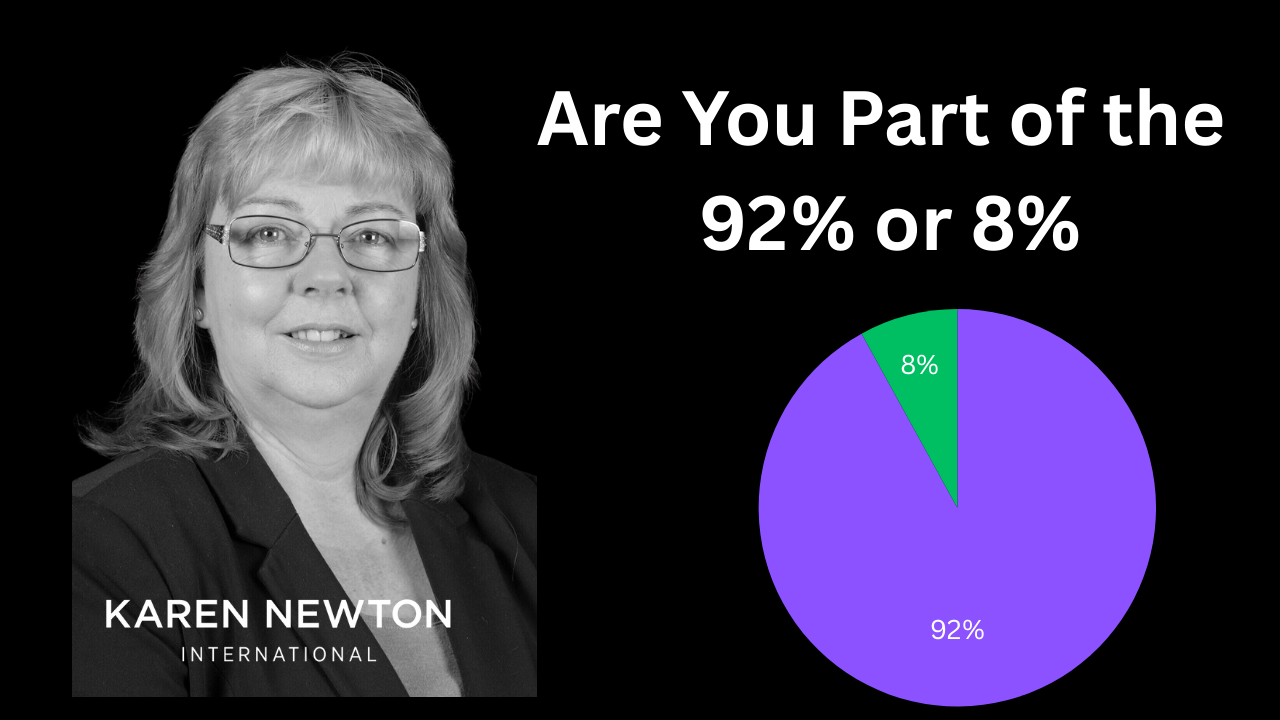

Are You Part of the 92% or the 8%

Are you part of the 92% or the 8%? It’s an interesting question and one that triggered a few responses when I wrote about this topic in 2012. It refers to a Harvard Study that followed students from a class for their lifetime. If refers to the 92% who are broke and the 8% who have financial freedom.

I’ve repeated sections of the blog below as it is worth reminding readers about the statistics.

Key Takeaway

The Harvard study shows that 92% of people retire broke while only 8% achieve financial freedom. The difference isn’t luck or intelligence — it’s having a plan, building assets instead of liabilities, and taking consistent action. Start small, stay consistent, and you can put yourself on the path to joining the 8%.

Table of Contents

Several years ago, a class of teenagers with dreams and aspirations for their futures became part of a study group where they participated in a lifetime study. The study looked at how many achieved financial freedom during their lifetime. The Results of the Study are summerized below.

The students selected were from similar backgrounds. They did not come from privileged backgrounds or have above average incomes or above average intelligence. They were ordinary teenagers who went on to live their adult lives.

The results of the study are very interesting as of 100 pupils coming up to their 65th birthday – the then retirement age – the Harvard statistics showed;-

- 38 were dead

- 62 were still alive. Of those 62 still alive

- 38 were financially broke

- 16 still needed to work just to survive

- 7 had retired and had a liveable income in their retirement years

- 1 was wealthy

Only 8 achieved financial freedom and only 1 was wealthy out of 100 participants of the study.

This study raised a lot of questions for me such as why did only 8% achieve financial independence, when during this period people tended to work with the same employer for most of their lives and retire with a golden handshake and pension for life. The other question is why did only 1% become wealthy.

Financial Freedom Planning

Most people only think about financial freedom when they are approaching retirement. At that stage it is often too late to build wealth quick enough to provide the financial freedom they desire for their retirement lifestyle.

The sooner you start planning your financial freedom the easier it becomes to retire earlier and enjoy life fully.

Zero to Millionaire is a membership teaching different investment strategies for building wealth and creating financial freedom.

Common Reasons People Don’t Have Money For Retirement

When I shared this information with clients and read responses social media posts, I saw a trend of reasons why people don’t have money for retirement.

- No plan and no goals to become wealthy

- Lack of knowledge about investing

- Buying liabilities instead of assets while thinking they are buying assets

- Lack of confidence or desire to prepare for retirement often expecting the government to provide for the future.

- A belief that investing is too complicated for them to understand.

When you change your belief system you change your choices. When choices are changed you change your wealth and create financial freedom.

Let’s take a look at each reason

No Plan and No Goal to Become Wealthy.

I was in my teens when I became fascinated with wealth and lifestyle. I studied wealthy people, what they were doing and how. I worked in the Inland Revenue and Banking so had an understanding of money but it wasn’t until I was 39 years old that I realised that I wasn’t wealthy was because there was no plan to be wealth.

I created a plan and some action steps and retired by the age of 43 wealthy enough to never have to work again.

There is still a stigma in society that people shouldn’t talk about money, shouldn’t be seen to be wealthy and as a consequence very few people actually put a plan together and action steps to ensure their financial freedom and dream lifestyle are achieved. When you build wealth it allows you to contribute more to society and causes that are important.

I love dogs and support do rescue centres. My dogs have all been rescues. I’m able to do more for a cause that is important to me because I have the money to do so.

When you have something that you are passionate about you can contribute more and change lives when you have more wealth.

Make the decision today, to plan for future wealth.

Lack of Knowledge about Investing

Since the Great Recession of 2008-2014 the world’s governments have been slowly passing the responsibility to the general public to provide for their own futures. They have amended work pension schemes and entitlements to state pensions while failing to provide the education for people to be able to make their own informed decisions.

Amendments to legislation for IFA’s have seen a big hole develop in the market where IFA’s have to receive payment from the customer so the IFA is no longer tied to specific products. This means the IFA or even the banks, who used to provide advise are looking for clients who have a substantial amount to invest. The person with £1000 or £5000 with no financial education are suddenly left with no support, no education and no understanding of how to provide for their futures.

Karen Newton International was created to fulfil that role of educating clients, who have little or no financial education and little or no money and teach them how to understand the markets and how to think about providing for their futures.

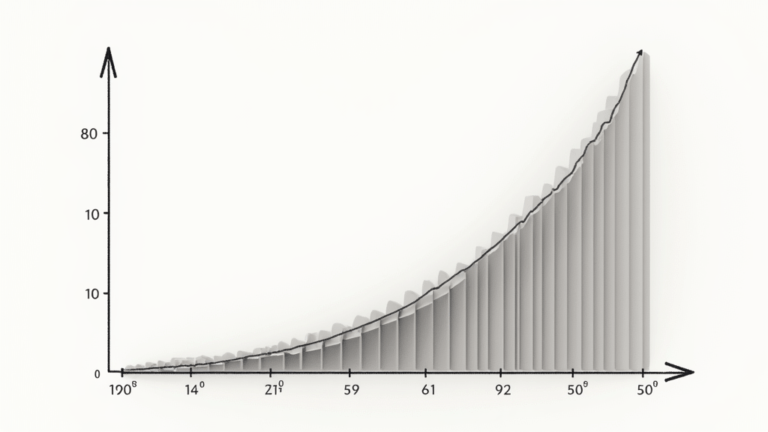

When I started coaching, I would ask clients not to buy a cup of coffee each day. Instead put that money into a jar and see how much they had at the end of the month. It was often around £100 so they had more than enough money to start an investment and begin the journey to financial freedom.

There are investments that start from just £1 or euro, dollar whatever your currency. All it requires is a commitment to start and follow through.

Buying Liabilities instead of Assets While Thinking they are Buying Assets

Rob Kiyosaki author of the Rich Dad, Poor Dad books came up with a fantastic description which easily explains the difference between assets and liabilities. An Asset is something that puts money in your pocket. A Liability is something which takes money out of your pocket. A very simple yet effective way of understanding Assets and Liabilities.

Each time you buy something ask yourself the question, Will it put money in my pocket or take it out?

Once you start acquiring income producing assets then money flows in on a regular basis and provides an income for the life of the asset or as long as you hold it. The more assets you acquire the wealthier you become.

The first investment my clients learn is how to build an online business and then invest in monthly income dividend shares. Two income streams which over time will build financial freedom.

Lack of Confidence or Desire to Prepare for Retirement often Expecting the Government to Provide for the Future.

Governments have lulled people into a sense of false security by repeatedly stating part of the taxes you pay are for your retirement so you receive a pension at retirement age. Sadly, all models the government come up with for setting the taxes aside either don’t eventuate or do not provide the returns needed to sustain a pension fund.

As each new government realises there is lack of funding for the ever increasing, older population, the panic sets in and they start tinkering around reducing the level of payment and increasing the retirement age.

All the while taxpayers believe they have contributed enough to a pot to receive a good pension when in reality there is only a very basic pension which often doesn’t even cover property taxes, utilities, food or clothing let alone provide for the lifestyle retirees were expecting

The best time to start preparing for your pension is at the youngest possible age. Parents who realise this often start savings plans for their kids which can be contributed to when the kid becomes an adult. Adults immediately they start work should be thinking of setting aside a percentage of their income, around 10% if possible, to ensure they have a fund for life’s emergencies, redundancies and retirement. The only person who will look after you in your old age is you. The sooner you prepare for it the better. The sooner you prepare the sooner you’ll achieve financial freedom.

A Belief that Investing is too Complicated for them to Understand.

Investing is very simple. Learning to invest is very simple. People make it seem complicated so you will buy their products and services. You don’t need to be a rocket scientist to achieve financial freedom. All you need is a plan to become wealthy, education so you know what you like or don’t like and an action plan to get you there. Don’t let other people rob you of your faith and ability to become a very successful investor and live the lifestyle of your dreams.

You owe it to yourself to become part of the 8%.

Further Reading

Additional Resources

If you’d like to dive deeper into this topic, I’ve created a podcast episode and video that expand on the study and share practical strategies for becoming part of the 8% who achieve financial freedom

Podcast Episode: Become Part of The 8% Who Have Financial Freedom

Listen in as I break down the study and share practical steps to join the 8% who achieve financial freedom.

Video: 92% Broke, 8% Free — Which Path Will You Choose?

Watch this short video where I explain the study and reveal the roadmap to building lasting wealth.

Frequently Asked Questions

What was the Harvard study that showed 92% of people ended up broke?

The study tracked a group of Harvard graduates over several decades and found that 92% of them ended up financially insecure, while only 8% achieved true financial freedom. The difference came down to mindset, planning, and consistent action rather than intelligence or opportunity.

Why do so many people retire broke?

Most people reach retirement without a plan for wealth. Common reasons include failing to set financial goals, not learning how to invest, buying liabilities instead of assets, relying on government support, and believing investing is too complicated.

What’s the difference between assets and liabilities?

An asset puts money in your pocket (like dividend shares, rental property, or a business), while a liability takes money out (like consumer debt, cars, or expensive lifestyle costs). Wealthy people focus on building assets first.

How can I start building wealth if I don’t know much about investing?

ou don’t need to start big — begin with small, consistent steps. Focus on learning the basics of shares, property, and other asset classes, and use tools like monthly compounding to grow steadily over time. Education and action are the key.

Should I rely on the government for my retirement?

Relying solely on government pensions or benefits is risky, as many systems are under financial pressure. Building your own wealth plan gives you control, independence, and security.

Is investing really as complicated as it seems?

It doesn’t have to be. Many investment strategies can be simplified into step-by-step systems. For example, focusing on consistent monthly investing, building multiple income streams, and reinvesting profits can make wealth-building much more manageable.

How can I become part of the 8% who achieve financial freedom?

Start with a plan. Set wealth goals, learn how to invest, focus on assets instead of liabilities, and take consistent action. Even small steps today compound into big results over time.

Learn More About Building Wealth

f you’re ready to go beyond theory and start applying practical strategies, my free guide 60 Lessons Learned will give you the real-world insights you need to build and protect your wealth.

Karen Newton International Ecosystem

Glossary

Definitions of words and terminology can be found in the Glossary

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.