Golds Role Amid Market Turmoil

Gold has long been heralded as a safe-haven asset, offering investors a refuge during periods of economic uncertainty. However, recent market meltdowns have seen gold prices exhibit unexpected volatility, leading some to question its reliability.

To comprehend this phenomenon, it’s essential to delve into the behaviors of different market participants and their impact on gold prices.

Table of Contents

- The Initial Dip: Traders Covering Losses

- The Search for Alternatives: Shifting Investments

- The Resurgence: Long-Term Investors Buying the Dip

- Current Trends: Benefiting from Strategic Investments

- Golds Role Amid Market Turmoil

The Initial Dip: Traders Covering Losses

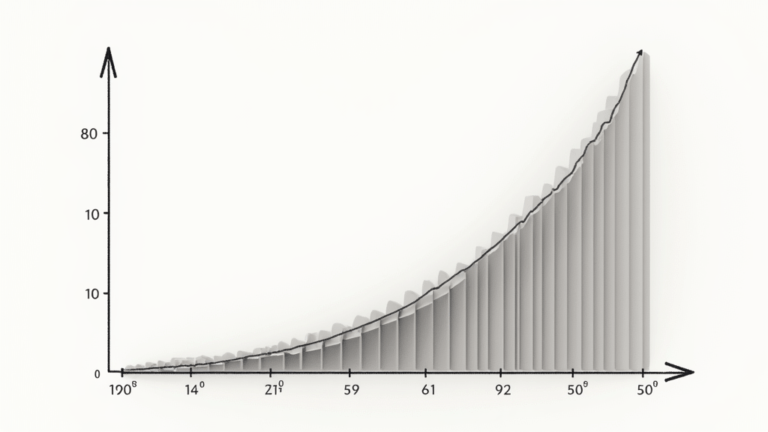

During sharp market downturns, many investors face margin calls, compelling them to liquidate assets to cover losses. Gold, being a liquid and high-value asset, often becomes a primary source of funds in such scenarios. This forced selling can lead to temporary declines in gold prices, even as broader markets are also falling. For instance, during the recent tariff-induced market selloff, gold prices fell more than 3% as investors sold off bullion to cover their losses from a wider market meltdown.

The Search for Alternatives: Shifting Investments

In the face of market volatility, some investors attempt to identify assets that are appreciating or at least stable. This behavior can lead to a reallocation of funds away from traditional safe havens like gold to other assets perceived as more promising in the short term. Such shifts can exert additional downward pressure on gold prices, as seen when investors turned to the U.S. dollar amid escalating trade tensions, causing gold prices to slip.

The Resurgence: Long-Term Investors Buying the Dip

Contrasting with short-term traders, long-term investors often view price dips as buying opportunities. Recognizing gold’s enduring value, these investors step in to purchase gold at lower prices, anticipating future appreciation. This influx of demand can help stabilize and eventually drive gold prices upward. Analysts have noted that despite temporary setbacks, gold remains fundamentally strong, supported by ongoing central bank purchases and geopolitical instability.

Current Trends: Benefiting from Strategic Investments

Recent data indicates that gold has rebounded from its temporary lows. For example, the spot price on Gold as I write this is $3136.65, reflecting renewed investor confidence. This resurgence benefits those who capitalized on lower prices during the dip, underscoring the advantages of a long-term investment perspective.

Golds Role Amid Market Turmoil

Gold’s performance during market meltdowns is influenced by a complex interplay of short-term trading pressures and long-term investment strategies.

While forced selling can lead to temporary price declines, the intrinsic value of gold and its role as a hedge against uncertainty continue to attract strategic investors. Understanding these dynamics enables investors to navigate market volatility effectively and make informed decisions regarding gold investments.

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.