A Beginner’s Guide To Understanding Compounding Interest

Imagine planting a single seed and watching it grow into a vast tree that keeps producing fruit year after year. That’s the power of compounding in the world of investing. Albert Einstein famously called compound interest the “eighth wonder of the world.“ Why? Because even small investments, when left to grow over time, can generate extraordinary wealth.

Table of Contents

- How Small Investments Can Lead to Massive Wealth

- What is Compound Interest?

- The Formula for Compound Interest

- How Compounding Works Over Time

- Why Time is The Most Important Factor

- How to Maximize The Power of Compounding

- Try our Free Compound Interest Calculator

How Small Investments Can Lead to Massive Wealth

The idea behind compounding interest is simple. Even small amounts of money, when invested over time, can build impressive wealth. For instance, investing a modest sum every month can eventually lead to large savings without requiring huge initial amounts. Consistency and the fact that every interest payment adds to the next one boost the total earning potential.

- Investing regularly helps your money grow steadily.

- Staying patient allows each interest payment to add value.

- Diversification can help shield your investments from risks.

This section shows that even modest investments can have long-lasting effects when you take advantage of compound interest.

What is Compound Interest?

Compound interest is the process where interest is added to the initial investment, and that interest then earns additional interest in later periods. Unlike simple interest, which generates returns only on the original principal, compound interest considers both the principal and the accumulated interest. In simple terms, it is the idea of earning money on money, making it a powerful tool for savings or investments.

The Formula for Compound Interest

The standard compound interest formula is: A = P(1 + r/n)^(n*t). Here, A represents the amount after interest, P is the principal, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years. Knowing this equation helps you understand how different factors contribute to the growth of your investment.

How Compounding Works Over Time

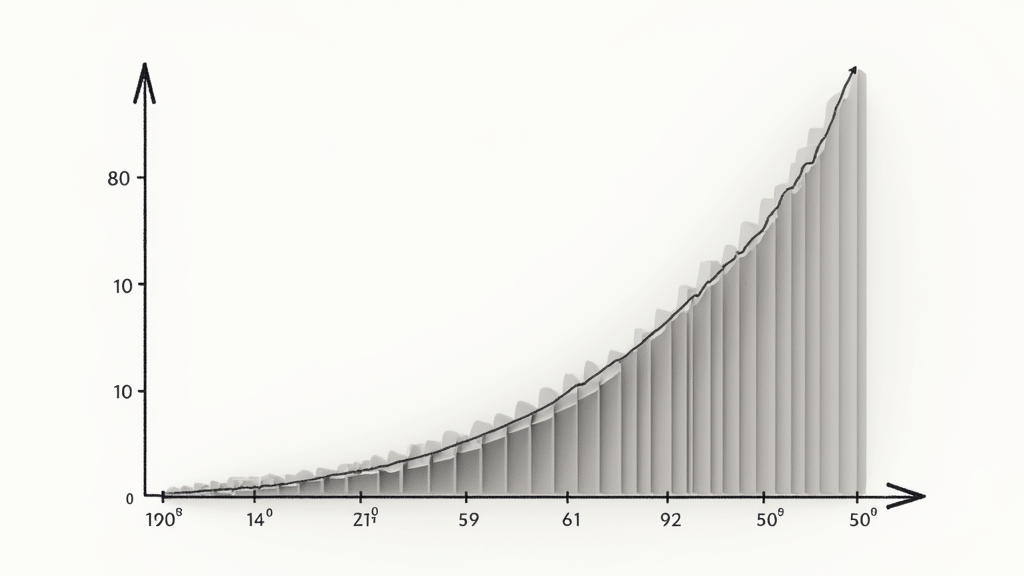

The longer your money is left to compound, the greater the results. Let’s consider a simple example:

- You invest £1,000 at an annual interest rate of 5%, compounded annually.

- After 10 years, your investment grows to £1,629.

- After 20 years, it becomes £2,653.

- After 40 years, it jumps to £7,039.

That’s without adding a single extra penny! Imagine if you continued to contribute regularly—your wealth would multiply exponentially.

Why Time is The Most Important Factor

Among the elements in the compound interest formula, time plays a really important role. A longer investment period magnifies the effects of compounding. Giving investments time to grow can produce significant benefits. Early investments allow interest to accumulate and compound over many years, making a notable difference in your final amount.

The key to compounding success is time. The earlier you start, the more powerful the effect. Even if you start with a small amount, long-term investing allows your money to snowball.

Let’s compare two investors:

- Investor A starts at age 20, investing £100 per month at a 7% return. By age 60, they have over £240,000.

- Investor B waits until age 30 to start, investing the same amount. By 60, they have £120,000—half as much!

How to Maximize The Power of Compounding

I recommend these actions to ensure you get the most out of your investments:

- Start investing as soon as possible – Even small amounts make a difference.

- Reinvest your returns – Keep the money growing by reinvesting dividends and interest.

- Be consistent – Regular contributions, even if small, compound over time.

- Think long-term – The longer you leave your money, the greater the impact.

- Avoid withdrawing early – Interrupting compounding slows down wealth growth.

These strategies help you fully take advantage of the compounding process and build wealth steadily.

Try our Free Compound Interest Calculator

To see the real power of compounding in action, try our Compound Interest Calculator.

– Instantly calculate your investment’s future value

– Adjust for inflation to see the real purchasing power of your returns

– Visualize growth with an interactive graph

– Download results to track your investment journey over time

This tool helps you plan smarter investments by showing how different interest rates, timeframes, and compounding frequencies affect your wealth.

Try it now and start planning your financial future!

Final Thoughts

The power of compounding is one of the most valuable financial principles. Whether you’re saving for retirement, investing in stocks, or growing your wealth through property, understanding and utilizing compounding can lead to financial success. Start today and let your money work for you!

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.