How Government Finances Shape Your Life

Government Finances affect every aspect of your life. Governments fund our schools, hospitals, pensions, benefits, and infrastructure — but behind the headlines about taxes and budgets lies a complex system of borrowing, spending, and policy juggling.

Right now, the UK government is under intense pressure: debt is rising, interest rates remain high, and speculation is growing that Britain may even need IMF help, echoing the 1976 bailout.

So how do government finances really work — and what does the shift by the Bank of England from QE to QT mean for you?

Key Takeaways – Government Finances

- Government Funding Sources – Taxes, Borrowing, QE (Past), QT (Present)

- High Interest Rates – Costlier debt for households and government

- QE – QT – Government losses safety net, borrowing costs rise

- Budget Squeeze – Limited Fiscal Headroom, tax hikes likely

- IMF Fears – speculation hurts confidence

- Personal Action – anticipate policy shifts and adapt

Table of Contents

How Governments Raise Money

Just like a household budget, the government has to balance income with spending. It does this by:

- Taxes – The backbone of public finance: income tax, VAT, corporation tax, National Insurance.

- Borrowing via Gilts (Bonds) – When taxes don’t cover spending, the Treasury issues gilts, which investors buy.

- Quantitative Easing (QE) – For much of the past 15 years, the Bank of England bought those gilts to keep borrowing costs down.

Why High Interest Rates Hit Hard

When borrowing is cheap, balancing the books is easier. But when the government borrows heavily in a high-rate environment, the impact is severe:

- Individuals – Mortgage and loan costs rise, cutting into household budgets. Savers may benefit, but only if banks pass on higher returns.

- Government – Servicing debt becomes far more expensive. With national debt at ~96% of GDP, the UK’s annual interest bill already exceeds £100bn. Every uptick in rates adds billions.

Like you applying for a bank loan, the government faces a higher “risk premium” when markets worry about its ability to repay.

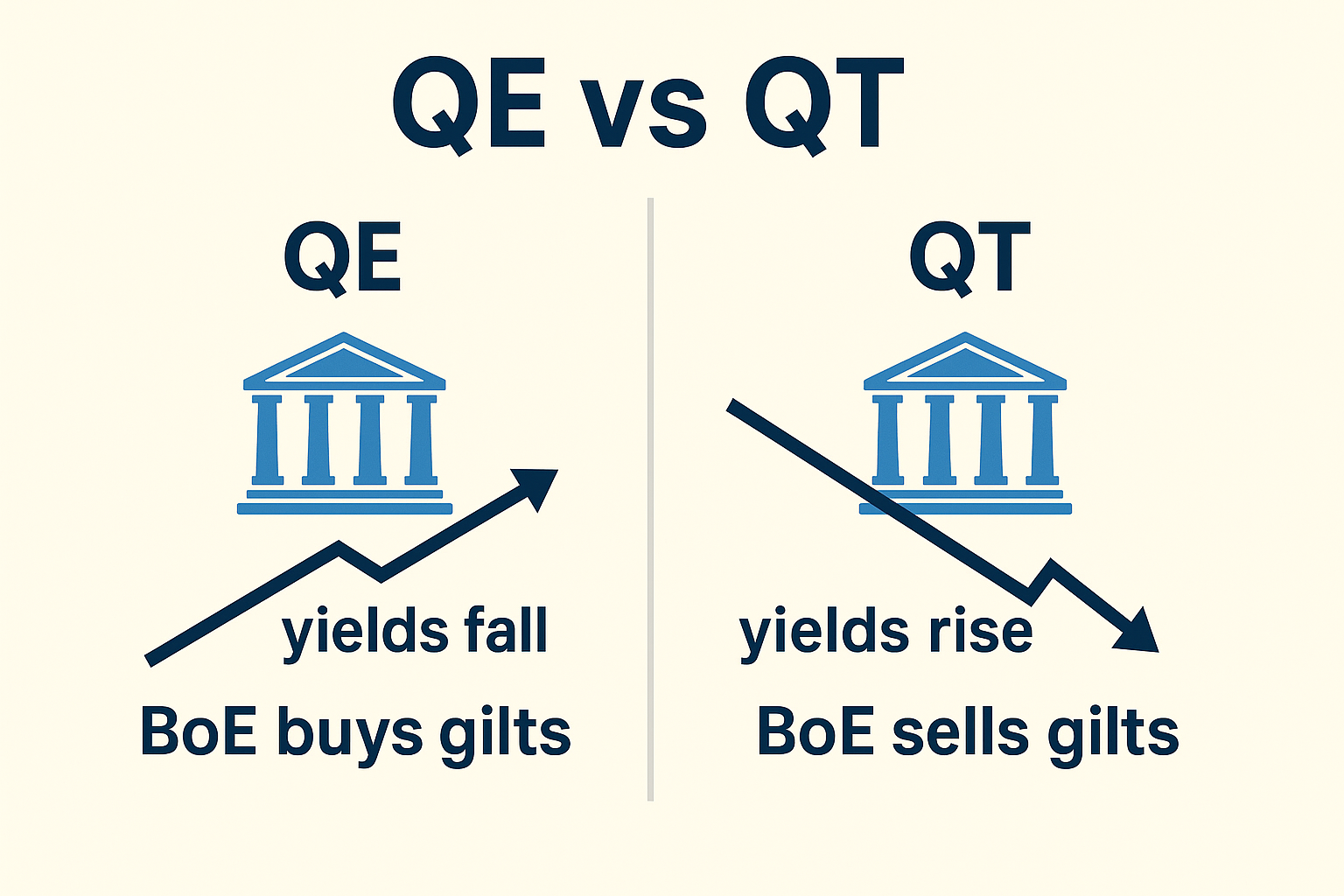

From QE to QT: What Changed at the BoE?

For years, the Bank of England acted as a guaranteed buyer of government debt. This “safety net” kept borrowing costs lower than they otherwise would have been.

- QE (Quantitative Easing): BoE bought gilts → demand rose → yields fell → borrowing was cheaper.

- QT (Quantitative Tightening): BoE is now selling gilts or letting them mature → demand falls → yields rise → borrowing costs climb.

Why the Policy Shift?

If QT raises borrowing costs, why adopt it?

- QE Was Emergency Medicine

- Introduced after the 2008 financial crisis and expanded during COVID.

- Helped liquidity but inflated asset prices and created long-term distortions.

- BoE doesn’t want to permanently hold £800bn+ of gilts — QT “normalises” markets.

- Inflation Control

- QE injected money into the system; QT withdraws it.

- Even if gilt yields rise, money supply shrinks, easing medium-term inflation pressure.

- Fiscal Discipline by Force

- QE allowed governments to borrow without real consequences.

- QT makes overspending painful, forcing discipline and reducing future inflation risks.

- Credibility with Investors

- The BoE must show independence. Continuing QE looks like financing the government.

- QT reassures investors and helps protect the pound.

Short-Term Pain, Long-Term Gain

Yes, QT raises costs today. But it restores balance, reins in inflation, and preserves market trust.

Impact on the Budget & Economy

The immediate fallout is painful for both government and citizens:

- Debt servicing costs soar – requiring more revenue via higher taxes or stricter spending.

- Less room for manoeuvre – limits tax cuts or major new spending plans.

- Reliance on investors – global buyers demand higher returns.

- Risk of a “Truss moment” – if markets panic, the pound falls and borrowing spirals.

Ripple Effects: Policy, Taxes, and the Economy

The government already raised taxes to record levels, yet faces widening gaps:

- Budget Gaps – Borrowing since April is £42.8bn, despite slightly lower July numbers.

- Autumn Budget Pressure – The OBR estimates just £9.9bn headroom against fiscal rules, with forecasts of £17–£50bn shortfalls.

- Tax Speculation – Likely options include stealth taxes (frozen thresholds), pension changes, or property/wealth levies.

- IMF Comparisons – High borrowing costs and twin deficits draw parallels to 1976. Even if IMF support is unlikely, the comparison weakens investor confidence.

Be Your Own… Strategy

Whether you have £1 or £1m in the bank, there are steps you can take to protect your finances:

- Be Your Own Economist – Look beyond headlines and understand how QT affects your mortgage, pensions, and taxes.

- Be Your Own Advocate – Demand transparency from policymakers on debt and spending promises.

- Be Your Own Strategist – Plan for stealth tax rises, frozen allowances, or benefit cuts — and adjust your personal wealth strategy early.

Government Finances Shape Your Life

Government finances may feel distant, but their impact lands directly in your wallet. High interest rates, QT, and budget pressures are shaping tomorrow’s taxes, pensions, and services.

That’s why now, more than ever, it’s time to Be Your Own Economist, Advocate, and Strategist.

Further Reading

Economy Hub

Get a guide to different aspects of the economy in the Economy Hub

FAQ – Government Finances

What do you mean by Government Finances?

Government finances refer to how a state manages money — raising revenue through taxes, borrowing, and other means, then spending it on public services like healthcare, education, pensions, and infrastructure. In the UK, government finances are closely monitored because rising debt and borrowing costs can affect everything from tax policy to inflation.

How does the UK government borrow money?

When taxes are not enough to cover spending, the UK borrows by issuing gilts (government bonds). Investors buy gilts in exchange for regular interest payments. In return, the government gets cash to fund its budget. The cost of this borrowing depends on market confidence and interest rates.

What are Gilts?

Gilts are UK government bonds — essentially IOUs. The Treasury issues them, and investors (banks, pension funds, individuals) buy them. They receive interest (the “coupon”) and their money back when the gilt matures. Gilts are a key tool for funding the government’s financial needs.

What is Quantitative Easing (QE)?

QE is when the Bank of England buys government bonds (gilts) in large amounts. This boosts demand for gilts, pushes yields (borrowing costs) down, and makes it cheaper for the government to borrow. QE was heavily used after the 2008 financial crisis and during the COVID-19 pandemic.

What is Quantitative Tightening (QT)?

QT is the reverse of QE. Instead of buying gilts, the Bank of England sells them or allows them to mature without replacing them. This reduces demand, raises yields, and makes borrowing more expensive for the government. QT is designed to shrink the money supply and reduce inflationary pressures.

Why do QE and QT matter for government finances?

Both directly affect how much it costs the government to borrow.

– Under QE, borrowing is cheaper, but the risk of inflation rises.

– Under QT, borrowing is more expensive, but inflation can be brought under control.

For households, this means changes in government finances will eventually show up in taxes, services, pensions, and even mortgage rates.

How do government finances affect me personally?

Strong government finances can mean stable taxes and reliable public services. Weak finances — especially when borrowing costs rise — often lead to higher taxes, reduced spending, or both. This is why gilts, QE, and QT may sound technical but actually influence your everyday budget.

Zero To Millionaire – ZTM Wealth Strategy

Want to learn how to future-proof your income, investments, and wealth? Explore the Zero to Millionaire Membership, where we cover practical business and wealth strategies to keep more money in your pocket — no matter what the economy is doing.

Karen Newton International Eco-Sytem

Glossary

A definition of words are available in the glossary

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.