Money Management Recession Cycle Strategy

Do you have a money management and recession cycle strategy?

There’s an economic storm on the horizon that will touch every household. Your investment and money management strategy will determine if you survive, thrive, or get wiped out.

In this guide, we’ll look at the recession cycle – the boom-and-bust rhythm that repeats through history and outline a simple playbook you can follow to protect and grow your wealth.

Key Takeaways Recession Cycle Strategy

- Recessions follow a predictable cycle – boom, bust, recovery, boom again.

- The Recession Cycle Clock helps you see where we are and what comes next.

- Smart investors don’t fear downturns, they use each stage to buy, hold, or sell.

- Protection comes from multiple income streams and assets that perform differently in each phase (business, shares, property, gold, silver, crypto).

- Your goal isn’t just survival, it’s to position yourself to thrive during recession cycles.

The Recession Cycle Strategy Explained

On average, recessions occur every decade. It’s not a matter of if another downturn is coming, but where we are right now in the cycle. This will help you make the right decisions for managing money.

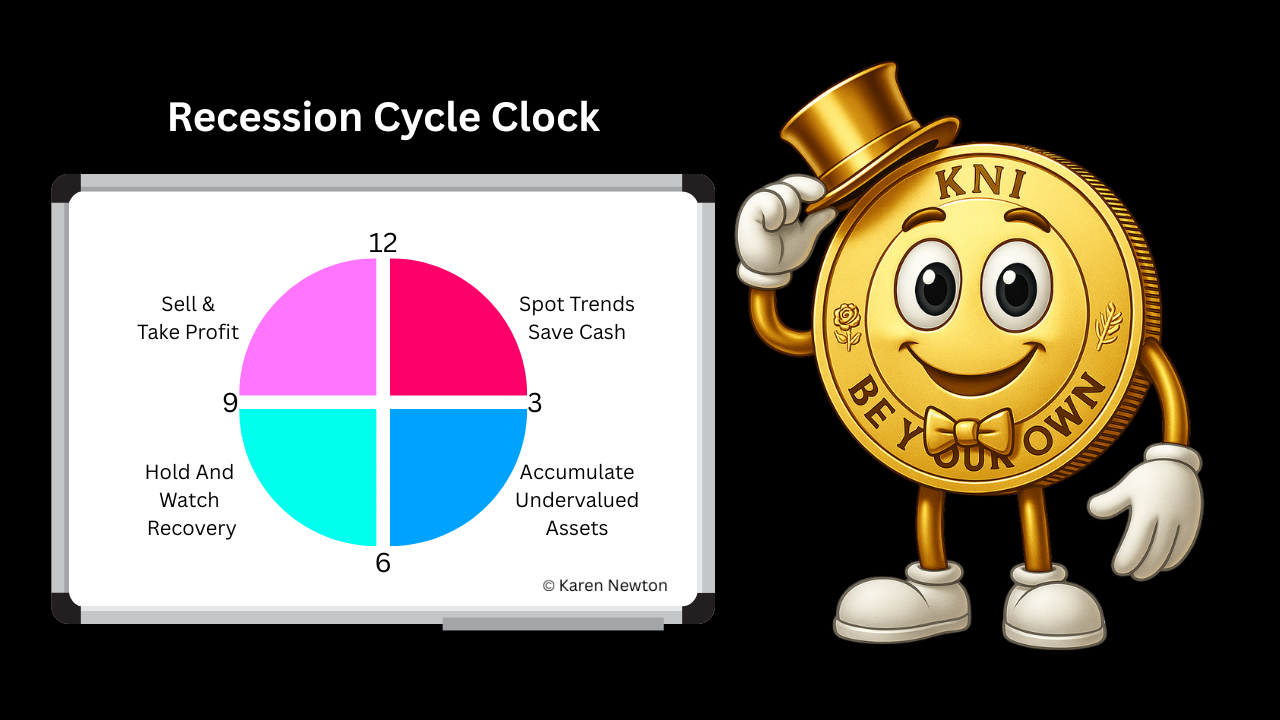

Imagine the cycle as a clock face:

- 12 o’clock – Peak → Downturn Begins

Growth slows, prices slip, and many dismiss it as a “blip.” In reality, the decline has started. - 3 o’clock – Recession in Motion

Job losses rise. Property sales stall. Paradoxically, the stock market often rises briefly before dropping hard. Gold and silver climb. - 6 o’clock – The Bottom

Job losses plateau. Property stabilizes. The stock market has fallen sharply. Gold and silver continue to rise but more slowly. - 9 o’clock – Recovery Begins

The phrase “green shoots” appears. Companies hire. Property prices recover. Growth resumes. - Back to 12 – Boom Time

Confidence returns. Everyone wants in. Businesses boom, consumers spend, inflation rises, property and shares hit record highs—until the next downturn begins.

This cycle repeats itself, again and again. Now there is no guesswork in putting together a recession cycle strategy as you always know what should be done and when.

The Investors Playbook

Smart investors don’t fear downturns, they work with it by having a recession cycle strategy. They understand each section and prepare for the next step in the cycle.

Here’s how they move:

- 12–3 (Spotting the Downturn): Identify trends which assets are falling the most and where are the best opportunities. Build cash reserves ready for the next stage.

- 3–6 (Accumulation Phase): Buy undervalued assets that were identified in previous sector.

- 6–9 (Hold & Watch): Hold the assets and let the recovery begin, don’t rush to sell.

- 9–12 (Exit at the Top): When others pile into the investment sell at the highest possible price and take profit.

This is how investors are always “in the right place at the right time.

How You Can Protect Yourself

You don’t need millions to play this game—you just need a plan. Here’s your mini recession cycle playbook:

- Build Online Income Streams – Start today, not next week. Creating multiple income streams ensure that if one income stream slows, another keeps money flowing.

- Invest in Monthly Income Dividend Shares – this provides cashflow every month—even in a downturn. This becomes your lifeline or your investment pool for acquiring new assets

- Use Property Options – Control property without the risk of repossession. Build a long-term portfolio the safe way.

- Hold Gold and Silver – this is your safety net in crisis. Can be liquidated and provide buying power.

Where Does Crypto Fit In?

Think of crypto as a mirror universe. Almost everything in the real world – business, property, shares, commodities has its equivalent in the digital space.

- Stablecoins backed by real-world assets (currency, gold, silver).

- DeFi income streams simulating dividends and property cashflow.

- High-growth opportunities that multiply if you understand the virtual cycle.

Add crypto to your recession cycle strategy and money management and you’ll strengthen the ability to grow in a recession

Don’t Fear Recessions, Fear Lack of Knowledge

Recessions aren’t disasters to hide from—they’re opportunities to prepare for. Within every 10-year cycle, the real growth window lasts just a few years. If you’re ready, you can turn downturns into stepping stones for exponential growth.

Make financial knowledge and smart money management your weapons for thriving during recession cycles.

Want to learn more? Join Zero to Millionaire and start building your recession-proof strategy today.

Further Reading

Visit Karen Newton International Economy Hub for further insights

More research and data about recessions available at Bank of England, Federal Reserve and IMF .

Video and Podcast Library

Learn more about recession strategies from Karen Newton International – Business and Wealth Strategies Video and Podcast library

FAQ Recession Cycle Strategy

When it comes to managing money during uncertain times, people often ask how to prepare, what to invest in, and when to act. Here are answers to the most common questions about using a recession cycle strategy to protect and grow wealth.

What is a recession cycle strategy?

A recession cycle strategy is a plan for managing money and investments through the recurring stages of the economic cycle—boom, bust, recovery, and growth. It helps you know when to hold cash, when to buy undervalued assets, and when to take profits at the peak.

How often do recession cycles happen

On average, major recessions occur about once every 10 years. Smaller corrections can happen more frequently. A solid recession cycle strategy prepares you for both downturns and recoveries so you’re never caught off guard.

What investments work best in a recession cycle strategy?

It depends on the stage of the cycle. Early in the downturn, cash and gold are strong. In the depths of recession, undervalued shares and property options present opportunities. During recovery, dividend-paying shares and businesses shine, and in boom times, taking profits is key.

Can a recession cycle strategy include crypto?

Yes. The same principles apply. You can use stablecoins, DeFi income streams, and growth tokens to mirror the real-world cycle. A balanced approach helps protect against volatility while multiplying your growth potential.

How can I start building my own recession cycle strategy?

Begin with multiple income streams—such as an online business—then add monthly dividend shares, property options, and precious metals. As your knowledge grows, layer in crypto. The key is to align your investments with the stage of the cycle and always be ready for the next turn.

Glossary

An explanation of words and terminology used in this article can be found under our glossary

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.