summer, driven by global supply chain issues and domestic energy costs.

Growth Cut in Half

The Treasury has halved the U.K.’s growth forecast from 2% to 1%, warning of higher debt costs and pressure on public services.

Government Spending Shifts

A £14 billion budget shortfall has prompted talk of welfare cuts and defense spending increases. At the same time, tax evasion crackdowns are being prioritized to boost revenues.

Retail Activity Holding—for Now

Footfall across high streets rose 3% in early April. While this offers short-term optimism, rising inflation may soon reverse the trend.

The EU Outlook: Rate Cuts, Sluggish Growth, and Diplomatic Tension

The EU’s situation is also complex, with central banks now taking action to avoid full-blown recession.

Seventh Rate Cut in a Year

The European Central Bank lowered its interest rates by another 25 basis points, trying to encourage lending and economic activity. But the underlying concern remains: growth is nearly stagnant.

Forecasts Revised Downward

The ECB now expects just 0.9% growth in 2025 across the eurozone. Tariffs are hurting exports and confidence, especially in manufacturing-heavy economies like Germany.

Markets Respond

Indices such as Germany’s DAX and the U.K.’s FTSE have experienced increased volatility. Safe haven assets, like gold and long-term bonds, are becoming more attractive.

Trade Disruption

EU exporters are facing barriers into the U.S. market. In response, Italian Prime Minister Giorgia Meloni has offered to mediate talks between the EU and the U.S. to resolve the trade dispute.

What This Means for Entrepreneurs & Investors

We’re not in crisis territory—yet—but we are in strategic territory.

The combination of inflation, slowing growth, and policy uncertainty calls for a shift in mindset. Here are a few moves to consider:

- Diversify Revenue Streams: If you rely on consumer spending, expect fluctuations. Multiple income sources are your safety net.

- Watch Interest Rate Trends: Borrowing may stay expensive longer than expected. Reassess any leverage or growth plans tied to low rates.

- Invest in Defensive Assets: Dividend stocks, gold, and inflation-linked bonds can offer more stability.

- Stay Educated: In a stagflation environment, those who act with insight—not impulse—will fare best.

Stagflation Warning Signs

The warnings of stagflation in 2025 are not just theoretical—they’re already shaping markets, policy, and personal finances. The global economy is entering a strategic reset phase.

Whether you’re running a business, managing a portfolio, or just planning your next financial move, the best position to take right now is an informed one.

Stay smart. Stay strategic. And most importantly—keep building your wealth with purpose.

Stagflation 2025 Updates

The Zero to Millionaire Membership has monthly live sessions with economy updates and strategy discussions for Business and Wealth.

FAQ: Understanding Stagflation 2025

What is stagflation 2025 and why is it a concern?

Stagflation is a rare economic condition where inflation remains high while economic growth slows and unemployment rises. In 2025, the global economy is showing signs of stagflation due to rising prices, sluggish growth, and persistent trade disruptions, making it a major risk for investors and businesses. Stagflation 2025 is the term given to the current economic situation.

How does stagflation 2025 affect small business owners?

Stagflation can reduce consumer spending, increase operating costs, and limit access to affordable credit. Small business owners may struggle to maintain margins and must adapt quickly by cutting expenses, diversifying income streams, or restructuring pricing.

What caused the stagflation 2025 fears?

Recent tariff escalations, global supply chain issues, and constrained monetary policy are all contributing factors. In the U.S., rising import costs and inflation expectations have triggered fears of a long-term stagflation cycle.

How should investors respond to stagflation 2025?

During stagflation, investors often pivot toward defensive strategies—such as dividend-paying stocks, inflation-linked bonds, and commodities like gold. Portfolio diversification and capital preservation become top priorities.

Can central banks stop stagflation 2025?

Stagflation presents a dilemma for central banks. Raising interest rates can curb inflation but worsen unemployment and slow growth. Lowering rates may boost growth but risks driving inflation even higher. As a result, policy responses in 2025 are cautious and often limited in impact.

Related Reading

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.