Are You Ready For The Next Recession

Recession warning signs are flashing.

Although it’s only been seven years since I left the UK for Spain, reading the business news this week felt like watching my Saturday morning shopping memories fade away.

Brands like Claire’s, Hobbycraft, Poundland and River Island are slowly disappearing from high street and retail parks. As a teenager, I remember rushing to Chelsea Girl (now River Island) for the latest fashions and now those once-bust stores are quickly vanishing.

This isn’t just nostalgia. These closures are a symptom of something bigger – a weakening economy that is already showing the early signs of a long and deep recession ahead.

Table of Contents

- Retail is the First Domino

- Property is Now Showing Stress

- The FTSE 100 is Hitting Highs – and That’s Not Good News

- History Repeats – The Brexit Shock Lesson

- My Recession Playbook

- Further Reading

- Why Recessions Happen and How to Prepare for Them

- Economy

- Frequently Asked Questions

- Learn More About Karen Newton International

- Glossary

Retail is the First Domino

Retail is often the first sector to show cracks in the economic cycle. As businesses restructure or close, staff are laid off. Building left empty. Rents, utilities and stock supplies unpaid. The flow on isn’t just the employees.

Latest information shows the retail sector hit hard. Some of the recent headlines:

- Claire’s – US parent in bankruptcy, UK stores at risk.

- Hobbycraft – multiple store closures and restructuring.

- Poundland – shutting dozens of locations across the UK.

- River Island – High Court-approved restructuring, closing 33 stores and forcing rent cuts.

Each closure represents lost jobs, declining local footfall, and reduced economic activity — and it rarely stops at retail.

Property is Now Showing Stress

Declining property prices has an impact on people’s perspective of the economy. They tend to tighten spending increase due to lack of confident creating a downward trend.

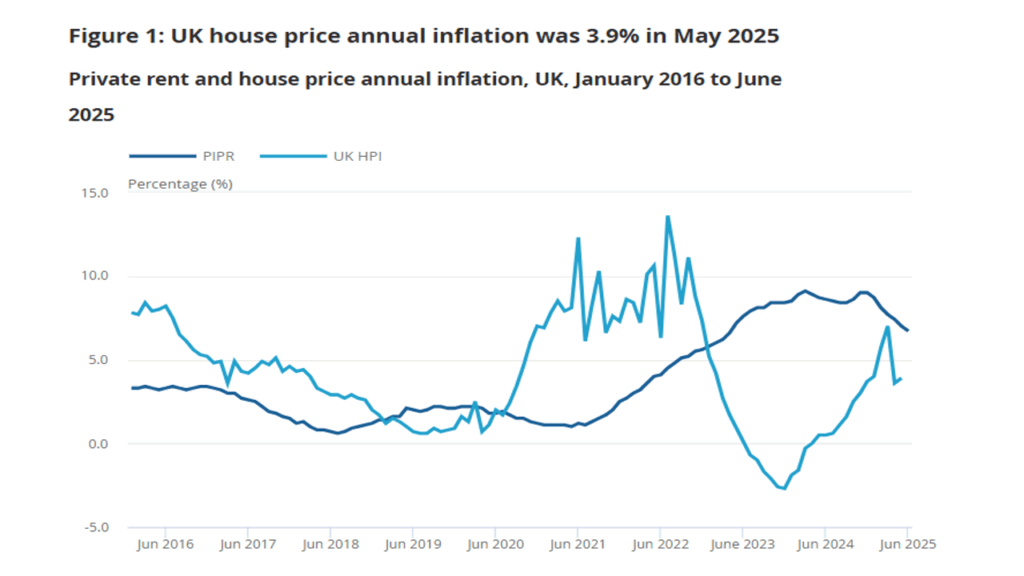

Recent ONS data (image above) confirms property prices are falling following a high in March 2024. In past cycles, this is a critical turning point – falling property prices hit household wealth, reduce spending confidence, and ripple into construction, finance, and related industries.

The FTSE 100 is Hitting Highs – and That’s Not Good News

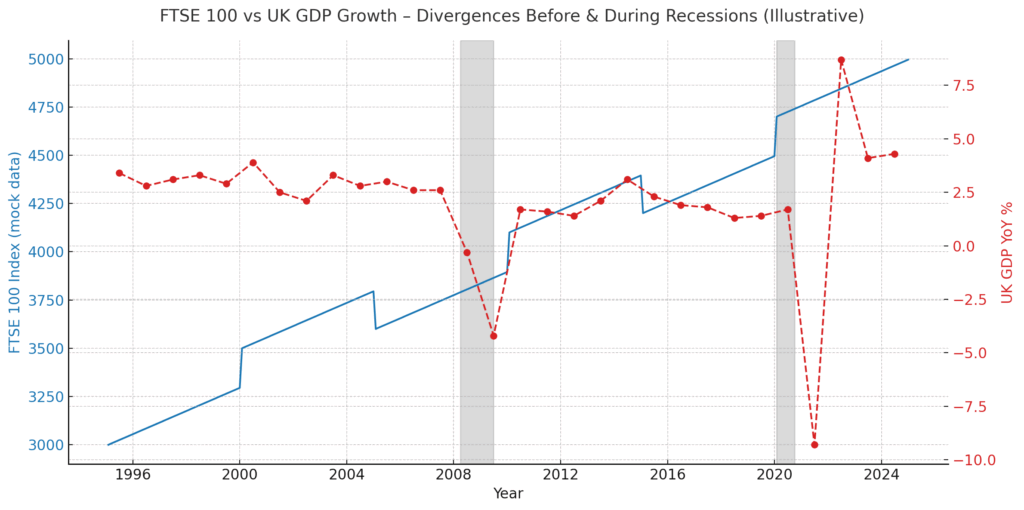

It may sound strange, but stock markets often rise just before a recession.

Why? Because the FTSE 100 isn’t a pure reflection of the UK economy:

- Around 80% of FTSE 100 earnings come from overseas, meaning global commodity prices and currency moves can mask domestic weakness.

- Late in the cycle, markets can see a “blow-off top” – a euphoric rally driven by momentum and passive fund flows before reality hits.

Chart: FTSE 100 vs UK GDP growth

History Repeats – The Brexit Shock Lesson

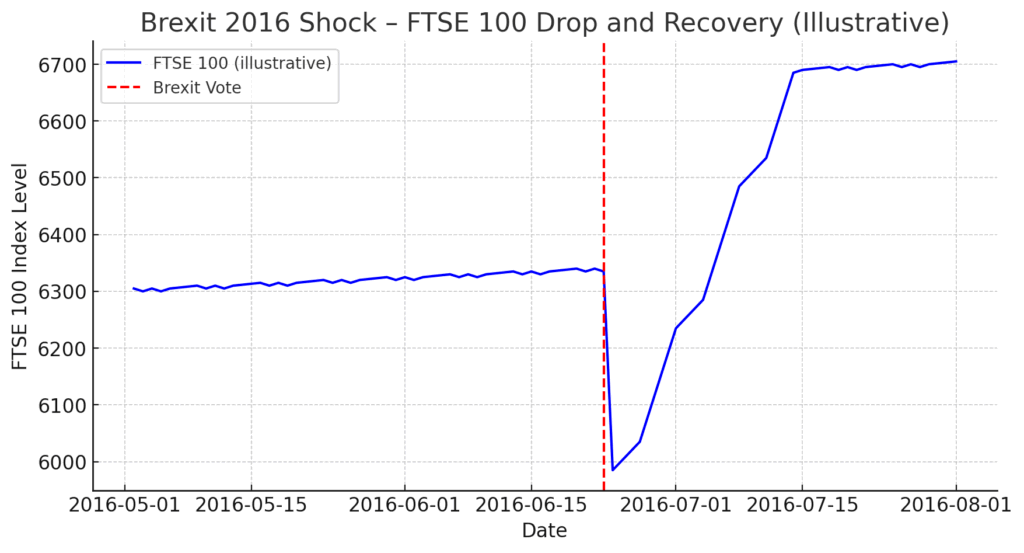

I remember the 2016 Brexit vote like it was yesterday. Knowing the real economic impact would take years to materialise the market reacted differently. The FTSE 100 dropped sharply overnight — and then rebounded within weeks.

That rebound created prime trading opportunities for those ready to act. The same principle applies in recessions – panic selling can create some of the best buying opportunities of a lifetime.

My Recession Playbook

Recession is inevitable. How you prepare for it determines your future wealth. In my own portfolio, I’m already preparing:

- Increasing income dividend shares

- Growing Crypto assets

- Re-evaluating precious metal holding

- Acquiring new assets to future proof income

- Developing Cash Reserves

I believe the next recession will be deep and long, and those who prepare early will be in the strongest position when recovery begins.

Your Next Step

If you want to not just survive but thrive through the coming downturn, you need a plan.

Inside the ZTM Wealth Strategy Membership, I share the exact strategies I’m using, the timing signals I watch, and the asset opportunities I’m targeting — so you can apply them to your own situation.

The next full-blown recession may be two to three years away. That’s not long to build a financial buffer that protects you and your family.

Further Reading

Why Recessions Happen and How to Prepare for Them

If you’re looking for a more information about of how recessions unfold — and how to build wealth during them — I recently published a full feature article on Medium.

Recessions Happen Nearly Every Decade — And the Next One Is Closer Than You Think

It explores the historical patterns, current red flags, and the strategic thinking behind the ZTM Wealth Strategy.

Economy

Get a guide to different aspects of the economy in the Economy Hub

Frequently Asked Questions

Why are so many UK retail stores closing right now?

Many retailers are facing rising costs, falling consumer spending, and increased online competition. In 2025, brands like Claire’s, Hobbycraft, Poundland, and River Island have announced closures or restructurings. These are early signs of broader economic weakness.

Is the decline in retail a sign of a recession?

Yes, historically retail is one of the first sectors to show strain before a recession. Store closures, job losses, and reduced foot traffic can signal a slowing economy.

Why is the FTSE 100 at record highs if the economy is struggling?

The FTSE 100 reflects large multinational companies, with around 80% of their earnings coming from overseas. This means global commodity prices, currency shifts, and investor sentiment can lift the index even when the UK economy is under pressure.

What does the drop in property prices mean for the wider economy?

Falling property prices reduce household wealth and consumer confidence. They also affect related industries like construction, finance, and home improvement, potentially accelerating an economic downturn.

When do stock markets usually fall in a recession?

Stock markets often peak shortly before or in the early stages of a recession. Sometimes, they diverge from the real economy for months before adjusting sharply to worsening conditions.

How long do you think the next recession will last?

Based on current data, I believe the next recession will be deep and long, potentially lasting a few years before a full recovery. This is why preparation now is essential.

Learn More About Karen Newton International

Glossary

For clarification on some of the words and phrases used in this post visit the Glossary

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.