Dividend and Compounding Strategy: The Smart Investor’s Secret to Long-Term Wealth

When most people think about share investing, they picture a fast-paced environment—flashing numbers on screens, people shouting “Buy! Sell! Sell!” It’s the image we often see in movies or on financial news. But Dividend and Compounding investing or rather real investing, especially for long-term wealth, often looks nothing like that.

In today’s digital world, successful investors are just as likely to be sitting on their balconies with a cup of coffee, checking their portfolios on a mobile app. And for many of them, one of the most powerful strategies they use is something far simpler and more patient than day trading.

Dividend and Compounding Investing is one of the most effective ways to build consistent, long-term wealth.

Key Points For Dividend and Compounding Strategies

- Dividend investing involves earning regular income from companies that share a portion of their profits with shareholders.

- Monthly and quarterly dividend-paying shares allow for faster reinvestment and compounding.

- The compounding effect accelerates wealth-building over time by reinvesting dividends to buy more shares, which then earn more dividends.

- A Dividend and Compounding Strategy is ideal for beginners looking for a simple, long-term investing approach.

- Companies with reliable dividend histories and consistent payout schedules are key to successful dividend investing.

- Reinvesting dividends regularly is essential to maximise the compounding effect.

- The longer you invest, the more powerful compounding becomes—patience is the key.

- Combining dividends and compounding offers a stable, passive income strategy that can support financial freedom goals.

Table of Contents

- Key Points For Dividend and Compounding Strategies

- What Is a Dividend?

- Compounding Effect

- Further Reading

- Dividend and Compounding FAQ

- What is a dividend in investing?

- What is the compounding effect?

- Is dividend investing good for beginners?

- How often should I reinvest dividends?

- What’s better: monthly or quarterly dividend stocks?

- Do all companies pay dividends?

- Can I live off dividends?

- What’s the best way to start with dividend and compounding investing?

What Is a Dividend?

A dividend is a payment made by a company to its shareholders, usually from profits. Think of it as a thank-you for owning shares in the business. Not all companies pay dividends, but many do—especially larger, established companies with a solid history of performance.

Companies typically pay dividends:

- Once a year (annually)

- Twice a year (semi-annually)

- Four times a year (quarterly)

- Twelve times a year (monthly)

For dividend-focused investors, companies that pay monthly dividends offer the best opportunities for regular income and reinvestment potential.

Compounding Effect

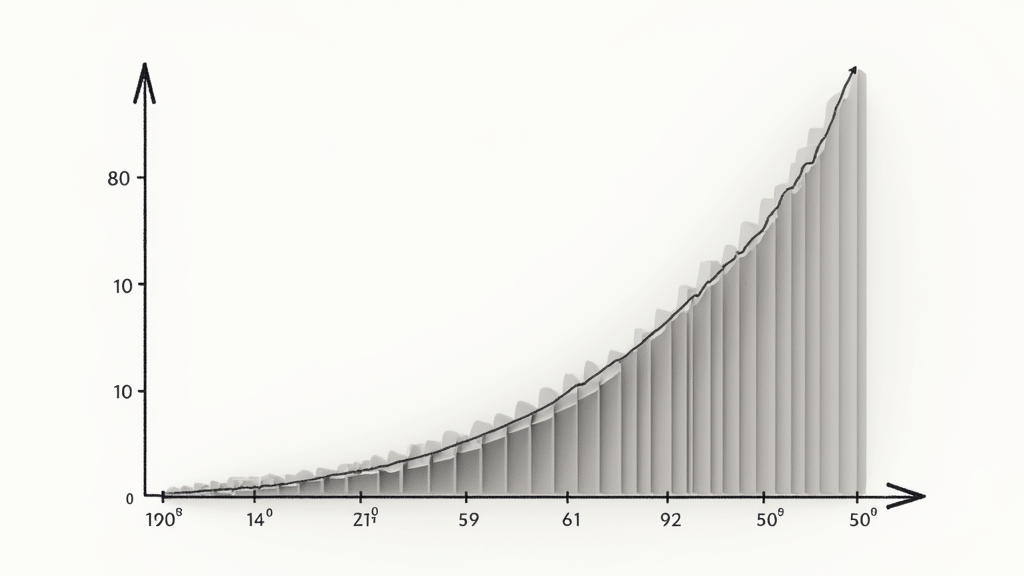

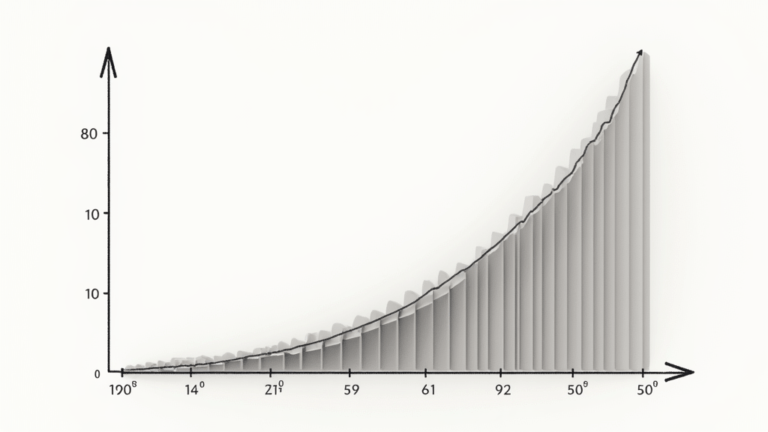

Imagine a hockey stick. It is flat on the ground level, curves gently, then goes almost straight up to the handle. The hockey stick is a perfect example of what a compounding effect chart would look like.

When investing in shares the return is low to start with. Then returns increase and create the gentle curve. Finally, returns grow exponentially creating the handle effect.

Albert Einstein described compounding interest as the 8th wonder of the world. He said “he who understands it, earns it. He who doesn’t, pays it” sadly very few have the patience to allow the compounding effect to grow to the exponential returns possible and earn financial wealth.

Combining dividend investing with the compounding effect and you build a powerful combination of strategies which can produce incredible results in the shortest possible time.

Further Reading

Dividend and Compounding FAQ

What is a dividend in investing?

A dividend is a portion of a company’s profits paid out to shareholders, usually in cash. It’s a reward for investing in and holding shares in a company. Dividends can be paid monthly, quarterly, or annually, depending on the company’s policy.

What is the compounding effect?

Compounding is the process of earning returns on both your original investment and the returns you’ve already received. When you reinvest dividends, your investment grows faster because you’re earning interest on your interest—leading to exponential growth over time.

Is dividend investing good for beginners?

Yes! Dividend investing is one of the best strategies for beginners because it’s straightforward, low-maintenance, and focuses on long-term growth. It allows new investors to build wealth gradually without needing to monitor the market constantly.

How often should I reinvest dividends?

Ideally, you should reinvest dividends every time they’re paid to take full advantage of compounding. This is especially effective with monthly or quarterly dividend-paying shares.

What’s better: monthly or quarterly dividend stocks?

Both have their advantages, but monthly dividend stocks allow you to reinvest more frequently, which accelerates the compounding effect. Quarterly stocks are also solid options and are more commonly available.

Do all companies pay dividends?

No. Not all companies pay dividends. Some prefer to reinvest profits back into the business. When using a dividend strategy, it’s important to choose companies with a reliable dividend history and a consistent payout schedule.

Can I live off dividends?

It is possible to build a dividend portfolio that provides regular income, especially in retirement or as part of a financial freedom plan. However, it typically requires long-term investing and a well-diversified portfolio of strong, dividend-paying companies.

What’s the best way to start with dividend and compounding investing?

Start by:

Staying consistent and patient to let compounding work its magic

Researching companies with consistent dividend payouts

Opening an investment account or brokerage platform

Reinvesting dividends automatically

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.