Investing Is Complicated – Or Is It?

Investing is complicated for many people, it sits firmly on the list of things they know they should do but never quite feel ready to start.

Despite more information, more platforms, and more encouragement than ever, investing feels increasingly confusing. Recent figures show that 61% of savers now find investing difficult to understand, rising to 75% among women. Data Source

That raises an important question:

If access to information has never been greater, why does investing feel more complicated than ever?

The answer has less to do with risk and far more to do with education.

Key Takeaways

- Investing is rarely taught in schools, leaving most people to figure it out alone

- More information has increased confusion, not clarity

- Complexity benefits the industry — not the individual

- Investing works best when it’s simple, structured, and repeatable

- You don’t need predictions or expertise to start — just a system

Table of Contents

Why Investing Isn’t Taught Early

Most people grow up learning how to save, budget, and avoid debt.

But investing, the very mechanism that builds long-term wealth is often treated as something advanced or optional. As a result, many adults enter working life believing they need specialist knowledge before they can even begin.

This creates hesitation. And hesitation leads to inaction.

When investing isn’t normalised early, it becomes something people feel they must “catch up on” later often during busy adult years when time, confidence, and clarity are already stretched.

How Complexity Became the Norm

The investing world has not made things easier.

Instead, it often emphasises:

- Market timing

- Technical charts

- Constant monitoring

- Competing opinions

While these approaches can have a place, they are not where most people need to start.

Complexity creates dependence. And dependence keeps people stuck on the sidelines.

Ironically, the most effective long-term investing strategies are rarely the most complicated they’re just the least talked about.

Why More Information Hasn’t Helped

Today’s investors are surrounded by:

- News headlines

- Market forecasts

- Social media commentary

- Contradictory advice

Instead of clarity, this creates noise.

The rise in confusion over the past decade shows us that the issue isn’t intelligence or ability it’s lack of structure.

People don’t need more information. They need a clear framework.

What Investing Really Needs to Work

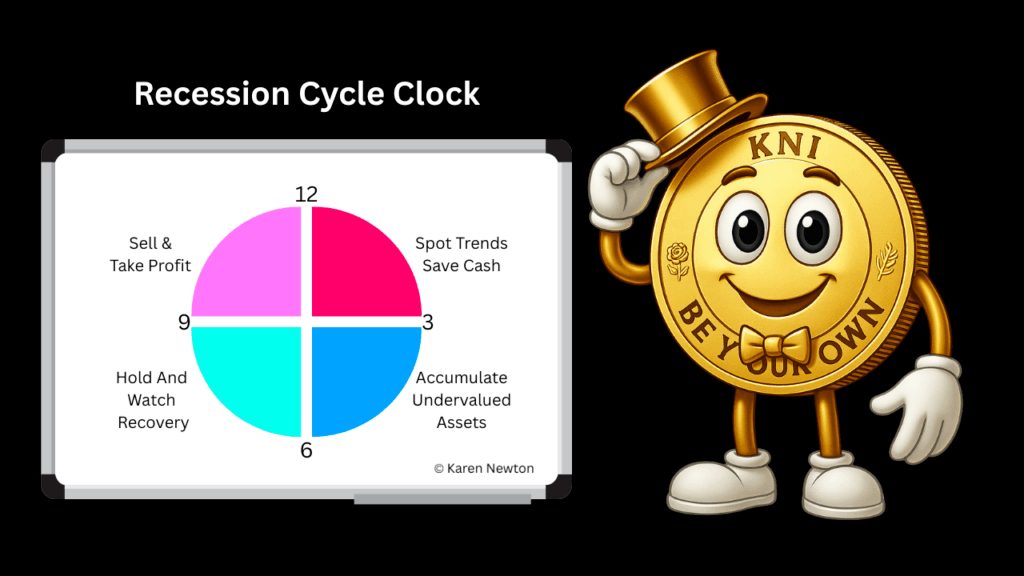

Successful investing doesn’t rely on prediction. It relies on:

- Consistency over time

- Sensible diversification

- Income and reinvestment

- Understanding cycles rather than chasing trends

When investing is approached as a system, not a guessing game, it becomes far more accessible.

You don’t need to be an expert. You need repeatable actions and patience that remove the concept that investing is complicated.

A Simpler Way Forward

Investing doesn’t have to be dramatic or stressful.

In fact, the quieter approaches, those focused on income, compounding, and long-term planning, are often the most resilient.

When fear is removed and replaced with understanding, people stop avoiding investing and start engaging with it on their own terms.

That shift alone can make a meaningful difference over time.

Further Reading

Learn more with Commentary – Deciphering the Economy

FAQ – Investing is Complicated

Is investing risky for beginners?

All investing carries some level of risk, but avoiding investing altogether can also be risky due to inflation eroding savings. Education and a structured approach help manage risk.

Do I need a lot of money to start investing?

No. Many strategies are designed to start small and build over time through consistency.

Investing is Complicated

No, there is more information available, but the fundamentals haven’t changed. The challenge today is filtering noise and focusing on core principles.

Why do so many women avoid investing?

Often it’s not confidence, but lack of clear education and relatable frameworks. When investing is explained simply, engagement improves significantly.

Can investing really be simple?

Yes. Simplicity is often more effective than complexity when applied consistently over time.

Removing the Feeling that Investing is Complicated

Investing is complicated, or is it?

If investing has ever felt confusing or overwhelming, it’s worth remembering that it was never designed to be taught simply.

Education doesn’t remove risk but it does remove unnecessary fear.

Taking time to understand the basics, follow a clear system, and build steadily can change not just financial outcomes, but confidence too.

Learn more about investing through the Zero to Millionaire Membership

Karen Newton Ecosystem

Glossary

A definition of words and phrases used in this blog can be found in the glossary

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.