Why You Need Patience To Succeed at Investing

We live in a world of instant gratification—fast food, same-day delivery, and social media likes within seconds. But when it comes to building wealth through investing, one trait stands above all others: patience.

You’ve probably heard the phrase, “they have the patience of a saint.” When it comes to investing, that’s not just a compliment—it’s a requirement. Those who succeed in the long run aren’t necessarily the smartest or the quickest—they’re often the most patient.

Key Takeaways

- Patience is essential for successful long-term investing—emotional reactions often lead to poor decisions.

- Chasing the next hot tip usually results in buying too late and selling at a loss.

- Real profits are made by buying when assets are out of favour and patiently holding until market conditions improve.

- Every investment follows a cycle—learning to recognize and respect these cycles is key to building wealth.

- Greed and fear are the enemy of profitable investing—stay calm, stick to your strategy, and avoid emotional decision-making.

- Exit strategies and entry points should be planned in advance to help eliminate stress and increase discipline.

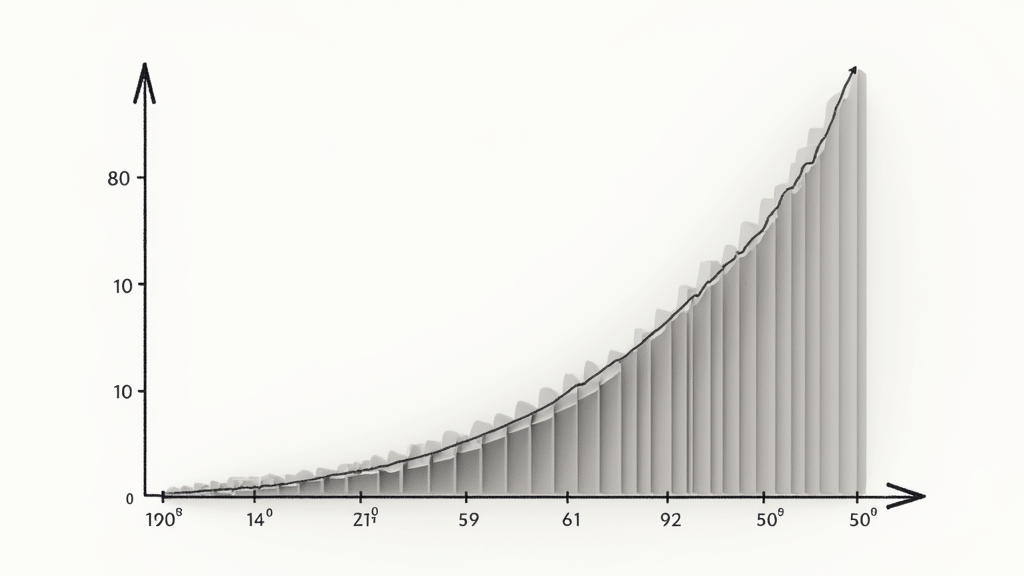

- Some investments take time—patience allows you to benefit from compounding growth and strategic timing.

Table of Contents

- Key Takeaways

- The Danger of Chasing the Next Hot Tip

- Real Wealth Comes from Patience

- Patience Helps You Buy Low

- The Waiting Game: Understanding Investment Cycles

- Emotions Are the Enemy of Patience

- Create a Strategy—and Stick to It

- Patience is a Skill You Can Develop

- Learn Patient Investment Decisions

- Further Reading

- FAQ About Patience

The Danger of Chasing the Next Hot Tip

Too often, I see people jumping from one investment to another, chasing after the next big thing. They read an article or hear a “hot” tip about a stock or cryptocurrency that’s “about to explode,” and they rush in.

But by the time the tip reaches the masses, it’s usually too late. The price shoots up as demand increases, and latecomers jump in, hoping it’ll continue to rise. Then the inevitable correction hits. The price drops, people panic, and they sell at a loss.

This isn’t investing. It’s emotional reaction. And it rarely ends well.

Real Wealth Comes from Patience

The real winners? They’re the ones who bought that same asset months—or even years—earlier, when nobody was talking about it. When it was undervalued. When others thought it was too boring or too risky.

They waited.

When the crowd came rushing in, these patient investors were the ones quietly selling, reaping the rewards of their foresight and calm.

Patience Helps You Buy Low

As an investor, I don’t chase hype. I follow the flow of money.

Instead of asking, “Where is everyone investing right now?” I ask, “Where are people pulling money out of—and why?”

Assets that are out of favour can often be picked up well below their true market value. Sellers are eager to move their money into the next trending asset, offering the patient investor a unique opportunity to buy low.

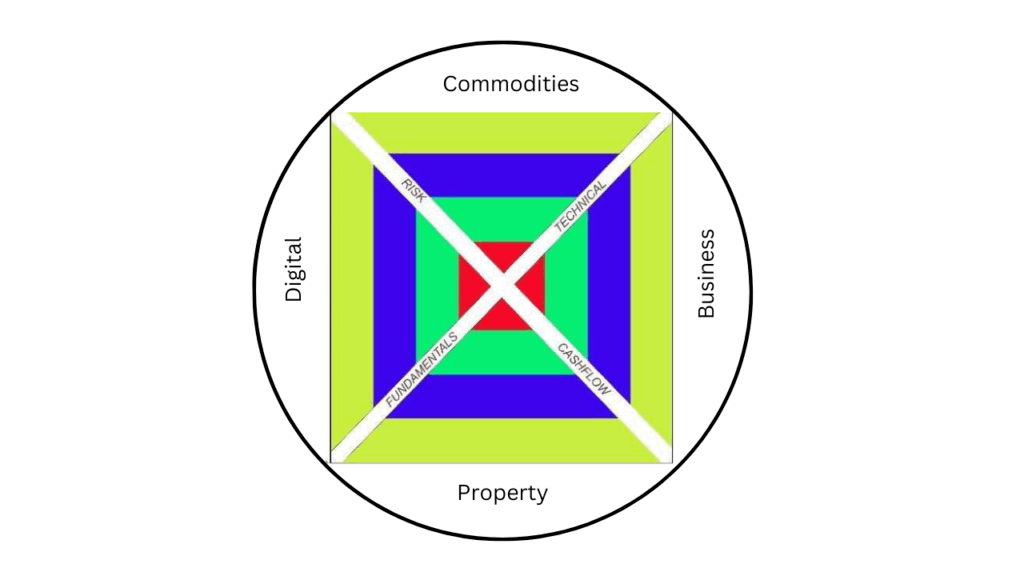

The Waiting Game: Understanding Investment Cycles

All assets move in cycles—periods of growth followed by declines. Your role as an investor is to recognize this, buy when others are fearful, and wait for the next upward cycle.

Sometimes that cycle takes months. Sometimes it takes decades.

Some of my own investments are over 20 years old and just now hitting their peak. Others have delivered results within days. But the lesson is always the same: patience pays.

Emotions Are the Enemy of Patience

To wait effectively, you must be emotionally detached from your investment. That’s not always easy, especially when prices are rising and greed kicks in.

You start thinking, “Just a little more. One more percent.”

But often, this greed leads to missing the optimal exit point. Markets change fast. What was an upward trend yesterday might be reversing today.

The opportunity is lost, and you’re left wondering what went wrong.

Create a Strategy—and Stick to It

Smart investors plan their entry and exit points in advance. Whether it’s a specific price target, percentage gain, or market signal, having a strategy helps remove emotion from the decision-making process.

Buy low. Hold. Wait. Sell high.

It sounds simple—but it requires incredible discipline and patience to execute.

Patience is a Skill You Can Develop

The good news? Patience isn’t something you’re born with—it’s something you can practice.

Start by tracking your investments. Set goals. Monitor cycles. Study historical data. And most importantly—don’t let the noise of the market distract you.

The greatest investors in history didn’t succeed overnight. They succeeded because they had a long-term mindset.

Learn Patient Investment Decisions

Want to learn how to make smart, patient investment decisions? Join the Zero to Millionaire Membership and get step-by-step guidance, tools, and support to build lasting wealth

Or listen to my Business and Wealth Strategy Podcast where I share investment cycles, market news, and how to master your mindset for long-term success.

Further Reading

FAQ About Patience

Q: Why is patience important in investing?

A: Because markets move in cycles. Rushing in or out often leads to poor timing and losses. Patience lets you ride out volatility and capture long-term gains.

Q: What’s the risk of chasing hot tips?

A: By the time you act, it’s often too late. Prices may already be inflated, leading to losses when the correction hits.

Q: How can I develop patience as an investor?

A: Create a clear strategy. Focus on the long-term. Avoid emotional reactions. And remember—wealth is built over time, not overnight.

Q: Are there tools that can help with timing and strategy?

A: Yes! Our AI-powered investment tools and cycle trackers in the membership can guide you on when to enter and exit based on strategy, not emotion.

Stay patient. Stay smart. And watch your wealth grow.

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.