Tariffs, Wars And Weather

Tariffs, wars, and weather rarely appear in the same conversation. One feels political, one geopolitical, and one environmental.

Yet increasingly, they are producing the same outcome: pressure on global systems and delays that ripple into everyday life.

From supply chains and pricing to business continuity and investment decisions, disruptions in one part of the world now travel faster and last longer than many people expect. Understanding why this happens — and where stability actually comes from — is becoming essential for business owners and investors alike.

Key Takeaways – Tariffs, Wars and Weather

- Tariffs, wars, and weather events all disrupt global systems in similar ways

- Global markets are efficient, but often fragile during periods of stress

- Domestic economies act as stabilisers when global systems slow or fail

- Local markets create business and investment opportunities closer to home

- Balance — not isolation — is the key to long-term economic resilience

Table of Contents

The Common Thread Behind Global Disruption

At a structural level, tariffs, wars, and weather all do the same thing: they interrupt flow.

- Flow of goods.

- Flow of capital.

- Flow of energy.

- Flow of labour.

Global systems are designed for speed and efficiency, not interruption. When disruption occurs, delays compound quickly, affecting businesses and households far removed from the original event.

Institutions such as the International Monetary Fund have repeatedly highlighted how global shocks — from trade disruptions to geopolitical conflict — can expose vulnerabilities in highly interconnected economic systems.

How Global Systems Create Delays We Feel Locally

Highly interconnected systems rely on timing. When one part slows, the effects cascade.

Common examples include:

- delayed manufacturing due to disrupted supply chains

- rising costs passed down to consumers

- shortages caused by transport or energy constraints

- stalled projects waiting on overseas inputs

These delays don’t always feel dramatic — they show up quietly in pricing, availability, and uncertainty.

Why Domestic Economies Provide Stability

Domestic economies operate differently.

They shorten supply chains, keep capital circulating locally, and allow faster adjustment when disruption occurs. When global systems stall, domestic markets often absorb the shock.

This doesn’t mean global trade disappears. It means local capability matters more than it did during periods of stability.

Strong domestic economies provide:

- continuity of employment

- quicker recovery after disruption

- resilience against external shocks

- adaptability when conditions change

Business Opportunities in Domestic Markets

Periods of disruption often create opportunities closer to home.

Examples include:

- local manufacturing and services replacing imports

- infrastructure and repair industries

- food production and distribution

- technology supporting decentralised systems

- service businesses meeting local demand

For entrepreneurs, domestic markets can offer clearer visibility, faster feedback, and more control — especially during uncertain times.

Investing with Resilience in Mind

From an investing perspective, resilience matters as much as returns.

Domestic-focused investments can:

- reduce exposure to global shocks

- benefit from government and infrastructure spending

- align with long-term demographic and economic shifts

Balancing global exposure with domestic strength allows investors to participate in growth while managing risk more effectively.

Final Thoughts

Tariffs, wars, and weather events may seem unrelated, but they all highlight the same reality: systems built purely for efficiency struggle under pressure.

Domestic economies don’t replace global markets — they support them. They provide stability, opportunity, and adaptability when global systems falter.

Understanding this balance helps business owners and investors make more informed, strategic decisions in an increasingly uncertain world.

Further Reading

Learn more visit – Deciphering the Economy

Frequently Asked Questions

Why are domestic economies becoming more important?

Because they provide resilience when global systems experience disruption, delays, or failure.

Does this mean global trade is ending?

No. It means balance is shifting. Domestic strength complements global participation.

How can business owners benefit from domestic markets?

By focusing on local demand, shorter supply chains, and adaptable business models.

Is domestic investing safer during uncertainty?

It can reduce exposure to global shocks, particularly when focused on essential services and infrastructure.

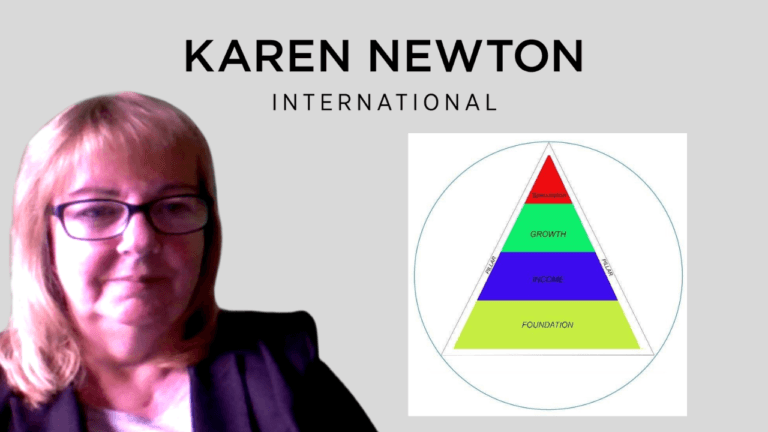

Understanding Economic Patterns and Cycles

Understanding economic patterns, resilience, and opportunity is becoming essential for navigating uncertainty.

If you want to build income, identify opportunities, and grow wealth strategically in changing conditions, explore the resources, training, and commentary across my website.

Start where you are. Build the income. Grow the wealth. Multiply the legacy.

Karen Newton Ecosystem

Glossary

A definition of words and phrases used in this blog are available in the Glossary

Karen Newton is a Business and Wealth Strategist, 3x International Bestselling Author, and founder of Karen Newton International. She combines practical experience with AI-Powered Entrepreneurship to help smart entrepreneurs build online income, invest strategically, and create long-term wealth through business growth, investments and joint ventures.