Strategies For Investing In Property With Little Or No Money

Property is a versatile investment opportunity offering many strategic ways to invest from full mortgage free ownership to using leverage to purchase a property. Here we look at some of the easiest ways to invest in property and how important timing is for each type of investment strategy.

Table of Contents

- Understanding the Market Cycles

- Mortgaged Properties

- Lease Options

- Rent-2-Rent Options

- Rent-To-Buy

- Strategies for Property Investing

Understanding the Market Cycles

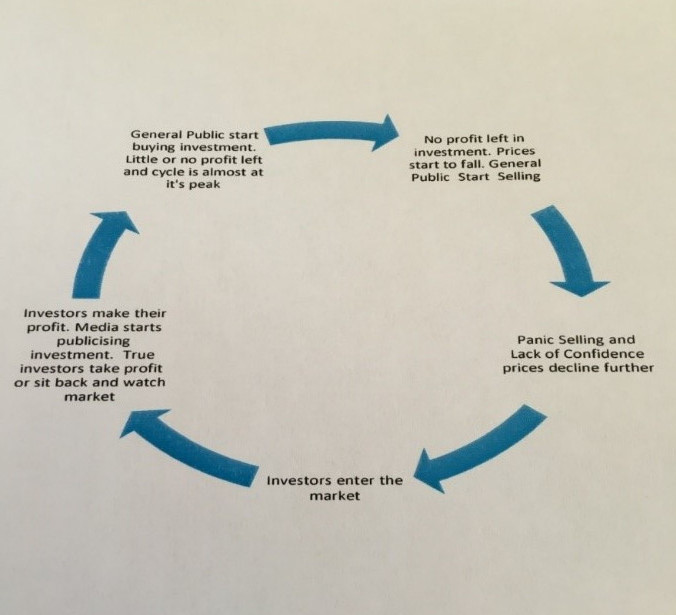

All markets operate on cycles. That being, when markets are high or low. With any investment you want to buy when the markets are low to maximize the returns possible. The property market is no different.

It would be so easy to invest if the cycles had a pattern and it was possible to say “every 10 years the price will be low” but cycles are for different lengths of time and are affected by the economy. Timing becomes an important factor in making decisions about property investing and is one of the reasons using different strategies is so beneficial to property investing.

You don’t have to own property to be able to money from it. Here we’ll look at different strategies which can be used at various stages in the investment cycle.

Mortgaged Properties

Considered by many to be the only way to invest in properties, mortgages offer the buyer a leveraged way of becoming the owner of a property using a deposit and funding from a lender. Traditionally, the buyer will pay a deposit which is from 5% – 35% and the lender will provide the remainder of the funds needed to purchase the property.

If the buyer is a homeowner, meaning they intend to live in the property, then almost anytime is the right time to buy.

If the buyer is an investor, then purchasing a property should happen only when property prices are low. The buyer can then take advantage of growing property values for capital growth as well as income.

In a market on the cusp of a bursting bubble or in a downward market, the cons of buying a property with a mortgage far outweigh the pros. One major concern being the LTV (Loan to Value) ratio. The LTV is what lenders use to determine the ability for mortgage payments being made and the loan remaining viable. The lender needs an asset (the property) to maintain a certain value so if the investor defaults on payments, then the lender still has an asset which can be sold and the loan repaid from the sale.

Lenders tend to become very twitchy when property values drop to the extent that many often invoke the LTV ratio clause in the mortgage contract to request the mortgage be repaid or a significant amount paid off the mortgage to bring it back within the LTV ratio. For example, if a property is purchased for $100,000 and a mortgage obtained on a LTV ratio of 75% the mortgage would be for $75,000. If the property value drops to $75,000 the LTV ratio would still remain at 75% as that is part of the terms and conditions, the buyer would only be entitled to a mortgage of $56,250. The investor would have to quickly pay off the difference $18,750 or risk having the property repossessed for breaking mortgage terms and conditions.

This is not as unusual as it seems with many investors losing their portfolio’s when they have done nothing wrong. They have maintained their monthly mortgage payments but just been caught by economic circumstances which are beyond their control.

Therefore, the timing for buying a property with a mortgage is critical. Buying at a low price is essential.

Lease Options

Lease Options offer a potential buyer a cheap way to get into the property market. The investor can either source a property themselves for a lease option deal or pay a sourcing agent a fee for finding the deal for them. For a small fee, the investor has control of a property with an option to purchase it in the future but the opportunity to make money from it immediately.

Lease Options create a win/win situation for the seller of the property and the potential buyer. Usually, the seller is having difficulty selling the property whereas the buyer doesn’t want to buy yet because – they don’t have a deposit; don’t qualify for a mortgage or the timing in the market is not right.

The buyer has the right to terminate the deal on a set time during the contract. This is known as the break clause. Or they can decide not to buy the property at the end of the contract term. The buyer has full control over the deal with a lease option contract being legally binding on both parties.

For example, the lease option is for 10 years, with a 12 monthly break clause and an agreed purchase price of $120,000. Property prices are at an all time high and expected to drop at any time. When the lease option is due to be fulfilled, if the property value is less than $120,000 the buyer can decide not to buy but return the property to the owner. If prices have gone up and the property is now worth $150,000 the investor is still able to buy the property for $120,000 as that is the agreed purchase price in the option.

When there is a prospect of a property bubble, a lease option is a viable way to get into the property market, have control of the property and earn from it without the future risk of having a mortgage recalled when the bubble bursts.

Rent-2-Rent Options

This type of option gives the investor the right to control and make money from a property deal without the intention of buying the property. This usually works well with property owners who are tired and don’t want the hassle of dealing with tenants or all the regulations associated with being a landlord. However, they still want to own the property and enjoy some income from it.

Rent-2-Rent deals can often be difficult to find and having connections to landlords through property network meetings can be beneficial.

These types of deals will work in any economic situation whether a property market is going up or down as there is no sale requirement with the deal.

Rent-To-Buy

Rent-to-Buy is a strategy whereby a property can be purchased on a lease agreement where the money paid monthly comes off the cost of the property.

For example, an agreement is reached to purchase the property in 10 years for £120k. This allows the buyer to pay the seller the sum of £1000 per month for 120 months so at the end of the 10 year lease the property has been paid in full and all that is required is for the lawyer to transfer ownership to the buyer.

Its a simple, effective strategy but one that takes time to find property owners willing to sell their property under these terms.

Strategies for Property Investing

Boom and bust is part of every economic cycle, despite governments saying they have everything under control, they are unable to control demand for properties which sees prices go up if there is insufficient on the market for sale. It also sees markets tumble when there have been unsustainable price increases.

Timing in the market is important and picking the right strategy for where the property market is in the cycle is essential. In my article about investment cycles, I explained the investor perspective of where in the cycle to buy and sell.

Options, and there are many more than covered in this article, let the property investor have some control of buying or investing into the property market.

Zero to Millionaire – Building the Foundation is a wealth creation course which covers a variety of options including, Lease Options; Rent-2-Rent Options; Seller Finance Options and Rent-to-Buy Options. All can be used as a strategy for building a property portfolio no matter what the current economic situation or what the property investment cycle is doing.

Joint Venture Opportunities are available through our Membership sites Members Only which offers two joint venture opportunities and/or KNI Mastermind this is the more advanced membership and has more joint venture opportunities.