Gold And Silver Hedge Against Uncertainty

Facing the current economic challenges, many people wrestle with daily uncertainties. Currency fluctuations, rising inflation, and shifting political climates make it necessary to find secure ways to protect one’s wealth. Precious metals like gold and silver have traditionally been seen as trusted stores of value, providing protection when conventional financial markets struggle. They offer a reliable form of security that modern paper and digital currencies often fail to provide.

Table of Contents

- Gold and Silver as a Hedge Against Inflation

- Understanding Price Volatility in Precious Metals

- Future Price Predictions for Gold and Silver

- Gold and Silver Performance

- Strategic Gold and Silver Investing

- Final Thoughts on Precious Metals

Gold and Silver as a Hedge Against Inflation

Gold and silver are seen as very important defences against inflation, a force that steadily diminishes money’s purchasing power. When prices climb over time, holding physical assets can help preserve value.

Historical trends reveal that during periods of economic stress, precious metals have consistently acted as buffers, protecting wealth when everyday money loses its strength. In this light, investing in gold and silver can be a sensible and protective move for anyone wanting to guard their financial future.

Understanding Price Volatility in Precious Metals

Markets for precious metals are complex. Global events, such as geopolitical clashes and major economic policy shifts, often cause rapid changes in investor behavior.

When tensions rise, demand for gold and silver can spike, leading to noticeable price jumps. On the other hand, periods of economic optimism may cause some investors to turn to riskier assets, slightly reducing the metals’ values. Additionally, issues on the supply side, like mining disruptions and seasonal changes, contribute to price movements.

The mix of these factors makes it important to keep an eye out for both local and international news. The Gold and Silver Hedge Calculator keeps track of your investments

Future Price Predictions for Gold and Silver

Looking ahead, experts offer varied opinions on future price movements for precious metals. Many believe that ongoing economic uncertainty will drive demand higher, while others argue that a return to stability might moderate price surges.

As of March 2025, gold prices have reached record highs, with spot gold trading at approximately $2,954.95 per troy ounce. Analysts are increasingly confident that gold will surpass the $3,000 mark soon.

Goldman Sachs, for instance, has raised its gold-price forecast to $3,100 by the end of 2025, driven by high central bank demand and investor preference for safe-haven assets amid global economic uncertainties and new U.S. tariffs.

Similarly, J.P. Morgan strategists have reiterated their bullish view on gold, citing its potential to hedge against economic uncertainties, with projections of gold prices averaging $2,950 per ounce in 2025, potentially hitting $3,000.

Historical data often shows that when governments print more money, inflation pushes investors toward gold and silver.

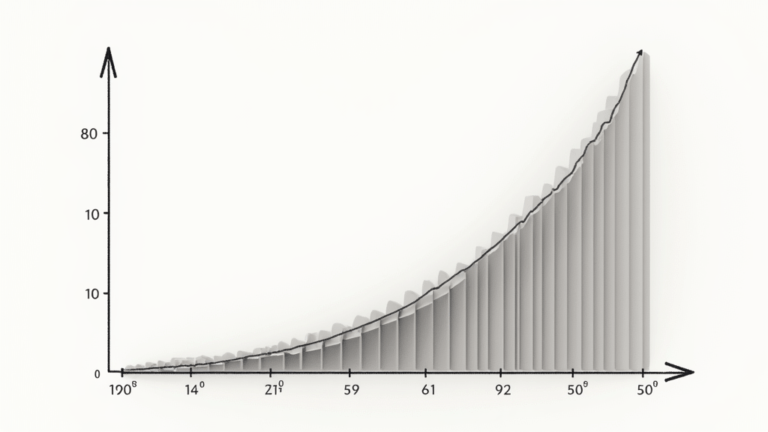

Gold and Silver Performance

When analyzed closely, various economic models suggest that while short-term fluctuations are expected, the long-term trend appears to be upward. I believe Gold will reach $3500 during 2025 with silver reaching $40.

Silver has been performing robustly, with prices experiencing a 29.3% increase year-to-date, compared to gold’s 25.9% rise.

Analysts expect silver’s rally to continue, driven by investor interest, favorable economic conditions such as declining interest rates, global uncertainty, and a weakening U.S. dollar. Additionally, rising demand from China, particularly for solar panels, has boosted silver prices

Strategic Gold and Silver Investing

Strategic investing in gold and silver requires a balanced approach that maximizes returns while managing risk.

One method is to identify price dips—buying when the market experiences temporary declines and selling when prices surge, following the classic buy low, sell high strategy. This approach requires market analysis, patience, and an understanding of economic trends that influence precious metal prices.

However, because predicting market movements with precision can be challenging, many investors use Price Cost Averaging (PCA) to reduce risk. PCA involves making regular, consistent purchases of gold and silver regardless of short-term price fluctuations, helping to smooth out volatility and build a position over time.

By combining these strategies, investors can take advantage of both immediate opportunities and long-term market growth, ensuring they accumulate assets at a sustainable average cost while still capitalizing on profitable price swings.

Final Thoughts on Precious Metals

Ultimately, investing in gold and silver is more than just a financial strategy; it reflects a prudent approach to dealing with economic uncertainty.

I urge anyone interested in strengthening their portfolio to take up a notch by exploring the unique benefits of these metals. They not only serve as a hedge during inflationary periods but also add stability during market fluctuations.

Blending different asset types can lead to more robust and resilient financial planning.

Taking the time to study market history, assess current trends, and monitor policy changes can help investors make smart decisions.

Consulting reliable sources ensures that every investment is backed by careful thought and a commitment to future growth. This careful strategy not only protects wealth but also builds confidence for future financial endeavors.

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.