Crypto For Beginners: 4 Easy Steps To Build Digital Wealth

Cryptocurrency isn’t just a trend—it’s a technological shift that’s changing how we think about money, investing, and even financial freedom.

For many crypto beginners, though, stepping into the world of cryptocurrency can feel like diving headfirst into a pool of tech jargon, hype, and volatility. With news headlines shouting about market crashes one day and millionaire memes the next, it’s hard to know where to begin—or even if you should.

This crypto for beginners guide is here to change that.

Whether you’ve never bought a single coin or you’ve dabbled and want to get serious, Crypto for Beginners is your clear, practical roadmap to understanding the basics, investing safely, and building passive income streams from platforms like Crypto.com.

Key Points

- Cryptocurrency is digital money secured by cryptography and built on blockchain technology.

- There are three main crypto types: Coins (like BTC), Tokens (built on other blockchains), and Stablecoins (pegged to fiat currencies).

- Tier 1 coins such as Bitcoin, Ethereum, and BNB are ideal for beginners due to their stability and track record.

- Meme coins are highly speculative and risky; they can offer high returns but come with high volatility.

- Beginners can start with small amounts using Crypto.com, a user-friendly platform that supports a wide range of coins.

- Use a mix of hot wallets (easy access) and cold wallets (secure long-term storage) for safety.

- The Price Cost Averaging (PCA) strategy helps manage risk by investing a fixed amount weekly instead of trying to time the market.

- Platforms like Crypto.com offer passive income opportunities through:

- Crypto Earn

- Staking

- DeFi Wallet

- Supercharger

- Crypto Baskets

- Understanding key terms like gas fees, dApps, altcoins, and HODL is essential for navigating the crypto world.

- Beginners should focus on safety, avoid scams, and stay informed with evergreen strategies rather than hype-based decisions.

Table of Contents

- Key Points

- What Is Cryptocurrency?

- Types of Crypto: Coins, Tokens, and Tiers

- Tier 1 Coins

- How to Start Investing in Crypto

- Safe Storage: Hot vs. Cold Wallets

- Smart Strategy: Weekly PCA Investing

- How to Earn Passive Income on Crypto.com

- Risks to Be Aware Of

- Common Crypto Terms: Quick Glossary

- Conclusion

- Crypto for Beginners Further Reading

- Crypto for Beginners – Frequently Asked Questions (FAQ)

- 1. What is the best cryptocurrency for beginners to invest in?

- 2. How much money do I need to start investing in crypto?

- 3. Is cryptocurrency safe?

- 4. What’s the difference between coins, tokens, and stablecoins?

- 5. What is PCA and why is it useful?

- 6. Can I earn passive income with crypto?

- 7. What’s the safest way to store crypto?

- 8. Do I have to pay taxes on crypto gains?

What Is Cryptocurrency?

Let’s start with the basics in this Crypto for Beginners Guide with What is Cryptocurrency?

At its core, cryptocurrency is a form of digital money. It exists only in electronic form, secured by cryptography, and powered by something called blockchain technology.

Here’s a simple breakdown:

- Cryptocurrency is a digital or virtual currency secured by cryptography.

- Blockchain is a decentralised digital ledger that records transactions across a network of computers. It ensures transparency, security, and immutability.

- Decentralised means no single authority (like a bank or government) controls the currency. Instead, it’s managed by a network of users.

Unlike traditional fiat currencies like the pound or dollar, cryptocurrencies are not issued by a central bank. This gives them unique benefits—like resistance to inflation and censorship—but also unique risks, such as volatility and regulatory uncertainty.

Types of Crypto: Coins, Tokens, and Tiers

Understanding the different types of crypto is the first step to making smarter investment decisions.

Coins

Coins are cryptocurrencies that operate on their own blockchain. Examples include:

- Bitcoin (BTC) – The original and most well-known cryptocurrency

- Ethereum (ETH) – Known for its smart contract functionality

Tokens

Tokens are built on existing blockchains. For example:

- Uniswap (UNI) – Runs on Ethereum

- Chainlink (LINK) – Also runs on Ethereum

Tokens often serve specific purposes in decentralised apps (dApps) or ecosystems.

Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value by being pegged to a reserve asset, such as a fiat currency like the US dollar. They are used to reduce volatility and make transactions smoother.

- USDT (Tether) – Pegged to the US Dollar

- USDC (USD Coin) – Another popular USD-pegged stablecoin

- DAI – A decentralised stablecoin pegged to USD

Stablecoins are useful for trading, earning passive income, or holding value during market dips.

Tier 1 Coins

These are the most established cryptocurrencies with high market caps and proven track records:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

These are considered “blue-chip” cryptos for beginners.

Meme Coins

These are often created as jokes or internet trends, but some gain traction:

- Dogecoin (DOGE)

- Shiba Inu (SHIB)

Meme coins can explode in value but are highly speculative.

How to Start Investing in Crypto

Getting started is easier than you think. Here’s how:

- Choose a Platform: For beginners, Crypto.com is user-friendly, mobile-first, and supports a wide range of coins. (Affiliate link here)

- Verify Your Identity: Most platforms require KYC (Know Your Customer) verification.

- Deposit Funds: Initial deposit has to be from a bank account thereafter use a card online systems such as Applepay or Googlepay.

- Start Small: Never invest more than you can afford to lose.

Safe Storage: Hot vs. Cold Wallets

- Hot Wallets: Connected to the internet. Easy to use but slightly more vulnerable (e.g., Crypto.com app).

- Cold Wallets: Offline and highly secure (e.g., Ledger or Trezor hardware wallets).

Tip: Use a hot wallet for daily access and a cold wallet for long-term storage.

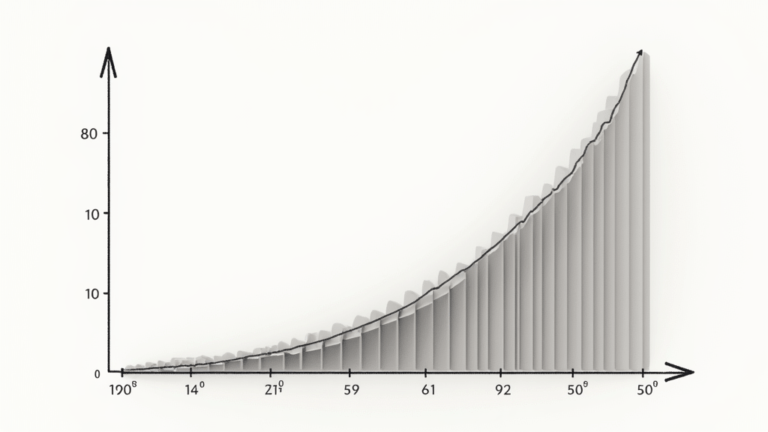

Smart Strategy: Weekly PCA Investing

One of the safest ways to invest in a volatile market like crypto is by using PCA (Price Cost Averaging).

Instead of investing a lump sum, you invest a fixed amount weekly. For example, £10 every Monday into Bitcoin or Ethereum. This smooths out the price over time and reduces risk.

Benefits:

- Reduces emotional decision-making

- Minimises risk of buying at the peak

- Builds a consistent investment habit

Consider setting up a recurring buy on platforms like Crypto.com.

How to Earn Passive Income on Crypto.com

Beyond buying and holding, Crypto.com offers several ways to earn income:

Crypto Earn

- Lock your crypto for 1-3 months to earn interest

- Interest is paid weekly in the same coin

Staking

- Lock coins to support the network and earn rewards

- Often used with coins like CRO or ETH

DeFi Wallet

- Earn higher yields through decentralised finance tools

- More control, but more risk

Supercharger

- Stake CRO and earn rewards in popular tokens like BTC or ETH

- No lock-in period

Crypto Baskets

- Invest in themed groups of coins (e.g., Top 10, DeFi, Metaverse)

- Great for diversification

Risks to Be Aware Of

Crypto is exciting but risky. Be cautious of:

- Scams & Phishing: Never share your seed phrase

- Market Volatility: Prices can swing dramatically

- Regulatory Changes: Governments are still figuring it out

Use 2FA, secure wallets, and avoid “get rich quick” schemes.

Common Crypto Terms: Quick Glossary

- Fiat: Traditional currency like USD or GBP

- Altcoin: Any crypto that isn’t Bitcoin

- dApps: Decentralised applications

- Gas Fees: Transaction fees (especially on Ethereum)

- Ledger: A record of transactions (also a popular cold wallet brand)

- HODL: Slang for “hold on for dear life”

Conclusion

Crypto doesn’t have to be complicated.

Start with the basics. Stick to Tier 1 coins. Use PCA to invest weekly. Explore platforms like Crypto.com to earn passive income.

Over time, you’ll build both knowledge and confidence.

Ready to start your crypto journey?

- Join Crypto.com (affiliate link)

- Subscribe to the Podcast for weekly strategies

- Check out the Zero to Millionaire Membership to learn how crypto fits into your long-term wealth plan

Crypto for Beginners Further Reading

Crypto for Beginners – Frequently Asked Questions (FAQ)

1. What is the best cryptocurrency for beginners to invest in?

For beginners, it’s best to start with Tier 1 coins like Bitcoin (BTC) and Ethereum (ETH). These have the longest track records, higher liquidity, and are widely used across the crypto space.

2. How much money do I need to start investing in crypto?

You can start with as little as £10. Many platforms, like Crypto.com, allow small investments and even offer recurring purchase options to automate weekly buys.

3. Is cryptocurrency safe?

Crypto comes with risks like volatility, scams, and regulation changes. However, using secure wallets, two-factor authentication (2FA), and sticking to reputable platforms can greatly improve safety.

4. What’s the difference between coins, tokens, and stablecoins?

- Coins operate on their own blockchain (e.g., BTC, ETH)

- Tokens are built on existing blockchains (e.g., UNI, LINK)

- Stablecoins are pegged to fiat currencies to maintain stable value (e.g., USDT, USDC)

5. What is PCA and why is it useful?

Price Cost Averaging (PCA) is an investing strategy where you invest a fixed amount regularly, regardless of market price. It reduces risk, avoids emotional decisions, and smooths out the average cost over time.

6. Can I earn passive income with crypto?

Yes. Platforms like Crypto.com offer passive income through Crypto Earn, staking, DeFi Wallet, Supercharger, and Crypto Baskets. These let you grow your crypto while holding it.

7. What’s the safest way to store crypto?

For long-term safety, use a cold wallet (hardware wallet like Ledger or Trezor). For easy access, a hot wallet like the Crypto.com app is convenient. Many users use both.

8. Do I have to pay taxes on crypto gains?

Yes, in most countries. Cryptocurrency is often subject to capital gains tax when you sell, trade, or earn income. It’s best to check your local tax laws or speak with a tax advisor.

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.