The Subprime Problem is Back – Protect Yourself, Be Your Own Bank

If the word subprime sounds familiar, it should. It was the small spark that ignited the 2007–2008 global financial crisis and it’s quietly returning. This time, the cracks aren’t in mortgages alone, but in car loans, corporate debt, and consumer credit. When you line up the signs from Hong Kong’s corporate borrowing pressures to the UK’s new bank deposit guarantees the pattern looks uncomfortably familiar.

Key Takeaways

- The 2007 subprime crisis began with bad loans packaged as “safe” investments — history is echoing again.

- Banks like Barclays and HSBC are now heavily exposed to consumer and corporate lending risk.

- Car loans and credit-card debt are today’s subprime triggers.

- Rising government and bank actions, like the Bank of England’s deposit guarantee increase, suggest institutions are preparing for instability.

- The antidote? Learn to Be Your Own Bank.

Table of Contents

1. Lessons from 2007 – The Original Subprime Collapse

Back in 2007, US Banks were issuing mortgages to borrowers who could barely afford them. These “subprime” loans were bundled, sold globally, and rated as safe. When defaults began, the entire financial system unravelled taking down banks, pension funds, and economies worldwide.

What looked like a housing issue was really a credit-quality problem, hidden beneath layers of financial engineering.

Fast forward to 2025 — the names and sectors have changed, but the mechanism is the same: too much cheap credit, too easily issued, chasing too little real income growth.

2. Today’s Pattern: Debt Expansion and Corporate Stress

Barclays, for instance, holds major exposure to car loans and unsecured consumer credit. HSBC faces corporate debt risks, particularly in Asia, as highlighted in my recent commentary on the Hong Kong property market and HSBC’s loan exposure.

Across markets, we’re seeing the same red flags — loan growth without income support, companies rolling over debt to survive, and banks taking on leverage to fund acquisitions like Barclays who have made several acquistions in 2025.

It’s not a crisis yet but it’s the same storyline that preceded 2007, only modernised for today’s economy.

3. Car Loans – The Silent Subprime Sector

Car finance has quietly become one of the most vulnerable areas of consumer debt.

For years, lenders have offered easy credit through personal contract purchase (PCP) and hire purchase agreements — loans that looked affordable in a low-interest world but are now straining households as costs rise.

Adding to the pressure, UK banks are now setting aside millions in provisions to cover potential losses from an ongoing court case that challenges the way car finance commissions were structured. If the ruling goes against lenders, compensation claims could mirror the scale of the PPI scandal creating yet another financial drain on the sector.

These products are also packaged into Asset-Backed Securities (ABS), sold to investors much like mortgage bundles before 2008. When defaults rise and asset values fall, both lenders and investors feel the impact.

It’s a modern replay of the subprime story different asset, same overextension. Small cracks become systemic when too many loans rely on optimistic repayment forecasts.

4. Why the Bank of England Raised Its Guarantee

In late 2024, the Bank of England quietly raised the deposit protection limit from £85,000 to £110,000.

On the surface, it’s presented as a consumer safeguard — but it also signals an awareness of potential banking strain.

In past cycles, similar adjustments preceded tightening liquidity and balance-sheet stress.

Raising the guarantee is both a confidence measure and a precaution. It’s a subtle sign that policymakers see turbulence ahead.

5. The Global Echo – Hong Kong, HSBC, and Corporate Debt

As covered in my earlier Hong Kong commentary, HSBC and other major lenders are carrying enormous levels of corporate exposure tied to property markets under pressure.

Falling valuations, weaker cashflow, and tightening policy in Asia are straining balance sheets — the global financial web means those risks don’t stay contained overseas.

When one region wobbles, liquidity shifts everywhere. These ripples combine with Western consumer debt fragility — and suddenly, the world is once again walking the fine line between confidence and crisis.

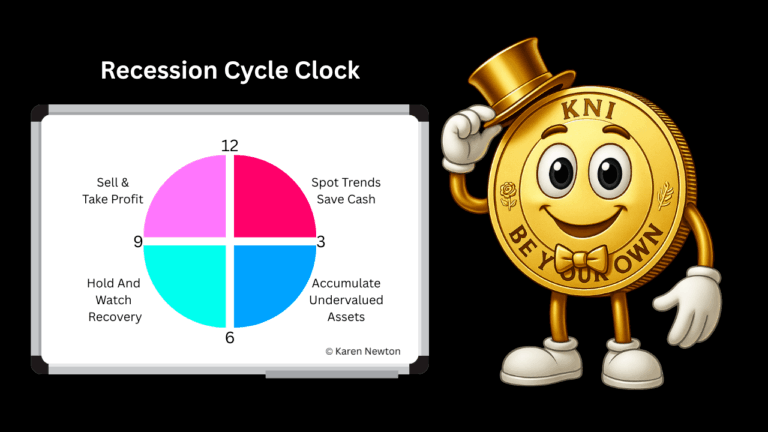

6. Be Your Own Bank – How to Build Financial Independence

That’s why “Be Your Own Bank” isn’t just a slogan — it’s a wealth strategy.

Banks profit by lending, reinvesting, and compounding. You can apply the same model to your personal finances:

- Liquidity: Keep accessible reserves for opportunity, not panic.

- Leverage: Use your income streams strategically to expand your assets.

- Control: Make decisions that prioritise your long-term goals, not the bank’s quarterly targets.

By generating monthly compounding income, whether through shares, crypto, or business, you create the same financial resilience institutions rely on.

You’re not waiting for the system to protect you — you’re protecting yourself with structure, diversification, and awareness.

Before you can Be Your Own Bank, you need a reliable source of income.

In the Online Entrepreneur Membership, we show you how to build AI-powered online income streams that can fund your long-term wealth strategy.

Once your income streams are in place, the next step is learning to build and protect wealth.

The Zero to Millionaire Membership teaches you how to invest strategically across shares, crypto, property, gold, and silver — the key assets of financial independence.

Further Reading

Frequently Asked Questions

How is today’s subprime issue different from 2007?

The scale and sectors differ — mortgages then, car loans and credit cards now — but the underlying problem of poor credit quality and excessive leverage is similar.

Why mention Hong Kong and HSBC?

Because global banking exposure is interconnected. Corporate debt stress in Asia can directly impact Western liquidity.

What does the new £110,000 Bank Deposit Guarantee mean?

It’s a safety net for savers — and a signal that regulators are bracing for potential instability in the financial system.

What’s the risk in car loans?

Defaults are climbing, and those loans are bundled into securities sold to investors. If defaults accelerate, systemic contagion becomes possible.

How can I protect my finances?

Keep liquidity, diversify income streams, and focus on assets that generate monthly cash flow — the foundations of being your own bank.

Karen Newton Ecosystem

Glossary

A definition of words and phrases used in this blog are available in the Glossary

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.