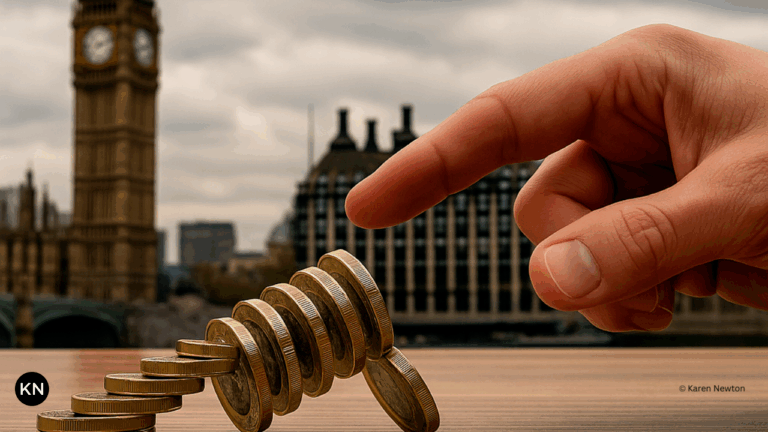

Falling Markets – 5 Moves For Strategic Investing

As panic ripples through global markets and investors brace for what appears to be a track towards a deep recession, now is not the time to react emotionally. It’s time to get strategic. When everyone else is focused on fear, smart investors are positioning for strength.

Here’s how to protect, pivot, and position yourself for long-term growth during this volatile season.

Table of Contents

- 1. Shares: Controlled PCA with a Cash Reserve

- 2. Crypto: Apply the Same Logic, Stay Cautious

- 3. Gold & Silver: Understand Their Roles

- 4. Property: Shift to Options and Protect Existing Assets

- 5. Business: Go Lean, Go Online, Grow Profit

- Don’t Panic Be Strategic

1. Shares: Controlled PCA with a Cash Reserve

One of the most effective strategies in a falling market is Price Cost Averaging (PCA). I personally use a 75/25 rule: 75% of my investment pot is allocated to buying and averaging down, while 25% is held in reserve. This allows me to lower the average cost of my holdings while keeping cash available in case the market drops further.

Key tips:

- Sell profitable positions to rebuy lower.

- Hold losing positions and apply PCA to reduce average cost.

- Don’t panic sell—reinvest strategically.

2. Crypto: Apply the Same Logic, Stay Cautious

Crypto, once mooted as “digital gold,” is proving to behave more like speculative tech in times of panic. While the potential for gains is high, so is the volatility.

Strategy:

- Apply the same 75/25 PCA structure.

- Treat crypto as high-risk and avoid going all-in.

- Focus on major players like Bitcoin and Ethereum; avoid altcoin speculation during volatility.

3. Gold & Silver: Understand Their Roles

Gold remains the true safe haven, although current prices may be inflated by speculation (e.g. concerns around Fort Knox holdings). Silver, being industrial, tends to lag behind.

Gold: Buy via ETFs to avoid high physical premiums.

Silver: Hold current holdings and accumulate more if the price drops to $28 USD or below.

4. Property: Shift to Options and Protect Existing Assets

The UK property market is starting to wobble under regulatory pressure and economic fear. In 2008, during the credit crunch, mortgage lenders triggered LTV clauses, causing many landlords to lose everything.

Strategic shifts:

- Use property options instead of traditional mortgages to reduce exposure.

- Check existing mortgage terms, especially LTV ratios.

- Lower LTV on existing buy-to-let properties to reduce risk.

5. Business: Go Lean, Go Online, Grow Profit

In tough markets, your business becomes your lifeline. Focus on generating cashflow and cutting unnecessary costs.

What to do:

- Move operations online.

- Simplify your offerings.

- Prioritise net profit over vanity metrics.

- Use profit to fund your investments.

- Embrace AI and automation to reduce overheads, streamline repetitive tasks, and position your business for scalable growth.

- Invest in digital tools that support marketing, customer service, and operations, giving you a competitive edge in the new economy.

Don’t Panic Be Strategic

This isn’t about surviving the storm. It’s about positioning yourself to thrive when the clouds clear. While others are reacting emotionally, you’re putting structure behind your actions. That’s the mark of a strategic investor.

Stay calm. Stay cash-flow positive. And above all, stay focused on the long game.

Disclaimer:

The information provided in this blog is for educational and informational purposes only. It does not constitute financial, investment, or legal advice.

All strategies and opinions expressed are based on personal experience and should not be considered a recommendation to buy, sell, or hold any financial asset. You should always consult with a qualified financial advisor or conduct your own due diligence before making any investment decisions.

Past performance is not indicative of future results. All investments carry risk.

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.