How High Will Gold Go?

Understanding Gold Through Economic Cycles

Gold has long played a unique role in the global financial system. Rather than being driven purely by speculation, its price tends to rise during periods of economic uncertainty, currency instability, and declining confidence in traditional markets.

During the aftermath of the global financial crisis between 2008 and 2014, prices climbed steadily as investors sought stability. In the UK, it reached a notable high in September 2011, reflecting widespread concern about banking systems, government debt, and long-term economic recovery.

These patterns are not unusual. Historically, gold has tended to perform best when confidence in financial systems weakens.

Table of Contents

Why Prices Rises in Uncertain Times

Gold and silver are often described as safe-haven assets because they are not directly tied to corporate earnings, government balance sheets, or monetary policy decisions in the same way shares and currencies are.

When global economies face:

- Recessions or slowdowns

- Rising debt levels

- Currency debasement

- Supply chain disruption

- Geopolitical instability

investors often look for assets that can help preserve purchasing power rather than maximise short-term returns.

This is why gold frequently attracts attention during times of economic stress, not because it guarantees profit, but because it can offer stability when other assets become more volatile.

Lessons From Previous Cycles

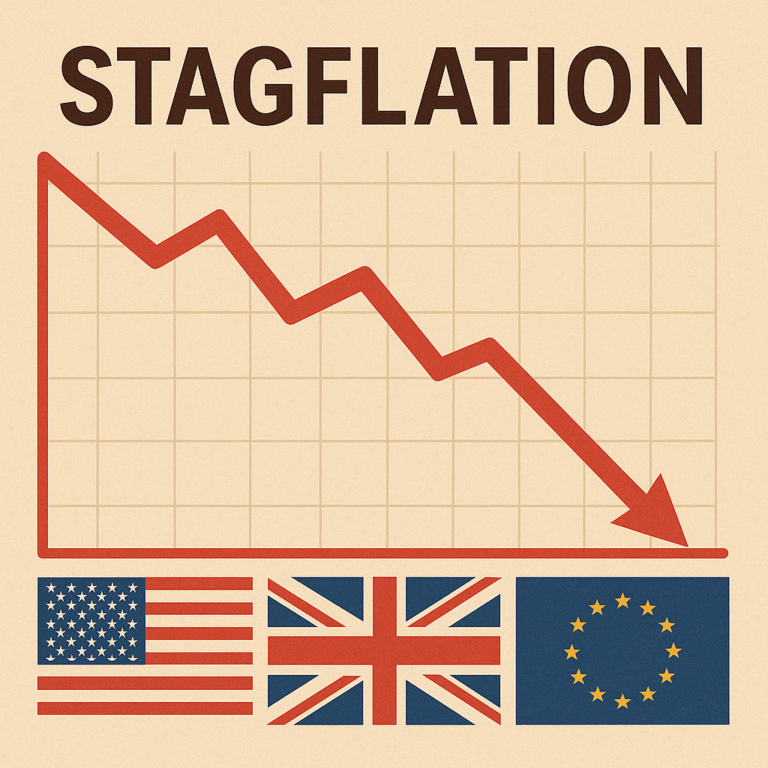

Research into long-term cycles shows that major bull markets often unfold over many years rather than months. One frequently referenced period is the bull market of the 1970s, which followed a prolonged phase of inflation, currency pressure, and declining trust in monetary systems.

Analysts who have studied historical trends note that price movements often remain gradual for long periods before accelerating rapidly in later stages of a cycle. This acceleration typically occurs when economic pressure becomes widespread and investor confidence in traditional assets deteriorates further.

While no two cycles are identical, history suggests that the strongest price movements tend to occur after prolonged periods of instability not at the first sign of trouble.

So, How High Will Gold Go?

This is the question investors often ask and the honest answer is that no one can predict an exact price.

What can be observed, however, is that gold tends to rise when:

- Economic fragility persists

- Inflationary pressures build

- Confidence in fiat currencies weakens

- Markets experience sustained volatility

Rather than focusing on price targets alone, many long-term investors view gold as part of a broader wealth strategy, one designed to balance risk, diversify exposure, and protect capital across different market environments.

Gold’s Role in a Balanced Strategy

Gold is rarely most effective when treated as a short-term trade. Instead, it is often used as:

- A hedge against systemic risk

- A counterbalance to equity-heavy portfolios

- A store of value during prolonged uncertainty

For this reason, it is typically most powerful when combined with other asset classes, such as income-producing investments, businesses, and diversified portfolios rather than relied upon in isolation.

Final Thoughts?

The question “How high will gold go?” will always resurface during uncertain times. But the more important question may be:

What role should gold play in a long-term wealth strategy?

By understanding the economic cycles rather than headlines, investors can make calmer, more informed decisions — positioning themselves for resilience rather than reaction.

Further Reading

Gold spot price is available from Kitco

Podcast and Video Library

Frequently Asked Questions

Is gold a safe investment?

It is often considered a safe-haven asset because it is not directly dependent on company profits or government policies. While it can still fluctuate in price, many investors use gold as a way to help protect purchasing power during periods of economic uncertainty rather than as a tool for short-term gains.

Does gold always go up during a recession?

Not always. It often performs well during prolonged periods of economic stress, currency weakness, or inflationary pressure, but short-term movements can be unpredictable. It tends to show its strongest performance over longer cycles rather than reacting immediately to economic headlines.

Is gold better than shares or property?

Gold serves a different purpose to shares or property. Shares and property are typically used for growth and income, while gold is often used for stability and diversification. Many long-term investors choose to hold gold alongside other assets rather than replacing them entirely.

Should gold be a long-term or short-term investment?

It is generally more effective as a long-term strategic holding rather than a short-term trade. Its primary role is often to balance risk within a portfolio, particularly during volatile or uncertain market conditions.

How much gold should I hold in my portfolio?

There is no universal answer. The appropriate allocation depends on individual goals, risk tolerance, and overall strategy. Some investors allocate a small percentage of their portfolio as a hedge, while others adjust exposure depending on market conditions.

Does gold protect against inflation?

Historically, it has been used as a hedge against inflation because it tends to retain value when the purchasing power of fiat currencies declines. However, its effectiveness can vary depending on the economic environment and timeframe.

Is physical gold better than gold ETFs?

Both have advantages. Physical offers direct ownership but comes with storage and insurance considerations. ETFs provide convenience and liquidity but do not offer physical possession. The choice depends on personal preference, accessibility, and strategy.

Should gold be my only defensive asset?

Most experienced investors avoid relying on a single asset for protection. Gold is often most effective when combined with other defensive or income-producing assets as part of a diversified strategy.

What is the biggest mistake people make when investing

One common mistake is chasing price predictions or reacting emotionally to headlines. Gold tends to work best when used thoughtfully within a broader wealth strategy rather than as a speculative bet.

Stay Ahead of the Cycles

If you want regular insights into market trends, investment cycles, and how different assets behave during uncertain times, the Strategic Investor Newsletter is designed to help you think clearly and act calmly.

Each edition focuses on context, strategy, and opportunity — not hype or headlines.

Subscribe to the Strategic Investor Newsletter

Build A Balanced Wealth Strategy

Understanding individual assets is only one part of the picture. The Zero to Millionaire Membership is built around creating income first, then investing across multiple asset classes — including shares, crypto, property, gold, and silver — with a strong emphasis on diversification and long-term planning.

It’s designed for people who want structure, education, and confidence in their decisions, not short-term speculation.

Explore the Zero to Millionaire Membership

Karen Newton Ecosystem

Glossary

A definition of words and phrases used in this blog can be found in the Glossary

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.