Variable Cost Averaging (VCA)

A Smarter Approach To Investing In Volatile Markets

Investing in the stock market requires a solid strategy, particularly in volatile conditions where prices fluctuate frequently. One such strategy that provides a systematic and controlled approach is Variable Cost Averaging (VCA). Unlike traditional Price Cost Averaging (PCA), where an investor commits a fixed sum at regular intervals, VCA adjusts the percentage of investment based on the share price’s relative position within its recent range.

This blog explores how Variable Cost Averaging (VCA) works, how it helps investors navigate volatile markets, and why it can lead to superior capital and dividend gains over time.

Table of Contents

- A Smarter Approach To Investing In Volatile Markets

- Understanding Variable Cost Averaging (VCA)

- Comparison with Price Cost Averaging (PCA)

- Why VCA is Ideal for Volatile Markets

- Implementing VCA in Your Investment Strategy

- Example of VCA in Action

- Conclusion

- Are you ready to take control of your investments?

- Frequently Asked Questions (FAQs)

Understanding Variable Cost Averaging (VCA)

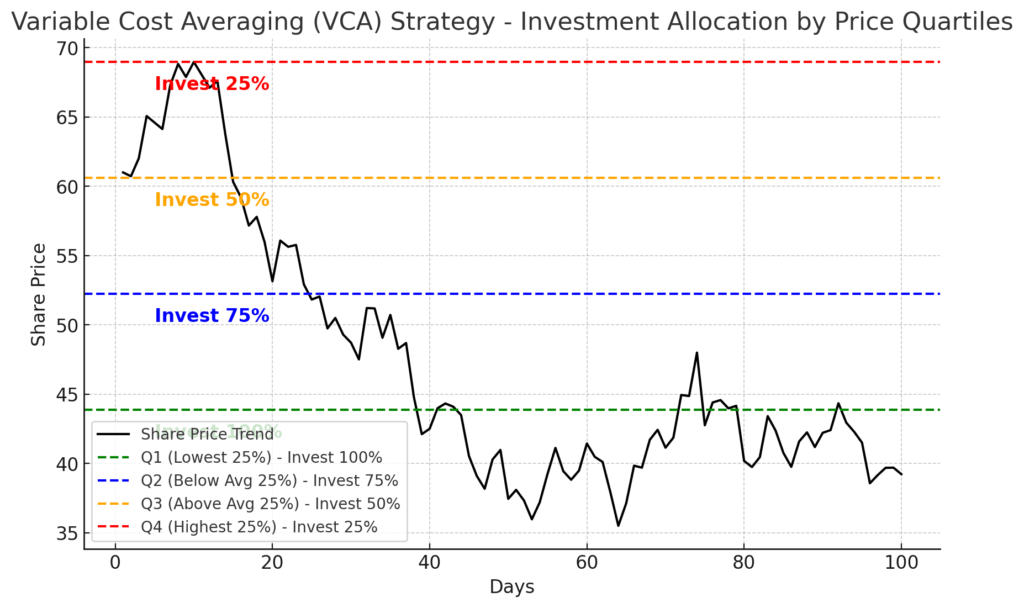

VCA is a refined approach to dollar-cost averaging (DCA), which adjusts investment allocation based on share price movements. Instead of investing a fixed amount at regular intervals, VCA splits available investment capital into different percentages depending on which quarter the share price is in within its price range over a given period.

This method ensures that more funds are allocated when prices are lower, leading to better capital gains, and fewer funds are invested when prices are high, reducing risk exposure.

How VCA Works

To implement VCA effectively, investors need to determine the price range of a stock over a given period, such as a year. This price range is then divided into four quarters:

- Lowest 25% (Q1) – Maximum Investment

- Below Average 25% (Q2) – Moderate Investment

- Above Average 25% (Q3) – Reduced Investment

- Highest 25% (Q4) – Minimum or No Investment

Each quarter determines how much of the available investment fund is allocated. Here’s an example of how the capital might be distributed:

- Q1 (Lowest 25%) – Invest 100% of available funds.

- Q2 (Below Average 25%) – Invest 75% of available funds.

- Q3 (Above Average 25%) – Invest 50% of available funds.

- Q4 (Highest 25%) – Invest 25% or hold funds.

Comparison with Price Cost Averaging (PCA)

In Price Cost Averaging (PCA), an investor commits the entire pot to the market each month, regardless of price levels. While this method helps to smooth out market volatility, it doesn’t optimize returns during price fluctuations.

With Variable Cost Averaging (VCA), investments are adjusted based on price positioning. This means:

- When prices are high, only a portion of the available funds are used.

- When prices are low, a larger portion (or the full pot) is invested.

- This ensures that more shares are bought when prices are low and fewer shares when prices are high, resulting in better cost efficiency over time.

Why VCA is Ideal for Volatile Markets

Volatile markets present both risks and opportunities. Traditional investing methods may fail to capitalize on price swings effectively, but VCA thrives in such conditions. Here’s why:

1. Reduces Risk Exposure

By allocating less capital when share prices are in the highest range, VCA minimizes the risk of overpaying for stocks. This is particularly useful in a volatile market where prices can swing dramatically.

2. Maximizes Share Accumulation

Since VCA invests more funds when prices are low, investors acquire a greater number of shares at a discount. Over time, this results in improved capital appreciation and increased dividend earnings.

3. Enhances Capital Returns

By avoiding large investments when prices are at their peak and maximizing investments during dips, the average cost per share remains lower, leading to higher returns. Historical trends show that this method can outperform fixed investing strategies, often achieving annual returns of 8% or more.

4. Boosts Dividend Income

More shares acquired at lower prices lead to higher dividend payouts, assuming dividends remain constant or grow over time. This creates a compounding effect, where reinvested dividends further enhance portfolio growth.

5. Provides Strategic Control

Unlike PCA, where investments are rigidly allocated, VCA allows strategic flexibility in investment decisions. Investors retain the ability to allocate funds more efficiently, adjusting for market conditions.

Implementing VCA in Your Investment Strategy

To successfully use VCA, follow these steps:

Step 1: Determine Investment Capital

Decide on the total amount you want to invest over a period (e.g., monthly, quarterly, annually). Keep a portion in reserve to capitalize on low prices.

Step 2: Define the Stock’s Price Range

Analyze the historical price range of the stock over the past 12 months and segment it into four quarters.

Step 3: Allocate Funds Based on Price Positioning

- If the price is in Q1 (lowest range) – invest 100% of the allocated funds.

- If the price is in Q2 (below average range) – invest 75% of the allocated funds.

- If the price is in Q3 (above average range) – invest 50% of the allocated funds.

- If the price is in Q4 (highest range) – invest 25% or hold funds for future dips.

Step 4: Monitor and Adjust

Regularly track market movements and adjust your allocation accordingly. This ensures that you remain aligned with the stock’s price fluctuations and capitalize on opportunities.

Step 5: Reinvest Dividends

To further maximize gains, reinvest dividends into your portfolio, applying the VCA method to ensure optimal share accumulation.

Example of VCA in Action

Let’s assume an investor plans to allocate $1,000 monthly into XYZ Corporation shares, and the stock’s 12-month price range is between $40 and $80.

- Q1 (Price $40-$50): Invest $1,000 (100%)

- Q2 (Price $50-$60): Invest $750 (75%)

- Q3 (Price $60-$70): Invest $500 (50%)

- Q4 (Price $70-$80): Invest $250 (25%) or hold.

If the price fluctuates, more shares are bought when prices are low and fewer shares when prices are high, optimizing the portfolio’s overall cost.

Conclusion

Variable Cost Averaging (VCA) offers a more controlled and strategic investment approach compared to traditional PCA, especially in volatile markets. By adjusting the percentage of funds invested based on price positioning, VCA enables investors to accumulate more shares at lower prices, reduce risk exposure, enhance dividend yields, and maximize capital returns.

If you’re looking for a smarter way to invest in stocks, particularly in unpredictable markets, VCA is a powerful tool to optimize returns while managing risk. By implementing this strategy, you can take full advantage of market volatility and build a stronger, more resilient portfolio.

Are you ready to take control of your investments?

Start using Variable Cost Averaging today and benefit from a smarter investment strategy that aligns with market trends. Let your capital work harder and smarter for better long-term gains!

Join Zero to Millionaire Membership and gain more insight to Share Investing Strategies

Frequently Asked Questions (FAQs)

1. Is VCA suitable for all types of stocks?

VCA works best for volatile stocks with fluctuating price patterns. It is less effective for stable, slow-moving stocks.

2. How often should I reassess the price range?

Reassessing every 6-12 months is ideal to ensure the pricing quarters remain accurate.

3. Can I apply VCA to ETFs and mutual funds?

Yes, VCA can be used with ETFs and mutual funds, especially those with frequent price swings.

4. Is VCA a short-term or long-term strategy?

VCA is best used as a long-term strategy for steady capital growth and increased dividends.

5. How do I track my investment performance with VCA?

Use investment tracking tools or spreadsheets to monitor your average cost per share and overall portfolio growth.

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.