How An ISA Can Be Your Best Friend When Investing

ISA is the best wealth kickstarter and often underestimated. It provides tax free investing and capital growth. Whether a seasoned investor or a beginner and can be your best friend when investing.

Table of Contents

- What Is An ISA Account

- What is the Qualifying Criteria?

- What can you save?

- How an ISA Can Be Your Best Friend When Investing

- Further Reading

- Frequently Asked Questons About ISA Investing

- Learn More About Karen Newton International Ecosystem

- Glossary

What Is An ISA Account

An ISA (Individual Savings Account) is a wrapper that goes around certain approved type of savings that allows the saver to earn income tax free. There is a limit on how much can be saved per year which for 2019/20 is £20,000 for an over 18 years old ISA account. It is an excellent way to save and invest as you don’t pay income tax or capital gains tax on the income earned within the wrapper which has the effect of allowing your investment to grow quicker as you get to keep all the money you make. In addition the government does not require any earnings within the wrapper to be declared on a tax return.

There are currently 4 different types of accounts for anyone 18 years old and over.

- Cash

- Stocks & Shares

- Innovative Finance

- Lifetime (saving allowance into this account is £4000 per year)

For under 18 year olds there is a Junior ISA. The saving allowances for 2019/20 is £4368. There are two types of accounts for under 18 year olds

- Cash

- Stocks and Shares

The saving allowance for both over 18 and under 18 years old can be split between any of the ISA’s if you qualify to hold that type of account. As an example, if you are over 18 year old, you might hold an Innovative Finance account and a Stocks and Shares account so your £20,000 savings allowance could be split between both of those accounts.

What is the Qualifying Criteria?

- From the age of 16 any UK resident can hold a cash ISA account.

- 18 years old and over can hold a stocks and shares and an Innovative accounts provided they are a resident in the UK

- A Lifetime account is for anyone over 18 but under the age of 40

For more information visit The UK Government Website

What can you save?

There are different types of savings which can be included within the ISA Wrapper.

Cash – this can include any money that you hold in a bank savings account; a building savings account; there are also some investments run through NS&I (National Savings and Investment) a government state owned savings bank which also qualify for Cash ISA

Stocks & Shares – the investments included in this type of account are shares in companies; unit trusts and investment funds; corporate bonds and government bonds. Not all of these types of investments will qualify to be included in an ISA. You will need to verify which ones can. If you are investing in shares, when looking at the overview page of the share, it will normally say simply “yes” or “no” that it can be included in a Stocks & Shares ISA.

Innovative Finance – was set up to allow people who loaned money through Peer-to-Peer Lending – loans made to individuals and businesses through alternative platforms other than banks – to be able to offset taxes on the income they earn. It has now been expanded to included crowdfunding debentures. The debentures are investing in businesses through buying the debt that the business owns.

Lifetime – this account was set up to help save towards your first home or retirement. You can add Cash or Stocks & Shares into this account between the age of 18-39. The limit is £4000 per year and the government will contribute a 25% bonus to the account, each year, up to a maximum of £1000 per year.

The money can only be withdrawn if you

a) want to buy your first home

b) you are aged 60 or over or

c) are terminally ill with less than 12 months to live. As the government adds the 25% bonus each year, if the money is withdrawn prior to the qualifying criteriWhy an ISA is your Best Friend for Investing?

above, they will charge a penalty so they can claw back the bonuses they have paid. With the Lifetime ISA there are rules about buying homes or transferring to the ISA to a different type of ISA. Whoever, your ISA is with, they will explain the rules.

How an ISA Can Be Your Best Friend When Investing

Most people when they invest, are hoping to build their wealth. However, it is not the money they want, it is the lifestyle that the money can buy. With the UK Government ISA’s this is recognised as if you want a savings account that pays a bit more money that a traditional savings account then the Cash ISA provides for this. Many organisations try to make them fixed term savings but there a flexible Cash ISAs that will allow you to save for a specific reason and then withdraw your funds while enjoying the benefit of tax-free interest on the account.

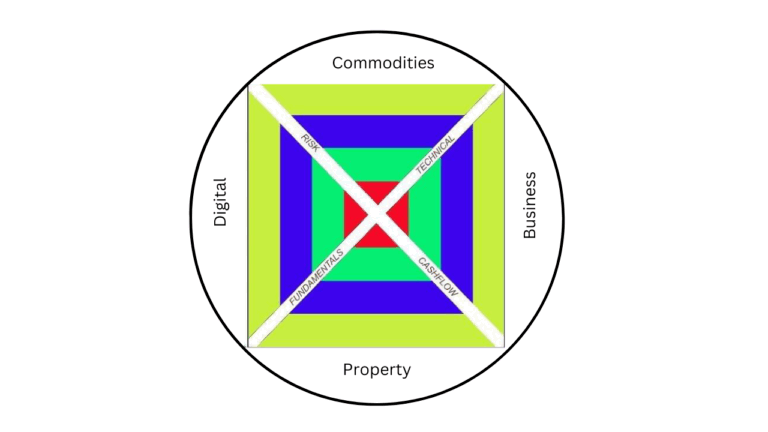

Over the past decade or so, the government has been encouraging the UK population to take more responsibility for their finances and future needs such as retirement or home care. Providing flexible ISA’s that allow the investor freedom of choice in the way they invest their money while providing them with incentives such as bonuses, free from income tax and free from capital gains tax style investments helps to encourage the public towards financial independence.

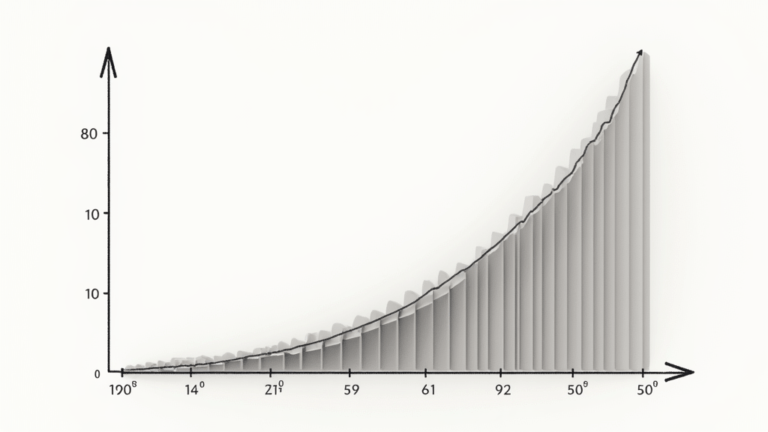

The investment allowance is a per year allowance. If you can save the £20,000 allowed this year and again next year and the year after you can generate a lot of tax-free interest, dividends and capital growth in a short time. This allows the power of the compounding effect to be far more effective in a shorter period of time. By this I mean that if you earned say £100,000 in dividends and had to pay say 40% tax, the amount available for reinvesting would be £60,000. Through an ISA the £100,000 earned would remain tax-free meaning the full £100,000 could be reinvested back into the investment. The investment grows quicker.

An ISA is your best friend for any type of saving or investment as the tax-free income and capital gains along with the bonuses paid through the lifetime ISA can accelerate your investment goals. Helping you to achieve the lifestyle dreams much quicker. Anything that helps you achieve your dreams and goals has be good.

Further Reading

Frequently Asked Questons About ISA Investing

What is an ISA and how does it work?

An ISA (Individual Savings Account) is a tax-efficient account that allows UK residents to save or invest without paying income tax on interest or dividends, and no capital gains tax on profits. You can invest up to your annual allowance (£20,000 for the 2025/26 tax year) across one or more types of ISA

What types of ISA are available?

The main types are:

Cash – Works like a regular savings account but with tax-free interest.

Stocks & Shares – Allows you to invest in shares, funds, bonds, and ETFs with tax-free growth.

Innovative Finance – Used for peer-to-peer lending or crowdfunding investments.

Lifetime – For first-home purchases or retirement (with government bonus).

Junior – For under-18s, with funds locked until age 18.

Can I have more than one ISA?

Yes, you can hold multiple accounts, but you can only open and pay into one of each type per tax year. For example, you could invest in both a Cash and a Stocks & Shares account in the same year, as long as your total contributions don’t exceed the annual allowance.

What happens if I withdraw money?

For most ISAs, once you withdraw funds, you can’t replace them without affecting your allowance. However, flexible ISAs allow you to withdraw and replace money in the same tax year without reducing your annual limit — useful if you need temporary access to funds.

Are ISAs risk-free?

It depends on the type:

Cash are low-risk but may not keep up with inflation.

Stocks & Shares can grow more over the long term but carry market risk.

Innovative Finance have higher potential returns but also higher default risk.

Learn More About Karen Newton International Ecosystem

Glossary

For glossary of terms and explanations use this link

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.