Bond Markets Vs. Tariffs Why Trump Had To Hit Pause

Bond Markets reacted unfavourable to Trumps tariff.

When President Donald Trump announced a sweeping return to global tariffs, headlines around the world buzzed with reactions—from economists warning of trade wars to business leaders raising concerns about supply chains and consumer costs.

But behind the scenes, something even more telling was happening:

The bond markets were already moving… and didn’t like what they saw.

Within days, Trump reversed course—issuing a 90-day pause on most of the planned tariffs. While the headlines focused on politics and diplomacy, the real pressure came from the markets, specifically the bond market.

This is one of those rare and powerful moments when financial indicators—not media spin—force a policy shift. Let’s break it down.

Table of Contents

- Understanding the Power of theBond Markets

- The Yield Curve and Recession Fears

- Policy Reaction: Trump Hits Pause

- Entrepreneur & Investor Takeaways

- Missed the Podcast?

- Bond Markets Vs. Tariffs Why Trump Had To Hit Pause

- Further Reading

- FAQ – Bond Markets

- Learn More About Karen Newton International Eco-Sytem

- Glossary

Understanding the Power of theBond Markets

When most people think of financial markets, they focus on stocks. Stock indexes dominate news headlines, social media, and investor sentiment.

But if you want to understand the economy’s true direction, you need to look at the bond markets.

Why?

- The bond markets set borrowing costs across the economy—from mortgages to corporate loans

- It reflects investor confidence in long-term economic health

- It often reacts before the stock market, pricing in risk early

- It influences government policy by signaling how sustainable debt or economic strategies really are

After the tariff announcement, yields on U.S. Treasuries jumped. That might sound like a good thing, but in this case, it wasn’t. It meant investors were demanding higher returns to hold government debt. Why? Because they believed the U.S. economy was at greater risk.

The Yield Curve and Recession Fears

The bond market doesn’t just tell you about rates—it gives you clues about the future. One of the most important clues is the yield curve.

Normally, a longer-term bond (like a 10-Year Treasury) has a higher yield than a short-term one (like a 2-Year). This makes sense—you’re tying up your money for longer, so you want more in return.

But when the yield curve inverts—meaning short-term yields are higher than long-term ones—it’s often a sign that the market is expecting a recession.

That’s exactly what we saw.

- 10-Year Treasury Yield: Spiked, but lagged behind

- 2-Year Treasury Yield: Rose sharply, reflecting Fed rate pressure

- Yield Curve Spread (10Y – 2Y): Turned negative → an inversion

This kind of inversion has preceded every U.S. recession since the 1950s. And it happened within days of the tariff announcement.

Policy Reaction: Trump Hits Pause

Facing mounting pressure, Trump delayed the tariffs by 90 days. According to market analysts like former J.P. Morgan strategist Marko Kolanovic, it wasn’t global diplomacy or political calculation that changed the timeline.

“The disruption in the bond market did the most to shake the administration’s stance.”

When bond markets move against you, they hit where it hurts—borrowing costs, investment confidence, and economic growth.

Trump even admitted the bond market was “tricky.” That’s about as close as you’ll get to acknowledging the financial system forced a political shift.

Entrepreneur & Investor Takeaways

This isn’t just about government policy—it has real implications for how you run your business and build your wealth.

1. Watch Bond Markets, Not Just Stock Tickers

Bond yields often shift before news hits. They show us what smart money is thinking.

2. Use Yield Curve Signals to Guide Strategy

When the curve inverts, it’s not time to panic—but it is time to review expansion plans, secure cash flow, and manage risk.

3. Diversify Invest Strategies During Volatility

In my own portfolio, I use PCA (Pound Cost Averaging) to slowly increase my holdings in dividend-paying shares. This builds income, smooths out market fluctuations, and aligns with long-term wealth growth—even when volatility is high.

4. Stay Adaptable

Just like politicians adjust to markets, so must entrepreneurs. The most successful businesses aren’t rigid—they’re responsive.

Karen’s Strategy in Motion

As part of my own Strategy in Motion this week, here’s what I’ve done in response to these market signals:

- Held off on new investment commitments until clarity returns

- Reviewed bond yield data daily to watch for shifts in risk

- Shared insights with private Mastermind clients using our new bond market tool

- Focused on creating diversified income streams that don’t rely solely on market timing

Missed the Podcast?

I go deeper into this topic on the latest episode of the Business and Wealth Strategy podcast.

Bond Markets vs. Tariffs – Why Trump Had to Hit Pause

Listen on Spotify, Apple, or wherever you get your podcasts.

Bond Markets Vs. Tariffs Why Trump Had To Hit Pause

The bond market might not get the attention it deserves in the media—but smart entrepreneurs know where to look. It’s a reminder that the money always moves first—and if you can read the signals, you can stay two steps ahead.

Want tools and weekly insights like this?

Explore the Zero to Millionaire Membership and start building lasting wealth.

Further Reading

FAQ – Bond Markets

What are bond markets?

Bond markets are where governments, companies, and institutions borrow money by issuing bonds. Investors buy these bonds in exchange for interest payments. Bond yields (the return investors demand) rise when markets see higher risks or expect inflation. To learn more about Bond Markets

How do bond markets influence government policy?

When bond yields rise, borrowing becomes more expensive for governments. If yields spike too quickly, it can create financial instability, forcing leaders to adjust economic or trade policies to reassure investors.

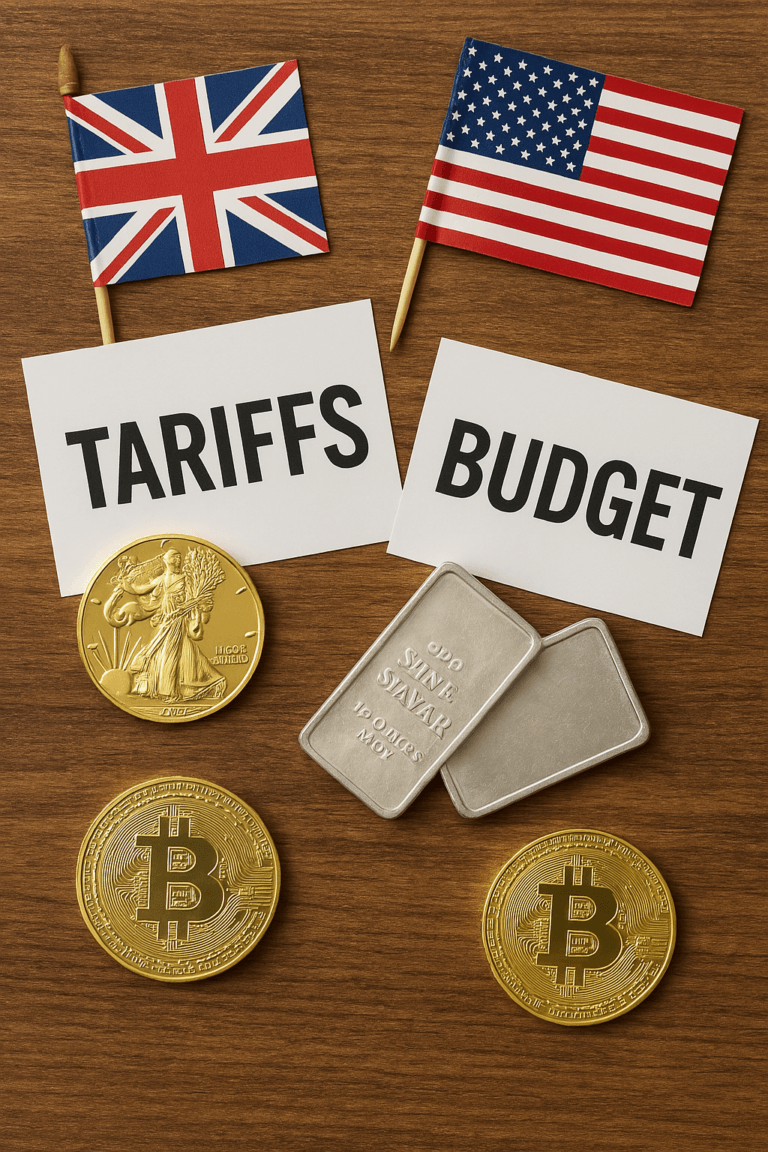

What are tariffs?

Tariffs are taxes on imported goods. They are often used to protect domestic industries or as a bargaining tool in trade negotiations. However, tariffs can also raise consumer prices and trigger retaliatory measures from other countries.

How do tariffs affect the economy?

Short term: They can protect local jobs and industries.

Medium to long term: They often raise prices for consumers and businesses, disrupt supply chains, and reduce overall trade. Tariffs can also contribute to inflation, which spooks bond markets.

Why did Trump impose tariffs in the first place?

Trump’s trade strategy aimed to protect U.S. industries (particularly manufacturing and steel) and to pressure trading partners — especially China — to agree to more favorable trade terms.

Why did Trump hit pause on tariffs?

Bond markets reacted negatively to escalating trade tensions. Rising tariffs risked slowing the economy and fueling inflation, both of which push bond yields higher. To calm markets and avoid destabilising U.S. borrowing costs, Trump paused or delayed further tariffs.

How are bond markets and tariffs connected?

Tariffs increase uncertainty, raise costs, and can trigger inflation. Bond markets respond by demanding higher yields, which raises government borrowing costs. When this pressure builds, it can force policymakers — like Trump — to adjust course.

Learn More About Karen Newton International Eco-Sytem

Glossary

Definitions of words used in this article are available in the glossary

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.