The Best Investment Strategy – Diversification

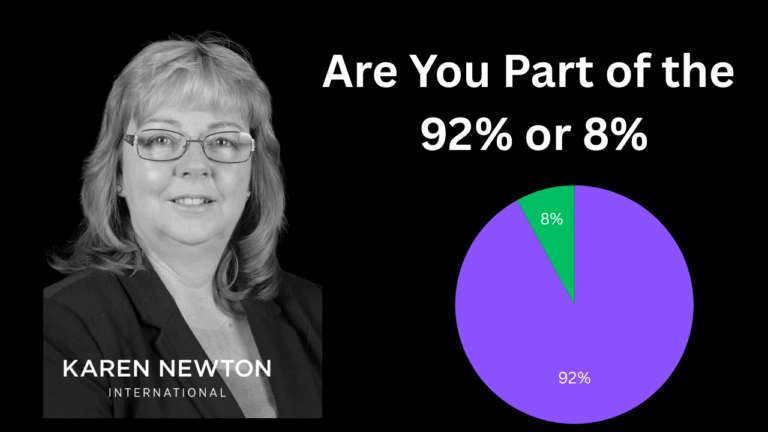

When most people hear the word diversification, they immediately think of spreading their money across multiple shares to reduce risk. They might invest in different companies, sectors, or countries, believing they are well-diversified. But here’s the truth: if all your investments are in shares, you’re still fully exposed to the share market. That’s not true diversification.

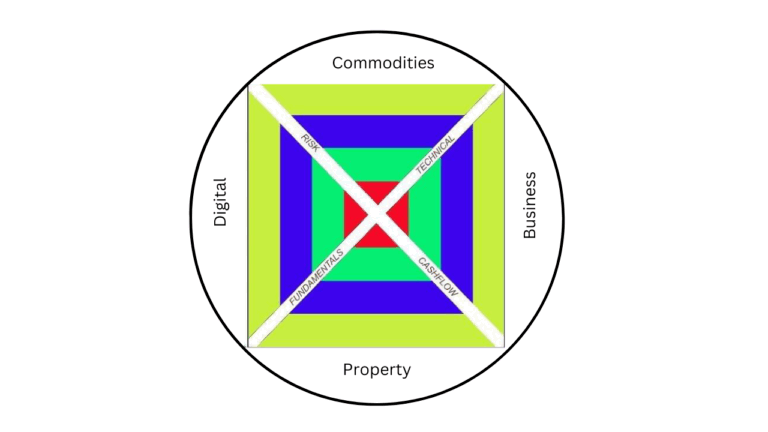

The best investment strategy—especially in uncertain times—is to diversify across different asset classes, not just within one. Real diversification means having money spread across different types of investments that behave differently depending on market conditions. This kind of strategic asset allocation is how wealthy individuals protect and grow their wealth in any economic environment.

Let’s explore why this matters and how you can apply it using six key asset classes: business, property, shares, cryptocurrency, gold, and silver.

Key Takeaways

- Diversification isn’t just about buying different shares—true diversification means spreading investments across different asset classes.

- Relying solely on shares still leaves your portfolio vulnerable to stock market downturns, no matter how many companies you invest in.

- Investing across six key asset classes—Business, Property, Shares, Crypto, Gold, and Silver—creates a balanced, resilient portfolio that performs in different economic conditions.

- Each asset class has a unique role:

- Business generates income and gives control.

- Property offers stability and passive income.

- Shares provide growth and liquidity.

- Crypto introduces innovation and high-growth potential.

- Gold serves as a hedge against inflation and crisis.

- Silver combines value and industrial demand upside.

- Diversified portfolios reduce risk, increase long-term wealth, and adapt to market cycles, helping you grow and protect wealth through any economy.

- Strategic allocation based on your goals and risk tolerance is key—diversification is not one-size-fits-all.

Table of Contents

- Key Takeaways

- Why Diversification Across Asset Classes Is So Powerful

- 1. Business – The Income Engine You Control

- 2. Property – Tangible Wealth and Passive Income

- 3. Shares – Ownership and Dividends

- 4. Cryptocurrency – Innovation and Asymmetric Opportunity

- 5. Gold – The Historical Safe Haven

- 6. Silver – The Undervalued Industrial Metal

- Putting It All Together – Your Diversified Wealth Strategy

- Final Thoughts: Diversification Is About Strategic Balance

- Further Reading

- Diversification FAQ: What You Need to Know

- What is true diversification in investing?

- Why isn’t owning multiple stocks sufficient for diversification?

- How many different investments do I need to be diversified?

- Can I over-diversify my portfolio?

- How often should I rebalance my diversified portfolio?

- Does diversification guarantee against losses?

- How do I start building a diversified portfolio?

- Diversify With The Zero to Millionaire Membership

Why Diversification Across Asset Classes Is So Powerful

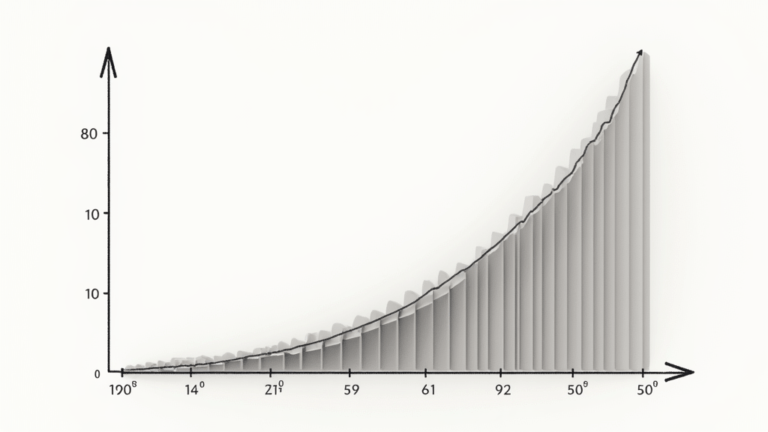

Each asset class responds differently to economic shifts. While one may be falling, another could be rising. By spreading your investments across multiple classes, you reduce your overall risk and increase your ability to stay profitable in all market conditions.

Here’s how the six core asset classes differ:

- Business: Produces income and growth through products/services. Can scale exponentially but requires work and risk tolerance.

- Property: Offers stable, long-term growth and rental income. Often appreciates during inflationary periods.

- Shares: Provide ownership in companies, with growth and dividends, but are subject to market volatility.

- Cryptocurrency: High-risk, high-reward, offering innovation, decentralisation, and new financial systems.

- Gold: Historically a hedge against inflation and economic uncertainty.

- Silver: Like gold, but more tied to industrial use, often more volatile but offers strong upside during economic shifts.

Diversification means spreading risk and performance for more stable investment performance.

1. Business – The Income Engine You Control

Building or investing in a business gives you an active role in generating wealth. It’s the only asset class where you can directly influence the outcome through effort, strategy, and innovation.

A business:

- Provides immediate income potential.

- Can scale with systems and technology (especially with AI).

- Creates value that can later be sold.

Whether it’s an online business, a local shop, or a share in someone else’s venture, business income can support other investments. It also acts as a buffer when markets are down—especially if you can pivot quickly.

2. Property – Tangible Wealth and Passive Income

Real estate has long been a favourite of wealthy investors because it offers both capital appreciation and regular income.

Benefits include:

- Passive income through rent.

- Appreciation over time.

- Leverage (mortgages let you control more with less upfront).

- Inflation hedge (as prices and rents typically rise).

Property markets don’t always move in sync with stocks or crypto. During volatile times, many investors shift money into real estate for stability. It’s also a physical asset—people will always need somewhere to live or run a business.

3. Shares – Ownership and Dividends

While not a standalone strategy, shares are an essential part of any diversified portfolio. They allow you to participate in the growth of the global economy without starting a business yourself.

Why include shares?

- Liquidity (easy to buy and sell).

- Historical long-term returns.

- Dividend income.

- Low barrier to entry.

A share portfolio can be tailored to match your goals—whether that’s monthly income (through dividend shares) or long-term growth (through index funds or individual companies).

But remember: investing in many shares is still exposure to a single asset class. This is why broader diversification is necessary.

4. Cryptocurrency – Innovation and Asymmetric Opportunity

Crypto is still a young, highly volatile asset class—but it’s one with enormous potential. As we move into a more digital and decentralised financial future, crypto provides exposure to innovation.

It’s ideal for:

- High-growth potential.

- Diversification from traditional finance.

- Hedging against fiat currency risks.

However, it’s high risk. The key is to treat it as a small portion of your portfolio—enough to benefit from upside without risking financial stability.

Used correctly, it’s an asymmetric bet: small investment, big potential gain.

5. Gold – The Historical Safe Haven

Gold has protected wealth for centuries. It doesn’t produce income, but it holds value during economic uncertainty, inflation, or currency crises.

Gold works best:

- When markets crash.

- During inflation.

- When trust in governments or fiat currencies declines.

It acts as insurance—something to hold when other markets are falling. Most investors allocate 5–10% of their portfolio to gold for this reason.

You can own it physically, via ETFs, or through allocated vault storage services.

6. Silver – The Undervalued Industrial Metal

Silver is often overshadowed by gold, but it has a unique role. It’s both a precious and industrial metal. This gives it dual purpose—hedging against inflation while benefiting from growing industries like solar energy, electronics, and EVs.

Why silver?

- Historically undervalued compared to gold.

- More volatile (and potentially more profitable) in bull markets.

- Increasing industrial demand.

Silver can surge during both monetary and industrial shifts, making it an exciting addition to a well-rounded portfolio.

Putting It All Together – Your Diversified Wealth Strategy

Rather than trying to “guess” which asset class will do best next, build a portfolio that includes all six. Here’s one example of a balanced diversification strategy:

| Asset Class | % Allocation | Benefits |

| Business | 20% | Active Income and Growth |

| Property | 20% | Stable, Leveraged, Income |

| Shares and Bonds | 20% | Growth, Dividends and Income |

| Cryptocurrency | 10% | Growth and Income |

| Gold | 15% | Hedge and Growth |

| Silver | 15% | Hedge and Growth |

This allocation can be adjusted based on your age, goals, and risk tolerance. A younger investor might lean more into business and crypto; someone nearing retirement might shift toward property and gold.

Final Thoughts: Diversification Is About Strategic Balance

Diversification isn’t just a nice idea—it’s the key to long-term wealth. It protects you from market crashes, allows you to take advantage of emerging trends, and builds true financial security.

By investing across multiple asset classes, you avoid putting all your eggs in one basket—even if that basket looks diverse on the surface. Instead, you gain resilience, flexibility, and the opportunity to grow wealth in every economic season.

The wealthy don’t rely on one market to get rich. They use multiple strategies working together.

So should you.

Further Reading

Diversification FAQ: What You Need to Know

What is true diversification in investing?

True diversification involves spreading investments across various asset classes—such as stocks, bonds, real estate, commodities, and cryptocurrencies—to reduce risk. This strategy ensures that if one asset class underperforms, others may offset the losses, leading to more stable overall returns.

Why isn’t owning multiple stocks sufficient for diversification?

Owning multiple stocks, even across different sectors, still exposes your portfolio to the stock market’s overall volatility. True diversification requires including assets that don’t move in tandem with stocks, such as bonds, real estate, or commodities, to mitigate systemic risks.

How many different investments do I need to be diversified?

While there’s no exact number, research suggests that holding a mix of 20 to 30 well-chosen investments across various asset classes can significantly reduce unsystematic risk. The key is to ensure these assets have low correlations with each other.

Can I over-diversify my portfolio?

Yes. Over-diversification, or “diworsification,” occurs when adding too many similar investments, leading to negligible benefits and potential dilution of returns. It’s essential to focus on quality over quantity and ensure each asset adds unique value to your portfolio.

How often should I rebalance my diversified portfolio?

Regularly reviewing and rebalancing your portfolio—typically annually or semi-annually—helps maintain your desired asset allocation. Rebalancing involves adjusting your investments to align with your risk tolerance and financial goals.

Does diversification guarantee against losses?

No. Diversification reduces risk but doesn’t eliminate it. While it can protect against significant losses in one area, overall portfolio value can still decline during widespread market downturns.

How do I start building a diversified portfolio?

Begin by assessing your risk tolerance and investment goals. Allocate your investments across various asset classes, such as:

- Shares: For growth potential.

- Bonds: For income and stability.

- Real Estate: For income and inflation protection.

- Commodities (e.g., gold, silver): As a hedge against inflation.

- Cryptocurrencies: For high-risk, high-reward opportunities

Diversify With The Zero to Millionaire Membership

The Zero to Millionaire Membership focuses on diversification and multiple income streams helping you to build a strong investment portfolio that performs well in upward and downward markets.

Join Zero to Millionaire Membership today

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.